Here at GoGreenDollar, achieving early retirement is undoubtedly one of the main focuses. In fact, the very first article ever posted on this site described the simple formula I’m using to retire in my 30s. In the time since that first article, I’ve discussed a multitude of topics, most of which relate to financial independence/early retirement in some way.

I’ve generated all of this information, but is it actually practical? Could an average person, with an average income do it or is having a high paying job a prerequisite for early retirement? How realistic is achieving financial independence/early retirement for a normal person? Let’s take a deeper look.

If we assume that traditional/normal retirement age is 65 then retiring any time before this age, age 64 for example, is technically “early retirement”. However, we of the FIRE movement have loftier goals. Retiring 15, 25, 30, or more years before 65 is the goal for most of us.

The median household income in America is approximately $60,000. At this level of income, what would it take for someone to achieve early retirement? Although it may seem like there are many variables, it ultimately comes down to just one thing: saving rate.

The Power Of Your Saving Rate

Saving rate doesn’t just determine the amount you save, it also determines the amount required to maintain your current lifestyle. For example, if someone with a $60,000 salary is able to save 25% of their income (i.e. $15,000), we can use this information to infer that the remaining 75% (i.e. $45,000) is enough to cover all of their expenses each year. Further, if you’ve been reading GGD regularly, you know that once you’ve identified your total yearly expenses, it’s a simple thing to use the 4% rule to calculate your retirement number (i.e. Yearly Expenses x 25 = Retirement Number).

So with nothing more than a saving rate, we are able to derive both yearly expenses and retirement number. But that’s not all. We can also directly approximate the time it will take someone to reach financial independence.

When Can I Retire?

Let’s take the 25% yearly saving rate from the example above. In order to accumulate one year of expenses (i.e. 75% of income, as stated above), you would need to save for a total of 3 years (i.e. 25% x 3 = 75%). Thus, in order to save 25 times your yearly expenses, as the 4% rule recommends, you would need to save for 25 times longer, aka 75 years (i.e. 3 years x 25 = 75 years)! But aren’t we forgetting something here? You wouldn’t just be saving this money, you would be investing it in order to take advantage of compound growth! Let’s run some numbers.

Since the ultimate goal is to accumulate 25 times yearly expenses and in this example 75% of income is equal to yearly expenses, we can re-compute the goal amount as, 75% of income times 25, which equals 1875% of income (i.e. 75% x 25 = 1875%).

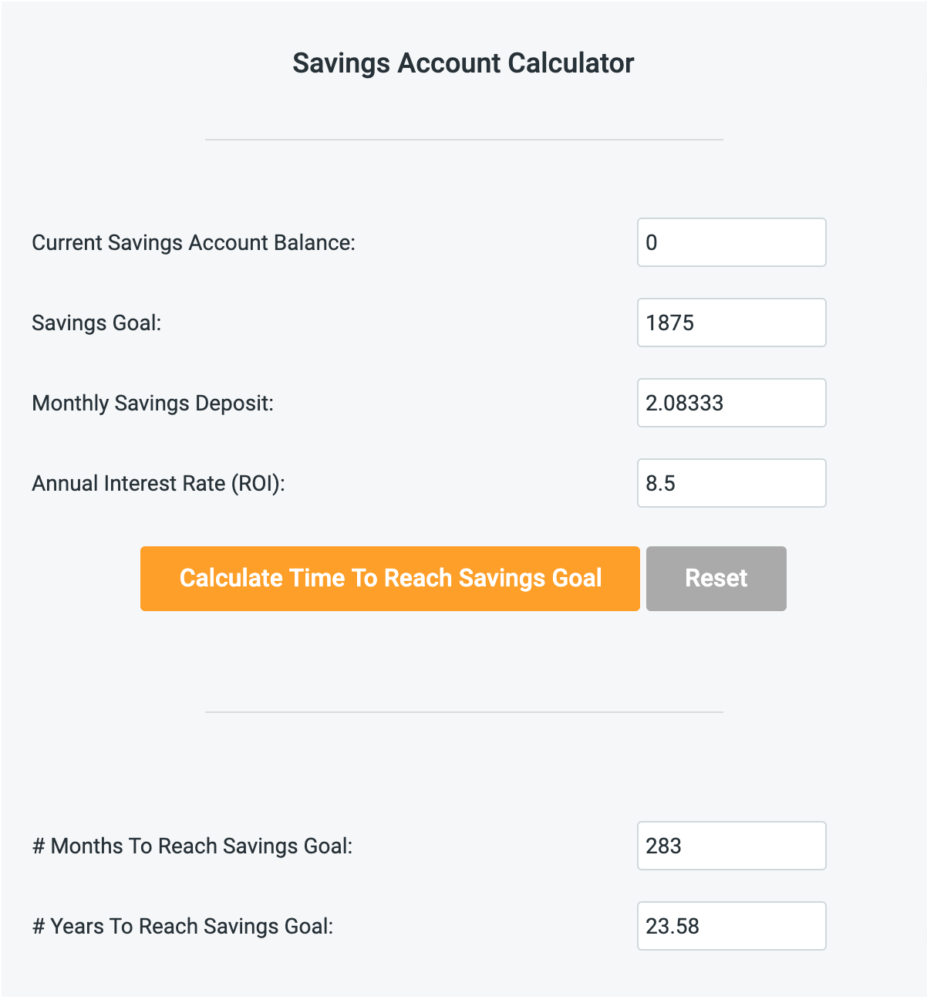

With that value, we now have all of the information we need to calculate our timeframe! It would be tedious to do by hand so we’ll take a shortcut by using a Savings Goal Calculator. We can enter our numbers as follows:

We assume that you are starting from $0, so Current Savings Account Balance is set to 0. For Savings Goal we use 1875, which we calculated above. For Monthly Savings Deposit we take our 25% yearly saving rate and divide it by 12 to get 2.08333 (i.e. 25% / 12 = 2.08333). Finally, for Annual Interest Rate we will use the historical stock market rate of return of approximately 8.5%. After entering the values into the calculator the result we get is 23.58 years (aka 283 months). So this means, anyone who saves and invests 25% of their income will have enough money to retire in exactly 23.58 years!

All of the calculations we have done are based solely on saving rate. The amount of income is never even considered. In our example, we demonstrated that anyone who manages to consistently save 25% of their income will accumulate enough to retire (i.e. 25 x yearly expenses) in about 23 and a half years, but why stop there? We can do this same set of calculations for any saving rate.

Saving Rate = Retirement Date

Given a particular saving rate, you now know how to determine the time it will take to go from $0, all the way to retired. But, instead of forcing you to figure the saving rate you should be aiming for, we've done the heavy lifting for you. Check out the table below to see how long it would take to reach early retirement at a given saving rate.

| Saving Rate | Years Until Early Retirement | Months Until Early Retirement |

|---|---|---|

| 10% | 35.42 | 425 |

| 15% | 30.25 | 363 |

| 20% | 26.58 | 319 |

| 25% | 23.58 | 283 |

| 30% | 21.08 | 253 |

| 35% | 18.83 | 226 |

| 40% | 16.92 | 203 |

| 45% | 15.08 | 181 |

| 50% | 13.42 | 161 |

| 55% | 11.92 | 143 |

| 60% | 10.42 | 125 |

| 65% | 9.00 | 108 |

| 70% | 7.67 | 92 |

| 75% | 6.33 | 76 |

| 80% | 5.08 | 61 |

| 85% | 3.75 | 45 |

| 90% | 2.50 | 30 |

Final Thoughts

So can an average person retire early? I’m not sure that we’ve really answered that question. Every individual has their own set of unique factors that may help or hurt them in their pursuit of achieving financial independence. What we have discovered, however, is that, with nothing more than your saving rate, you can determine how far off the prospect of early retirement actually is. So whether you have a salary of $40,000 or $200,000, the key to achieving financial independence and, ultimately, early retirement all comes down to the rate at which you save and invest your money. Cut expenses and live frugally, and you’ll probably be able to retire sooner rather than later. Spend lavishly and save meagerly, and you may end up working forever. Which will you choose?

Note: As I've mentioned before, I realize that there are many people who are truly struggling financially. People who, in some cases, cannot afford to allocate even a single dollar to anything outside of their most basic necessities. For someone in this situation, the focus should not be on investing. Instead, they should focus on increasing their income. Here are a few options: Request a raise at work, change jobs/companies, create a side hustle (blogging?), get a second job, go back to school to learn a new skill or trade.

Tools To Get You Started

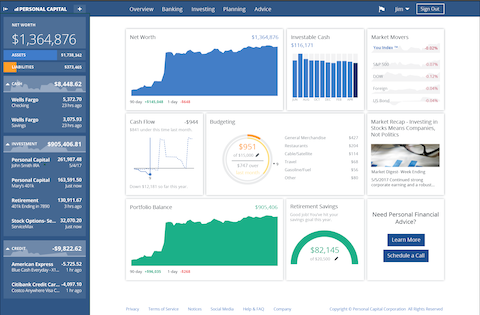

Get a head start on your journey toward achieving financial independence by analyzing and tracking your income, expenses, investment performance, and overall net worth with the free online wealth management tool Personal Capital.

We use Personal Capital regularly to analyze our investment fees, track our investments, and project our net worth. We also periodically review our progress toward retirement with their retirement planning calculator.

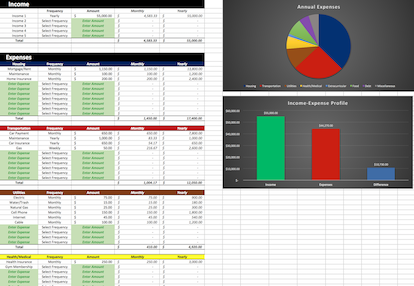

If you’d rather do things on your own, become a subscriber today and you’ll receive our Free Financial Planning Dashboard. This tool allows you to enter your income and expenses to create a detailed budget. You can use it to track your spending habits over time or just to get an idea of where your money is going each month. Take a look at the automatically generated charts and you may discover you have a little more cash to invest than you thought.

If you’re interested in detailed instructions on how to budget, save, pay off debt, and invest, check out The 6 Phases of Building Wealth. This book provides step-by-step instructions for working through each “Phase” in the process of achieving Financial Freedom. If you're just starting out, the information in this book will provide you with an invaluable resource. You can pick up the digital version for only $2.99 on Amazon.

Disclosure: Some of the links found on this website may be affiliate links. Affiliate links pay GGD a small commission when you click through and/or make a purchase. This is at zero additional cost to you.

Full Disclaimer/Disclosure

Related Posts

-

Retire Early And Pay Zero Income Taxes…Forever

Although your taxes may be lower than you think there's a good chance you still spend a significant portion of your income on taxes each year. Generally speaking, if you get a paycheck, a portion of it…

-

The Simple Formula I’m Using To Retire In My 30's

Wake up, go to work, spend a few hours with family, go to bed, rinse and repeat. Some form of this routine probably describes the typical day for most of us. Throughout our lives, we’re…

-

Seek Freedom, Not Riches

I recently had a debate with a group of friends. We were discussing the merits of pursuing financial independence and, potentially, early retirement, versus maintaining a normal job until old age and never really striving…