Just about everyone strives to increase their income over time. The more we make, the more secure we feel. When it comes to achieving financial independence, however, making more money is not always the most effective method. Don’t get me wrong, you should strive to make as much as you can during your working career. Increasing your income is almost always a good thing. But, all things being equal, cutting expenses provides a greater benefit to someone whose goal is financial independence.

Make More Or Spend Less

Jessie recently read a riveting article about the cost of pancakes 😀 that inspired her to drastically change her money habits. After making these changes and enjoying some financial success, she has decided that she would like to pursue financial independence. She currently has $0 saved but is ready to do whatever she can to increase the likelihood of achieving her new goal. She knows that the higher her saving rate, the less time it will take to become financially independent, so she begins to apply for new jobs, hoping to increase her income. She gets two offers. The first offer would give her a $7,500 annual increase in pay. The second offer is for the exact same salary she currently makes, but it’s in an area with a much lower cost of living. Which offer should she accept?

Let’s run the numbers.

Assumptions

Investment Rate Of Return = 7%

Financial Independence Withdrawal Rate = 4%

Current Salary = $50,000

Offer #1 Salary = $57,500

Offer #2 Salary = $50,000

Current Cost Of Living = $30,000

Offer #1 Cost Of Living = $30,000

Offer #2 Cost Of Living = $22,500

“Cost Of Living” represents all of Jessie’s expense. This includes all fixed expenses (e.g. housing, car payment, food, clothing, etc.) and all flexible expenses (e.g. entertainment, shopping, subscriptions, etc.). Jessie’s salary minus her cost of living equals her yearly savings.

Offer #1

If Jessie accepts offer #1 her cost of living won’t change, so all of her expenses will remain exactly the same. This means she can put all of her additional income toward her goal of achieving financial independence.

Retirement Number = 25 x Cost Of Living = 25 x $30,000 = $750,000

Yearly Savings = Salary – Cost Of Living = $57,500 - $30,000 = $27,500

Saving Rate = $27,500 / $57,500 = 47.8%

Using Jessie’s saving rate and the 4% rule (i.e. you can withdraw 4% of your portfolio each year and the money should last several decades; since 100%/4%= 25, we can multiply living expenses by 25 to calculate your retirement number) we can determine that Jessie will reach financial independence in about 16 years if she accepts offer #1! In just 16 short years, Jessie will have accumulated enough wealth to maintain her current lifestyle indefinitely without needing to work. Not bad at all, but could she do even better?

Offer #2

By accepting offer #2 Jessie would significantly and permanently lower her cost of living. Making this move would directly cut her expenses by $7,500 per year. How would this affect her savings?

Retirement Number = 25 x Cost Of Living = 25 x $22,500 = $562,500

Yearly Savings = Salary – Cost Of Living = $50,000 - $22,500 = $27,500

Saving Rate = $27,500 / $50,000 = 55%

Even though her income didn’t change, the lower cost of living allowed her to save the same amount each year that she would have had she taken the job with higher pay. As a result of the reduction in her expenses, Jessie’s saving rate has increased dramatically. Moreover, she now requires much less in savings to reach financial independence. With a saving rate of 55%, Jessie will reach financial independence in less than 13 years, a full 3 years sooner than if she were to accept the higher paying job!!!

Note: Though the historical average yearly stock market return is 7-10%, I am using 7% for all investment calculations to be conservative. If Jessie were to receive a higher average rate of return, something that is historically likely, she would reach financial independence at an even faster pace!

But...How?

So what’s the deal here? How can reducing expenses be so much more powerful than increasing income? As you’ve probably figured out, it’s all about the relationship between saving rate and cost of living (i.e. total yearly expenses). When you increase your income, your saving rate goes up, but your cost of living remains the same. In other words, you’re able to contribute more money toward financial independence, but the total amount you need to accumulate to cover all of your expenses stays fixed. Conversely, reducing your expenses allows you to increase your saving rate and lower your cost of living. You’re able to put away more each month while aiming to accumulate a smaller total amount. These two factors, compounded together, are what make cutting expenses more advantageous than increasing income when it comes to achieving financial independence.

As pointed out by one of our commenters below, in addition to saving rate and cost of living, the effects of taxes should also be considered. While we know that the value of every dollar cut from our expenses is truly a dollar saved, the value of every dollar of increased income isn't necessarily a full dollar. Instead, its value will depend on the effective tax rate. For example, an additional dollar of income for someone with an effective tax rate of 20%, would only be worth $0.80 ($1.00 - 20% = $0.80). This further exemplifies how reducing expenses can surpass the effects of increasing income.

Other Ways To Cut Expenses

Moving to an area with a lower cost of living is one way to cut expenses, but there are many others. The specific circumstances of your life (e.g. income level, desired standard of living, number of dependents, etc.) might make some options more feasible to you than others, however, I think the vast majority of us can find a few ways to cut back, even if only by a small amount. Here are a few options that you might want to consider.

Eliminate Debt – Paying off debt is a simple way to immediately reduce your monthly expenses. As long as you're not creating additional debt, this reduction can be permanent. In addition to lowering your monthly bills, eliminating debt can also save you a great deal of money in interest payments. When it comes to cutting expenses, I personally think eliminating debt is by far the best option. Try this method to get a head start on erasing your debt for good.

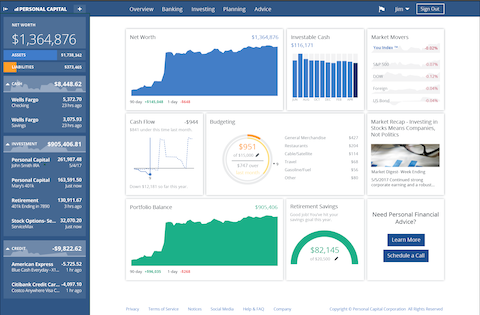

Create A Budget – How much money did you spend on groceries last month? How about on entertainment? On shopping? Without a budget, it’s unlikely you know exactly what you spend each month on these types of flexible expenses. By implementing a budget you’ll be able to keep track of how each dollar is spent and it will be much easier to make adjustments to reduce expenditures. In order to create your first budget, devote some time (30-90 days) to tracking and recording your spending in order to get a good idea of how you are allocating your money. I recommend using a tool like Personal Capital or Mint to make this process easier. Take a look at the results of your analysis and form a budget around your spending habits. Use your budget to spend with more discipline and also to determine areas where you can cut expenses.

Refinance Home or Auto Loan – Refinancing your loans can be a powerful tool for saving money. With the right deal, you may be able to both reduce your monthly payment and lower your interest rate. Not only will this save you money in the short-term by decreasing your monthly expenses, there’s also the potential to shave thousands of dollars in interest payments off of your loan.

Reduce Electrical/Water/Resource Usage – In previous articles, Ms. GGD has touched on the financial savings that can be achieved through water conservation and reduced resource usage. Integrating the money-saving strategies she's described into your way of life (e.g. sealing windows and doors in home, taking shorter showers, turning off faucet while brushing your teeth, adjusting thermostat when away from home, unplugging electrical devices when not in use, etc.) is a great way to permanently reduce some of your monthly expenses while also helping the environment.

Increase Insurance Deductibles – If you rarely file insurance claims, increasing your deductible can be an effective way to reduce expenses. Depending on your plan, making this change could significantly reduce the premiums you pay each month. While it’s true that you’ll be responsible for a larger portion of any claim you file, the monthly savings you get will most likely outweigh this one-time cost.

Final Thoughts

It may not seem so intuitive, but when it comes to achieving financial independence, permanently reducing your expenses/cost of living has a much greater impact than increasing your income by the same amount. This absolutely does not mean you should stop doing things to increase your income. On the contrary, I highly recommend you maximize your earning power at every opportunity. Though cutting expenses out-stripes increasing earnings, having a higher income still gives you the power to save, invest, or even spend more money. If you’re able to both cut expenses and increase your income over time, you’ll be on the fast track to financial independence. However, if you’re in a position where you can only choose one or the other, I think you would be best served by choosing to cut expenses.

Tools To Get You Started

Get a head start on your journey toward achieving financial independence by analyzing and tracking your income, expenses, investment performance, and overall net worth with the free online wealth management tool Personal Capital.

We use Personal Capital regularly to analyze our investment fees, track our investments, and project our net worth. We also periodically review our progress toward retirement with their retirement planning calculator.

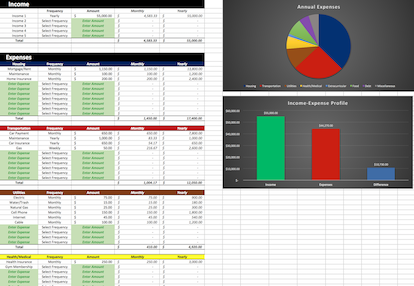

If you’d rather do things on your own, become a subscriber today and you’ll receive our Free Financial Planning Dashboard. This tool allows you to enter your income and expenses to create a detailed budget. You can use it to track your spending habits over time or just to get an idea of where your money is going each month. Take a look at the automatically generated charts and you may discover you have a little more cash to invest than you thought.

If you’re interested in detailed instructions on how to budget, save, pay off debt, and invest, check out The 6 Phases of Building Wealth. This book provides step-by-step instructions for working through each “Phase” in the process of achieving Financial Freedom. If you're just starting out, the information in this book will provide you with an invaluable resource. You can pick up the digital version for only $2.99 on Amazon.

Disclosure: Some of the links found on this website may be affiliate links. Affiliate links pay GGD a small commission when you click through and/or make a purchase. This is at zero additional cost to you.

Full Disclaimer/Disclosure

Related Posts

-

Retire Early And Pay Zero Income Taxes…Forever

Although your taxes may be lower than you think there's a good chance you still spend a significant portion of your income on taxes each year. Generally speaking, if you get a paycheck, a portion of it…

-

Save Energy. Save The Planet. Save Money.

When you need light in a dark room, the solution is usually to flip the light switch. It’s something we do—probably multiple times—every day. But have you ever considered where the electricity to power that…

-

Water Conservation: Your Life Depends On It

With major environmental threats to our planet, fresh, clean water is becoming increasingly difficult to access. So many people and creatures rely on this precious, life-sustaining fuel, and we must pay attention…NOW. The increase in…

There’s another aspect about cutting expenses that can make it more effective than increasing income… Taxes. Every extra dollar in income is taxed, meaning that every extra dollar in income is worth less than one dollar. Whereas every less dollar in expenses is not taxed, meaning you get the full effect of that dollar (you could even argue it decreases your taxes, since you might be paying less sales tax).

That said, there is a floor to how low you can decrease your expenses, whereas theoretically there is no ceiling to how high your income can go.

Absolutely! Great Points Joe. It’s easy to forget about things like sales tax.