How much money does someone need in order to safely retire?

I’m sure this question has given many aspiring retirees pause. After all, no one wants to be forced back into the workforce once they’ve made the life-altering decision to leave it. Would a $250,000 savings be enough? How about $1,000,000? Maybe even more?

Figuring out how much you need to retire is an extremely important task and would typically be a daunting one as well. Luckily, there’s a way to shortcut the process, making it a super simple calculation. Let me introduce you to the 4% rule.

The 4% Rule

Although I’ve briefly touched on the 4% rule in the past, I think it’s time we take a more in-depth look. The 4% rule, also known as the safe withdrawal rate, is a rule of thumb that suggests, with a mix of stocks and bonds, you can safely withdraw 4% of your holdings each year (annually adjusted to keep pace with inflation) and the money will last for at least 30 years.

The equation goes like this:

retirement savings x 4% = safe withdrawal rate

So, based on this rule, someone who has just retired with an accumulated savings of $1,000,000 would be able to safely withdraw and spend approximately $40,000 each year (i.e. $1,000,000 x 4% = $40,000).

“Hey, but this only tells us how much we can spend in retirement, not how much we need to save in order to reach retirement in the first place!”

Patience my friends. With a bit of math, the answer becomes clear.

Since we already know how to calculate the safe withdrawal rate, all we have to do is solve the equation for retirement savings instead:

safe withdrawal rate / 4% = retirement savings

Since 4% of any sum is 1/25th of that sum (i.e. 100% / 4% = 25), this equation can actually be slightly simplified to:

safe withdrawal rate x 25 = retirement savings

So if you desired a safe withdrawal rate of $50,000 for example, you’d need to accumulate a savings of approximately $1,250,000 (i.e. $50,000 x 25 = $1,250,000) in order to retire.

Since we now have an equation to calculate the savings required to achieve a particular safe withdrawal rate, what safe withdrawal rate should we use? How about our actual yearly expenses!

Making this substitution leads us to the final equation:

yearly expenses x 25 = retirement savings

So how much money do you need in order to safely retire?

Answer: 25 times your yearly expenses.

Note: Don’t know your yearly expenses? Try creating a budget (online tools like Empower Personal Dashboard can help with this process) to organize and track your spending.

Why Does The 4% Rule Work?

The 4% rule is based on a research paper co-authored by three finance professors at Trinity University in 1998. The goal of the paper was to determine the safe rate of withdrawal for an investment portfolio in retirement. Using data from 1925 to 1995 (later updated to 2009) the professors determined that that rate was approximately 4% and that an investment portfolio reduced by this amount each year would last at least 30 years (a typical retirement period). This study resulted in what became colloquially known as “the 4% rule”.

It should be noted that the actual 4% withdrawal rate refers only to the first year of retirement. In subsequent years, the withdrawal amount from the previous year is adjusted for inflation and used as that year’s withdrawal amount. This is what allows a retiree to maintain constant buying power throughout retirement.

What About Early Retirement?

At this point, I know exactly what many of you are thinking,

“But Mr. GGD, the 4% rule was created with a 30-year time period in mind. What about us early retirees?”

Don’t worry, I haven’t forgotten about my FIRE brothers and sisters.

While the Trinity study, and thus the 4% rule, does indeed use a 30-year period as the threshold for success, we have to remember that the goal of this study was to find the withdrawal rate that was successful for 100% of time periods. Even a 99% success rate would fail to pass these strict requirements. As a result, in the vast majority of 30-year time periods studied, a hypothetical retiree would actually be left with significantly more money than they started with. Not only that, the 4% rule also assumes you will never earn another dollar from any source other than your investment portfolio. Things like social security, part-time employment, and side hustles are not considered in the analysis so any money earned from sources like these would only increase your chances of success. Lastly, the 4% rule does not factor in any adjustments in spending rate in response to current market conditions. In reality, an early retiree would likely have the flexibility to slightly reduce their withdrawal rate (or skip an inflation adjustment) in a down market.

This all leads us to the conclusion that, for very early retirees, the base assumptions of the 4% rule most likely don’t fully apply. As a result, I think adopting a 4% withdrawal rate (or 25 times expenses) can be considered a reasonably safe method of determining how much you need for retirement, even for those of us who plan to retire very early.

Let’s break it all down in an example.

Example

Shay has yearly living expenses of $40,000. She is also a regular reader of GoGreenDollar.com, so she knows that she can calculate her retirement number by multiplying her living expenses by 25. Doing this gives her $1,000,000.

Over the next several years, Shay saves, invests, and pays off debt. Eventually, she manages to accumulate a $1,000,000 retirement nest egg. She retires from her job and begins using the 4% rule to make yearly withdrawals. The following is the result.

Assumptions:

Yearly Expenses = $40,000

Yearly Inflation = 2.5%

Investment Rate Of Return = 7.0%

Savings Required To Retire = $40,000 x 25 = $1,000,000

Year 1:

Beginning Of Year Balance = $1,000,000

Withdrawal Amount (i.e. spending money) = $40,000

Balance After Withdrawal = $1,000,000 - $40,000 = $960,000

End Of Year Balance = $960,000 + 7.0% = $1,027,200

Year 2:

Beginning Of Year Balance = $1,027,200

Withdrawal Amount (increased by inflation) = $40,000 + 2.5% = $41,000

Balance After Withdrawal = $1,027,200 - $41,000 = $986,200

End Of Year Balance = $986,200 + 7.0% = $1,055,234

Year 3:

Beginning Of Year Balance = $1,055,234

Withdrawal Amount (increased by inflation) = $41,000 + 2.5% = $42,025

Balance After Withdrawal = $1,055,234- $42,025 = $1,013,209

End Of Year Balance = $1,013,209 + 7.0% = $1,084,134

Year 4:

Beginning Of Year Balance = $1,084,134

Withdrawal Amount (increased by inflation) = $42,025 + 2.5% = $43,076

Balance After Withdrawal = $1,084,134 - $43,076 = $1,041,058

End Of Year Balance = $1,041,058 + 7.0% = $1,113,932

Year 5:

Beginning Of Year Balance = $1,113,932

Withdrawal Amount (increased by inflation) = $43,076 + 2.5% = $44,153

Balance After Withdrawal = $1,113,932 - $44,153 = $1,069,780

End Of Year Balance = $1,069,780 + 7.0% = $1,144,664

Shay continues to use the 4% rule for the next 25 years…

Year 30:

Beginning Of Year Balance = $2,294,169

Withdrawal Amount (increased by inflation) = $79,860 + 2.5% = $81,856

Balance After Withdrawal = $2,294,169 - $81,856 = $2,212,313

End Of Year Balance = $2,212,313 + 7.0% = $2,367,175

Shay was able to retire comfortably while maintaining the standard of living she was accustomed to and she never came close to running out of money. In fact, like many followers of the 4% rule, she ended up with much more money than she started with!

Final Thoughts

So there you have it! Using the 4% rule, you can calculate exactly how much money you need to save in order to safely retire. Now that you know the procedure, try out your own numbers and see what you get. Your savings target may be closer than you imagined!

Tools To Get You Started

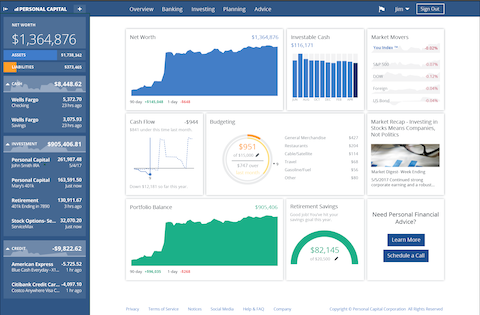

Get a head start on your journey toward achieving financial independence by analyzing and tracking your income, expenses, investment performance, and overall net worth with the free online wealth management tool Empower Personal Dashboard.

We use Empower Personal Dashboard regularly to analyze our investment fees, track our investments, and project our net worth. We also periodically review our progress toward retirement with their retirement planning calculator.

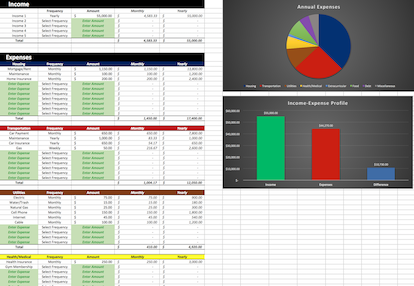

If you’d rather do things on your own, become a subscriber today and you’ll receive our Free Financial Planning Dashboard. This tool allows you to enter your income and expenses to create a detailed budget. You can use it to track your spending habits over time or just to get an idea of where your money is going each month. Take a look at the automatically generated charts and you may discover you have a little more cash to invest than you thought.

If you’re interested in detailed instructions on how to budget, save, pay off debt, and invest, check out The 6 Phases of Building Wealth. This book provides step-by-step instructions for working through each “Phase” in the process of achieving Financial Freedom. If you're just starting out, the information in this book will provide you with an invaluable resource. You can pick up the digital version for only $2.99 on Amazon.

Disclosure: Some of the links found on this website may be affiliate links. Affiliate links pay GGD a small commission when you click through and/or make a purchase. This is at zero additional cost to you.

Full Disclaimer/Disclosure

Related Posts

-

Why Saving Money In The Bank Will Leave You Broke (Part 1)

In 1923, Germany began printing and circulating two-trillion mark banknotes. That’s a “2”, followed by 12 zeros (i.e. 2,000,000,000,000) on each individual banknote! What would cause a country to print such a large denomination of…

-

Retire Early And Pay Zero Income Taxes…Forever

Although your taxes may be lower than you think there's a good chance you still spend a significant portion of your income on taxes each year. Generally speaking, if you get a paycheck, a portion of it…

-

The Simple Formula I’m Using To Retire In My 30's

Wake up, go to work, spend a few hours with family, go to bed, rinse and repeat. Some form of this routine probably describes the typical day for most of us. Throughout our lives, we’re…