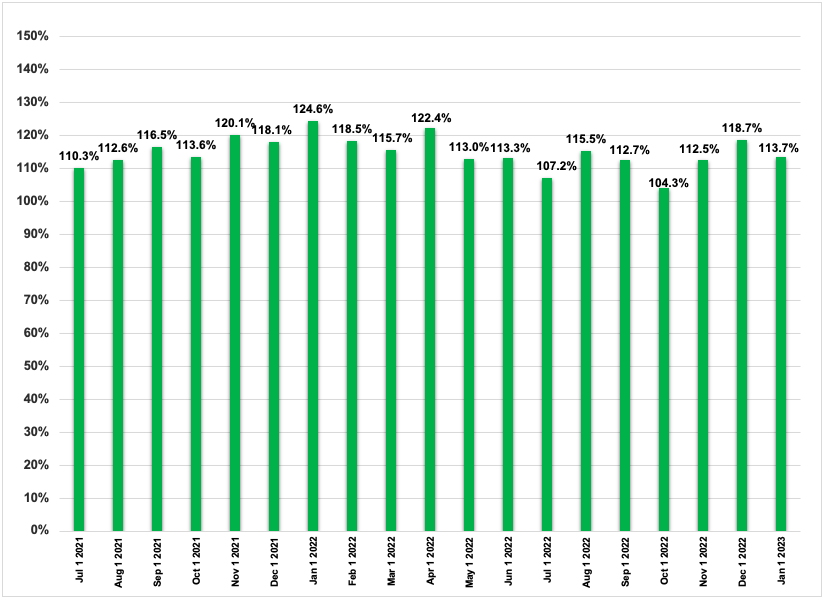

The Monthly Financial Update gives our readers an inside look at the allocation and performance of our investment portfolio. At the beginning of each month, we share a snapshot of our investments and highlight their performance over the previous month. In addition, we compute our progress towards achieving our retirement number.

Not Quite What We Planned...

Well, that didn’t go quite as we had planned. After many ups and downs (mostly downs), our portfolio ends 2022 with a negative overall year-over-year return. This is rather disheartening seeing as our goal for this year was to hit 150% of our retirement number. Unfortunately, the financial markets as well as the economy as a whole had other plans. While this setback will most likely force us to make some adjustments to our early retirement timeline, we won’t let this minor hiccup break our spirits! In truth, the fact that our portfolio has weathered the market swings relatively well is a promising sign for our future retirement plans.

On the bright side of things, our total portfolio didn’t shrink quite as much as the S&P 500, which fell by 19.44% in 2022!

While we didn’t reach all of our goals for 2022, we are not discouraged in the least. We know that by sticking to our investment strategy things will inevitably turn around. Therefore, our goals for 2023 will be the following:

Goals for 2023:

1. Continue saving and investing according to our plan

2. Purchase a home!! That's right, we're making the jump! A combination of wildly increasing rent payments--we had a $275 per month increase just this year!--paired with an expanding family (Baby GGD is on the way!), has led us to plans of buying our first home!

Results:

-4.21% month-over-month growth

113.7% of retirement number saved

2022 Total Net Worth Growth (Jan. 2022 - Jan. 2023) = -8.77%

Check out our detailed performance in the table below.

The Numbers

Accounts Portfolio Allocation Change In Value

(December-January)

Liquid Funds 0.24% +6.77%

High-Yield Savings 11.15% +7.15%

REITs 0.35% -0.87%

401(k)s 40.54% -4.60%

IRAs 4.59% -5.77%

HSA 1.82% -4.76%

Cryptocurrencies 0.03% -1.98%

Taxable Stock Investments 40.53% -6.43%

Debt 0.75% -3.66%

Total = 100%

Portfolio Allocation = Current asset distribution of our portfolio

Change In Value = Change in account value due to asset appreciation/depreciation, deposits, and withdrawals

Tools To Get You Started

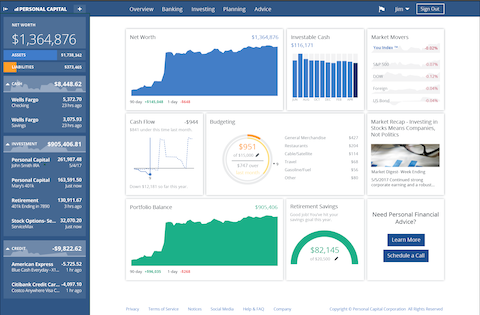

Get a head start on your journey toward achieving financial independence by analyzing and tracking your income, expenses, investment performance, and overall net worth with the free online wealth management tool Empower Personal Dashboard.

We use Empower Personal Dashboard regularly to analyze our investment fees, track our investments, and project our net worth. We also periodically review our progress toward retirement with their retirement planning calculator.

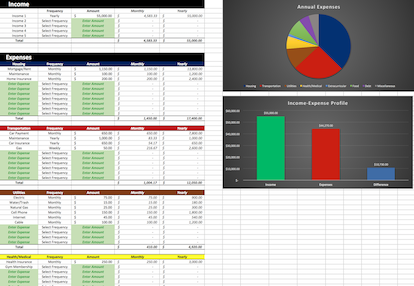

If you’d rather do things on your own, become a subscriber today and you’ll receive our Free Financial Planning Dashboard. This tool allows you to enter your income and expenses to create a detailed budget. You can use it to track your spending habits over time or just to get an idea of where your money is going each month. Take a look at the automatically generated charts and you may discover you have a little more cash to invest than you thought.

If you’re interested in detailed instructions on how to budget, save, pay off debt, and invest, check out The 6 Phases of Building Wealth. This book provides step-by-step instructions for working through each “Phase” in the process of achieving Financial Freedom. If you're just starting out, the information in this book will provide you with an invaluable resource. You can pick up the digital version for only $2.99 on Amazon.

Disclosure: Some of the links found on this website may be affiliate links. Affiliate links pay GGD a small commission when you click through and/or make a purchase. This is at zero additional cost to you.

Full Disclaimer/Disclosure

Related Posts

-

Year-End Monthly Financial Update - January 1, 2020

The Monthly Financial Update gives our readers an inside look at the allocation and performance of our personal portfolio. At the beginning of each month, we share a snapshot of our investments and highlight their…

-

Year-End Monthly Financial Update - January 1, 2022

The Monthly Financial Update gives our readers an inside look at the allocation and performance of our personal portfolio. At the beginning of each month, we share a snapshot of our investments and highlight their…

-

Year-End Monthly Financial Update - January 1, 2021

The Monthly Financial Update gives our readers an inside look at the allocation and performance of our personal portfolio. At the beginning of each month, we share a snapshot of our investments and highlight their…