The other day, while browsing through YouTube videos, I came across one that featured Tony Robbins discussing investing. I watched the video and found it had some good, if not groundbreaking, suggestions. There was one portion in particular that really stood out to me, however. Robbins suggested that you should view investing like, “setting up a business on the side. A financial business with no employees, that will be an extraordinary economic nest egg that brings you income for life”. I love this analogy. It just about perfectly sums up how I view my investments, however, I'd add a slight twist to it. Instead of viewing your personal financial firm as employee-free, let’s say that each share of stock you hold is actually one of your employees. Once hired, these employees never tire, will never quit, don't require a salary, and work for you 24 hours a day. The only way to lose one of your employees is for you to personally fire them (i.e. sell a share). Your employees are always working to grow your company. All you are required to do is...well, nothing. Simply hire them (i.e. buy a share) and they do the rest. The best part of all is that pretty much anyone can own such a company. It's as simple as choosing to invest.

So, why do so many pass up on the opportunity to invest?

The answers are varied, but most probably fall into one of the following categories: lack of knowledge, fear of losing money, previous bad experiences, or a belief that investing isn’t affordable.

Each of these is a valid concern that you, or someone you know, may have when it comes to investing. In fact, I shared many of these same concerns for a large portion of my life. It took a lot of dedicated research, study, and experimentation to get over my fears and fully immerse myself in the world of investing. Hopefully, I can make the transition a bit easier for you (or that friend you've been trying to convince).

Below, I’ve described, in detail, the surprisingly simple investment strategy I use in most of my personal trading. I’ve broken the process down into step-by-step instructions so that anyone can follow along. I don't guarantee you’ll achieve any specific result if you adopt this strategy. I will, however, present to you the rationale behind each step in the process, using a bit of logic and some real data along the way.

Surprisingly Simple Step #1 - Determine Asset Allocation

A classic rule of thumb used to help determine proper asset allocation is to subtract your age from 100 and use the resulting number to determine the percentage of stocks you should hold. Using this method, a 30-year-old would subtract 30 from 100, giving them a 70% allocation of stocks in their portfolio. The remaining 30% would be allocated to bonds or some other conservative asset.

This rule is useful for its simplicity, but it is not nearly aggressive enough. As early retirees, we need to create long-term growth over decades. In order to generate sustained growth, a higher allocation of stocks is required. By modifying the allocation method just a bit, we can accomplish this goal. Instead of using 100 in the calculation, we will increase the constant by 25%, giving us 125. Using this new number, a 30-year-old would allocate 95% of his portfolio to stocks (i.e. 125 – 30 = 95) and 5% to more conservative investments.

So, besides being easy to understand and implement, what makes this a good allocation strategy? How does buying large amounts of stock translate into more growth? What purpose does the conservative part of your portfolio serve? To answer these questions, let’s examine a little history.

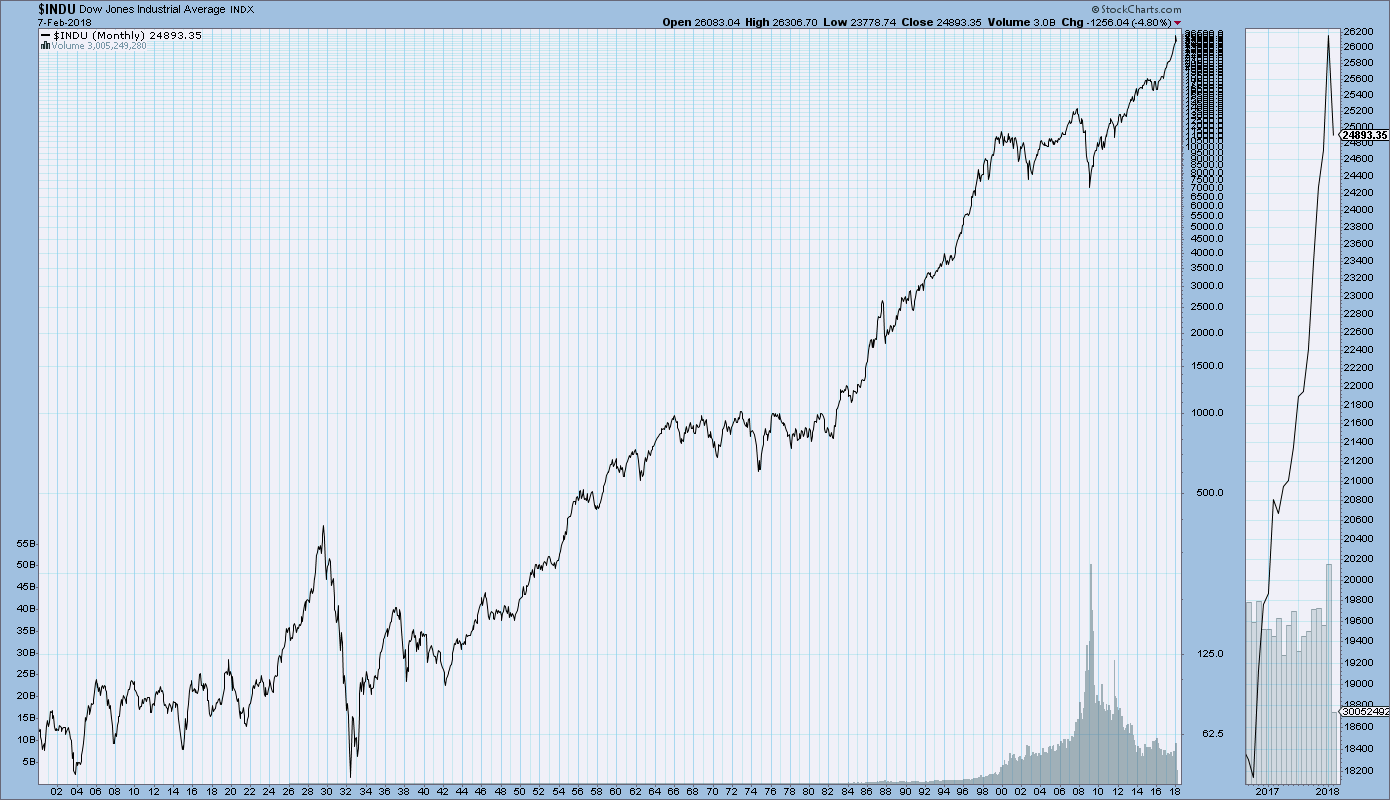

The following chart shows the performance of the Dow Jones Industrial Average over the last 100+ years.

Dow Jones Industrial Average (1900-2018)

If you had consistently invested over any long-term period of time, you would have come out on top. Even through the Great Depression (the large drop early in the chart), as long as you didn’t panic and sell your holdings, your investment would have grown over the long-term. In fact, the worst annual return in history, over a 20-year period, was 2.5%. Over a 35-year span the results are even better, with the worst return ever recorded being 6.1% per year (the best was 12.9%!). The point is: given enough time, stocks always increase in value. Your investment may not grow every day, every month, or even every year, but over the long-term, growth is almost guaranteed.

So how much growth should we expect? Historically, stocks grow at a rate of about 7-10% per year. At this rate, left alone, your investment would double in value every 7-10 years. This is the type of growth we will need as early retirees and that is why the allocation strategy is designed to favor stocks so heavily.

So what’s up with the bonds? Well, as we’ve discussed, the stock market is not always the most stable thing in the world. Over the long-term stock investing is close to a sure thing, but over short periods it can be hit or miss.

The bond market, on the other hand, is much less volatile. It doesn’t experience the same highs or lows as the stock market. Instead, it remains relatively stable over the short-term.

Historical Performance - Total Stock Fund (VTSMX) vs Total Bond Fund (VBMFX)

As we age, the number of “long-term” periods we have remaining in life, in which we can wait for our investments to recover, is continually decreasing. Therefore, the older we become, the more stable we need our portfolios to be. This is where bonds come in. Since bonds are more stable than stocks over the short-term, adding a larger percentage of bonds to our portfolio as we age makes perfect sense.

Surprisingly Simple Step #2 - Purchase A Mix Of Stocks And Bonds

Now that you’ve determined your portfolio's allocation, it’s time to select the actual investments. Your goal is to “invest in stocks and bonds”, but what does that really mean? Should you just pick a few well-known companies to invest in? Should you start watching the investment hour on the news or reading the business section in the paper? Maybe look into that stock a friend of yours mentioned the other day. Apple is a good investment, right? Oh I know, Bitcoin!

You may be thinking, “Wait a minute. That doesn’t sound very simple.” I totally agree!

Throw out all of the complex ideas you have about investing. We’re going to make this...well...surprisingly simple. All you'll need to do is invest in two specific funds.

- Investment 1 – A Total US Stock Index Fund (or alternatively, a Total US Stock Exchange Traded Fund (ETF))

- Investment 2 – A Total Bond Market Index Fund (or alternatively, a Total US Bond Market ETF)

How could it be so simple? It’s through the power of index funds (…and ETFs).

Index funds are a type of mutual fund made up of components designed to track a market index—like the S&P 500 or Dow Jones Industrial Average. The performance of an index fund is tied directly to its underlying index. If the underlying index falls, the fund falls, if the index rises, the fund rises. Since there is a very limited amount of manual management required from a brokerage firm to maintain an index fund, the expense ratios (i.e. fees) of these funds are typically very low.

ETFs share many similarities with index funds. They can track an index and have very low fees. The primary difference between the two—for our purposes at least—is that ETFs are traded as individual shares on a stock exchange while index funds are just buckets of money you can add to over time.

Now that you are familiar with Index funds and ETFs, all you have to do is select 2 funds; one that tracks the US Stock Market and one that tracks the US Bond Market. For your convenience, I've provided some recommendations:

For your stock allocation, I recommend Vanguard's index funds. Specifically, VTSAX ($3,000 minimum to start, but any amount after your initial investment) or VTSMX (replaced by VTSAX in 2018). If you don't have quite enough to reach the minimum investment requirement, you can go for an ETF. I like Vanguard's VTI.

For bonds try, VBTLX ($3,000 minimum to start, but any amount after your initial investment), VBMFX (replaced by VBTLX in 2018), or the ETF, BND.

Surprisingly Simple Step #3 - Perform Annual Account Rebalancing

Congratulations, you’ve finished the “hard” part! The last step is something you need to do very infrequently. In fact, you’ll only need to do it once each year. That step is portfolio rebalancing.

As the value of your investments change over time, things can (and will) get a little out of whack. Your bonds and stocks will rarely grow at the same rates. As a result, your portfolio allocations are unlikely to stay in line with the desired percentages. In order to keep this from getting too out of hand, each year—the end of the year is probably best—you should realign your investments to bring them back to the desired asset allocation. If your bonds have grown more than your stocks, then you’d sell some bonds and use the proceeds to buy stocks. If your stocks have outgrown your bonds then you’d do the opposite. Yep, just that simple.

So what’s the deal with rebalancing? Well, the main goal is to keep your investments correctly allocated based on your age (see Surprisingly Simple Step #1). If the ratio of stocks and bonds gets too far off track it could limit your investment growth (with too many bonds) or add unnecessary volatility (with too many stocks). The second reason for rebalancing is that it can result in additional investment growth. Here's an example.

Example

After reading about our Surprisingly Simple Investment Strategy, 45 year-old, Tony decides to invest $100,000. He buys $80,000 in stocks (125 - 45 = 80%) and $20,000 in bonds (100% - 80% = 20%). The stock market experiences a correction and Tony’s stock holdings lose 15% of their value, leaving him with stocks worth $68,000 and bonds worth $20,000.

Scenario 1 – Do nothing

Tony Does Nothing. He holds onto his stocks and bonds and eventually the stock market recovers. After the recovery, he has $80,000 in stocks and $20,000 in bonds once again, a total of $100,000.

Scenario 2 – Rebalance

With stocks worth $68,000 and bonds worth $20,000, Tony’s current portfolio allocation is 77.3% stocks (i.e. $68,000 / ($68,000 + $20,000)) and 22.7% bonds. Based on his age of 45, he should have 80% of his portfolio allocated to stocks. In order to rebalance his investments, Tony sells $2,400 of his bonds and uses the funds to purchase stocks. Tony now has the correct asset allocation for his age, with $70,400 in stocks and $17,600 in bonds. The stock market eventually recovers, increasing the value of Tony's stock holdings. This leaves Tony with $82,823 ($70,400 / 85%) in stocks and $17,600 in bonds, a total of $100,423!

Tony was able to create an extra $423 in growth just by rebalancing.

Why Not Sell?

Let’s discuss a 3rd scenario for Tony. This is less related to rebalancing and more related to the psychology of investing, but I thought it would be a good opportunity to point something out. When the value of an investment drops, many people become fearful of additional “losses” and decide to sell. This is actually the worst action you can take. I put quotes around the word losses because you don’t actually lose any money until you sell. So, in essence, selling in fear is the equivalent of trying to avoid a hypothetical loss by creating an actual loss. As we’ve shown, the stock market goes up over time, so it is simply a matter of time before any pull-back returns to profitability.

If Tony had sold his stocks after the 15% drop, he would be left with $68,000 in cash and $20,000 in bonds or $88,000 total. After the stock market recovery, since he had no money invested in stocks, he’d still have the same total. If he had rebalanced appropriately he would have had $100,423 at this point. Even if he had simply done nothing, he would at least be back to his original $100,000. Instead, Tony locked in his loss by selling and is now left with only $88,000 of his original $100,000 investment.

Final Thoughts

Step #1

Subtract your age from 125 to determine your stock allocation percentage. The remaining amount (out of 100%) should be allocated to conservative assets.

Step #2

Using the portfolio allocation you calculated in step #1, buy the stock index fund/ETF and bond index fund/ETF of your choice.

Step #3

Once each year, realign your investments so that the ratio of stocks and bonds is in line with the appropriate portfolio allocation based on your age.

And that is all folks. Simple right? Maybe even surprisingly so…

Tools To Get You Started

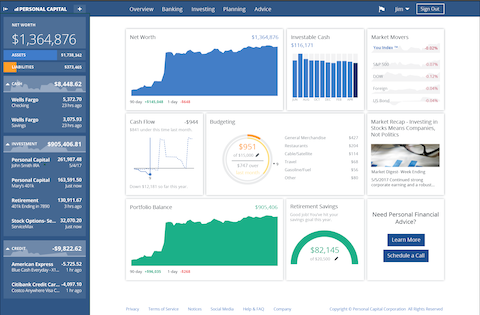

Get a head start on your journey toward achieving financial independence by analyzing and tracking your income, expenses, investment performance, and overall net worth with the free online wealth management tool Empower Personal Dashboard.

We use Empower Personal Dashboard regularly to analyze our investment fees, track our investments, and project our net worth. We also periodically review our progress toward retirement with their retirement planning calculator.

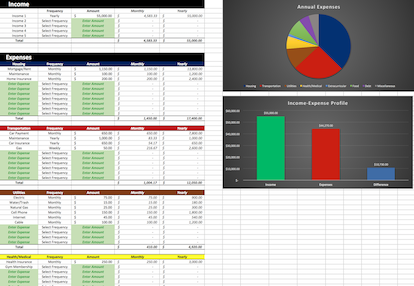

If you’d rather do things on your own, become a subscriber today and you’ll receive our Free Financial Planning Dashboard. This tool allows you to enter your income and expenses to create a detailed budget. You can use it to track your spending habits over time or just to get an idea of where your money is going each month. Take a look at the automatically generated charts and you may discover you have a little more cash to invest than you thought.

If you’re interested in detailed instructions on how to budget, save, pay off debt, and invest, check out The 6 Phases of Building Wealth. This book provides step-by-step instructions for working through each “Phase” in the process of achieving Financial Freedom. If you're just starting out, the information in this book will provide you with an invaluable resource. You can pick up the digital version for only $2.99 on Amazon.

Disclosure: Some of the links found on this website may be affiliate links. Affiliate links pay GGD a small commission when you click through and/or make a purchase. This is at zero additional cost to you.

Full Disclaimer/Disclosure

Related Posts

-

Monthly Financial Update - February 1, 2018

The Monthly Financial Update gives our readers an inside look at the allocation and performance of our personal portfolio. At the beginning of each month, we share a snapshot of our investments and highlight their…

-

Why 401(k)s Are The Best Investments, Period

There are plenty of great investment options out there to choose from, but very few can compete with the advantages of a 401(k). When you add in employer matching to the equation, I believe 401(k)s…

-

The Simple Formula I’m Using To Retire In My 30's

Wake up, go to work, spend a few hours with family, go to bed, rinse and repeat. Some form of this routine probably describes the typical day for most of us. Throughout our lives, we’re…

Investing is a great and easy thing that a lot of people don’t do. It’s sad, that they’d rather just sit on it and not let their money work for them like this articles said comparing it to being your own employees!

I agree, you’ve got to put your money to work!