I was in my early 20s when I booked my first trip to Las Vegas. Some friends and I wanted to try our hands at a little gambling (and a little partying…) and Vegas seemed like the perfect place to do it. The day before the trip my grandfather came over to visit and, after discovering I was going to Las Vegas, asked me what strategy I planned to use on the blackjack table. I looked at him in confusion and responded with “Strategy..?” He immediately sat me down and taught me the ins and outs of the game.

After an intense session of training, I felt energized. I had unlocked the secrets! I would go to Las Vegas, win lots of money, and come back a king!

Gambling...

Needless to say, my dreams of grandeur didn’t go quite as expected. Don’t get me wrong, I had a great time hanging with friends and experiencing Las Vegas for the first time. It was the “come back a king” part that didn’t work out. Let’s just say, my wallet was much lighter leaving Vegas than it had been when I arrived.

I followed all the strategies yet I still came home broke. What went wrong?

I’m sure this may come as a shock (insert sarcasm…), but, even though it can be fun and exhilarating, gambling is specifically designed for the player to lose. Each time you roll the dice on the craps table or spin the roulette wheel, you are more likely to lose money than you are to win it. This simple fact allows the casinos in Las Vegas to earn literally tens of billions of dollars every year. You read that correctly. They bring in TENS of BILLIONS, each and every year, all from people like my younger self, trying to win big.

Though every casino game has different odds, the house pretty much always has the edge. Usually somewhere between 0.5% and 15%. This “edge” translates directly to the average profit a casino can expect to make over time on a particular game. For example, the house edge in blackjack is typically 0.5-2% so a casino can anticipate a profit of 0.5-2% of the sum of all bets made on their blackjack tables. That may not sound like much, but with hundreds of thousands, or even millions, of dollars being wagered on a daily basis in a single casino, the numbers can add up very quickly. It should also be noted that blackjack, with its 0.5-2% house edge, is one of the most “player friendly” games. Some other games give the house an edge of up to 15%!

Since gambling involves games of chance it is impossible to accurately predict the outcome of any individual session of play. However, long-term regular gambling will always trend toward the mathematical odds. As a result, any regular gambler should expect a negative overall rate of return on their money.

...vs Investing

So how is investing any different? Especially if we’re talking about investing in the volatile stock market. Isn’t it just another form of gambling?

That couldn’t be further from the truth.

Not only are investing and gambling not the same, they are actually total opposites in many ways. Let me explain…

While gambling gives you a slight chance of coming out ahead in the short-term, unfavorable odds, which result in a house edge, mean you have almost zero chance of making a profit over the long-term. Conversely, though the growth of an investment in the stock market can also be unpredictable in the short-term, historically, any such investment has always resulted in a long-term gain. In fact, there has been no 20 year period in history where an investment in the stock market would have resulted in a loss. The “worst case” would have resulted in a yearly gain of 2.5%. But what about on any given day?

Since the year 1950, there have been a total of 7,135 days where the market declined. In that same time, the market has had over 18,000 positive days. That’s more than a 2.5 to 1 ratio! In other words, over the last 69 years (i.e. 1950 to 2019) there was approximately a 72% chance that the stock market increased in value on any given day. That’s about as far from gambling odds as you can get!

Quick Example

Jef is a good blackjack player. He hasn’t quite mastered card counting, but he knows how to play well enough that he always makes the most mathematically sound decision on any given hand (i.e. he hits when he should hit, stands when he should stand, doubles down when he should double down, splits when he should split, etc.). At his level of skill the house only has a minuscule 0.5% edge.

One day he decides it’s time to get serious about saving for retirement, and what better way to do it than by taking advantage of his superior blackjack skills? He develops the perfect plan.

Each month he will take $250 to the casino and use it to play blackjack. When he leaves the casino he will deposit all of his winnings, plus the initial $250, into a traditional savings account to be left alone until retirement. Jef believes that by saving $250 per month plus the blackjack winnings he plans to make, he’ll be able to build a nice-sized nest egg by retirement. He implements his plan and follows it faithfully for the next 30 years.

Assumptions:

House edge = 0.5%

Gambling Amount = $250 per month

Years Of Gambling = 30

Total amount contributed = $250 x 12 months x 30 years = $90,000

Final Account Value = $89,550

After three decades and countless hours spent in the casino gambling, Jef will retire with a nest egg of approximately $89,550. Even though in total he contributed $90,000 to his gambling efforts, he still ended up with slightly less. 0.5% less to be exact. Over the years Jef had some big wins and some big losses but he was ultimately unable to overcome the odds. Even with just a tiny 0.5% edge, the winnings inevitably trended toward the house.

What if instead of using his gambling prowess to save for retirement Jef had chosen to invest in the stock market? Let’s run the numbers.

Assumptions:

Rate Of Return = 8.5%

Contribution Amount = $250 per month

Years Of Investing = 30

Total amount contributed = $250 x 12 months x 30 years = $90,000

Final Account Value = $415,600

By investing his money instead of using it to gamble, Jef could have saved an additional $326,050 (i.e. $415,600 - $89,550)! In addition, he could have saved himself hundreds, if not thousands, of hours of traveling to and from casinos and wasting away sitting at blackjack tables. I think the right choice is pretty clear.

Final Thoughts

While it is often said that investing in the stock market is the same as gambling, this couldn’t be further from the truth. Not only are these two activities very different, but I’d go as far as saying they are actually opposites. Simply put, when you gamble regularly, you are almost guaranteed to lose money over time. On the other hand, when you invest in the stock market regularly, you are almost guaranteed to make money over time. The key component of this comparison is the phrase "over time". Over short periods both stock investing and gambling can be equally unpredictable, but as the time horizon grows longer, they will begin to diverge in opposite directions. This is one of the reasons that savvy investors slowly shift away from stocks and into bonds as they get older.

Tools To Get You Started

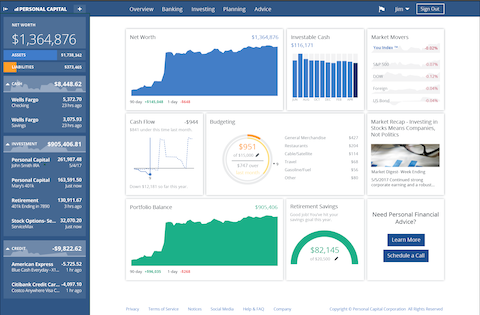

Get a head start on your journey toward achieving financial independence by analyzing and tracking your income, expenses, investment performance, and overall net worth with the free online wealth management tool Personal Capital.

We use Personal Capital regularly to analyze our investment fees, track our investments, and project our net worth. We also periodically review our progress toward retirement with their retirement planning calculator.

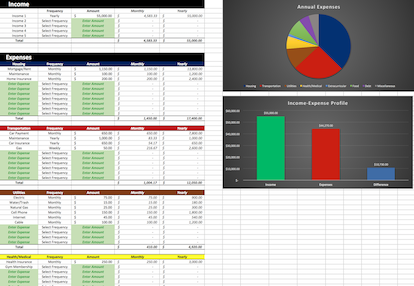

If you’d rather do things on your own, become a subscriber today and you’ll receive our Free Financial Planning Dashboard. This tool allows you to enter your income and expenses to create a detailed budget. You can use it to track your spending habits over time or just to get an idea of where your money is going each month. Take a look at the automatically generated charts and you may discover you have a little more cash to invest than you thought.

If you’re interested in detailed instructions on how to budget, save, pay off debt, and invest, check out The 6 Phases of Building Wealth. This book provides step-by-step instructions for working through each “Phase” in the process of achieving Financial Freedom. If you're just starting out, the information in this book will provide you with an invaluable resource. You can pick up the digital version for only $2.99 on Amazon.

Disclosure: Some of the links found on this website may be affiliate links. Affiliate links pay GGD a small commission when you click through and/or make a purchase. This is at zero additional cost to you.

Full Disclaimer/Disclosure

Related Posts

-

Time Is Your Most Powerful Investing Tool

If you’ve been consistently following the posts on GoGreenDollar you know that there are a multitude of resources for the aspiring early retiree. We’ve broken down the process of setting up an investment account into step-by-step…

-

The Stock Market Always Goes Up

My first taste of investing came after graduating from college and starting my first “real” job. This initial experience consisted of picking which funds–from a list of 10 or 15–I would invest in, in my…

-

Surprisingly Simple Investment Strategy For Retiring Early

The other day, while browsing through YouTube videos, I came across one that featured Tony Robbins discussing investing. I watched the video and found it had some good, if not groundbreaking, suggestions. There was one…