Investing. I love to talk about it, read about it, and write about. As a result, I have a tendency to bring it up quite often as a topic of conversation. I was recently having one of these investing conversations with some colleagues at work and our discussion turned towards the, often times, difficult trade-off between allocating money for investing versus spending it on the things we want. At one point I offhandedly made the comment, “every dollar you invest today is like a seed that will grow into part of your fortune in the future”. I paused and thought about what I had just said. Could a few dollars really make a significant difference? This question was important because, in my experience, the reason many people don’t invest is because they feel they can’t afford to. If someone has only a few dollars remaining each month after covering their expenses, is investing still worth it? I decided to find out.

I Can't Afford It

Whenever I speak to someone who is hesitant about investing, I’m always curious as to the reason why. The answers vary from person to person (e.g. lack of knowledge, fear of losing money, previous bad experiences, etc.), but one of the most common is “I can’t afford to invest.”

Upon hearing this, my typical reply is, “you can’t afford not to invest.” I then go on to stress the importance of starting as soon as possible by explaining the power of compound growth. Following that, I’ll jump into detailed explanations of ways to eliminate debt and methods of budgeting that focus on reducing expenses so that funds can be re-allocated to saving/investing.

Frequently, by the end of this conversation, the person has been convinced of the error of their ways and is excited to begin investing (many still fail to follow through, but at least the seed has been planted). However, many people remain unconvinced no matter what I say to them. Many claim that, at best, they can only afford to set aside a few dollars each week for investing and that it simply wouldn’t be worth the effort. Let’s put that assertion to the test.

Example - You Can't Afford Not To

Byron was recently introduced to GoGreenDollar.com and, after reading some articles, is feeling super energized about investing. He’s set up his investing account and has his strategy ready but there’s one problem. He doesn’t have a lot of “wiggle room” in his current budget. In fact, Byron thinks he can only afford to deposit about $25 a week into his investment account. Will that be enough?

Assumptions

Rate Of Return = 8.5%

Investment Contributions = $25 / week

Results ($25 Per Week)

Years Cumulative Contributions Total Account Value

1 $1,300 1,358

5 $6,500 $8,100

10 $13,000 $20,470

15 $19,500 $39,364

20 $26,000 $68,221

25 $32,500 $112,293

30 $39,000 $179,605

35 $45,500 $282,411

40 $52,000 $439,426

45 $58,500 $679,235

Even with a contribution rate of only $25 per week, Byron’s investment portfolio would grow exponentially over time. In fact, if Byron maintained this contribution level long term, he would accumulate hundreds of thousands of dollars!

Let’s change things up a bit. What if, instead of maintaining a $25 contribution rate, Byron decided to take advantage of his periodic raises at work and increase his weekly investment contribution by $1 each year (i.e. year 1 = $25, year 2 = $26, year 3 = $27, year 4 = $28, year 5 = $29, etc.)? Let’s run the numbers.

Alternate Results ($25 Per Week + $1 Each Year)

Years Weekly Contributions Cumulative Contributions Total Account Value

1 $25 $1,300 $1,358

5 $29 $7,020 $8,693

10 $34 $15,340 $23,590

15 $39 $24,960 $47,962

20 $44 $35,880 $86,806

25 $49 $48,100 $147,751

30 $54 $61,620 $242,453

35 $59 $76,440 $388,710

40 $64 $92,560 $613,708

45 $69 $109,980 $958,969

Amazingly, increasing his weekly contributions by just $1 each year would add 10’s or even 100’s of thousands of dollars to the long-term value of Byron’s investment portfolio! With enough time, Byron could even become a millionaire. All by starting with just $25 per week!

If the question is whether investing a few dollars each week (or month) is worth the effort, I think we have established that the answer is, unequivocally, yes.

Note: I realize that there are many people who are truly struggling financially. People who, in some cases, cannot afford to allocate even a single dollar to anything outside of their most basic necessities. For someone in this situation, the focus should not be on investing. Instead, they should focus on increasing their income. Here are a few options: Request a raise at work, change jobs/companies, create a side hustle (blogging?), get a second job, go back to school to learn a new skill or trade.

Final Thoughts

As I’ve stated before, time, not money, is the true key to investing success. As a result, given enough time, even a few dollars per week can grow into a significant nest egg. Remaining consistent over time will pay off big time (in cash) in the end.

If you are still hesitant to begin investing because you don’t have much money to start with, just begin with whatever you can afford and go from there. The results might surprise you.

Tools To Get You Started

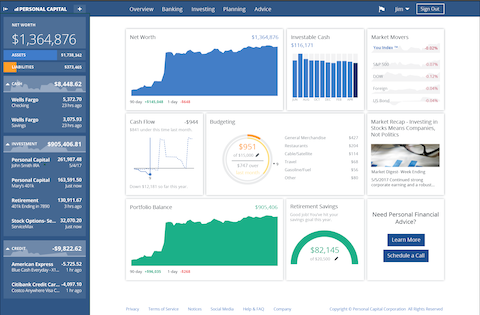

Get a head start on your journey toward achieving financial independence by analyzing and tracking your income, expenses, investment performance, and overall net worth with the free online wealth management tool Personal Capital.

We use Personal Capital regularly to analyze our investment fees, track our investments, and project our net worth. We also periodically review our progress toward retirement with their retirement planning calculator.

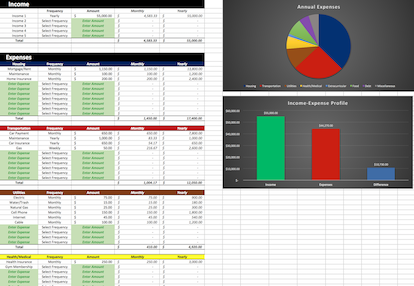

If you’d rather do things on your own, become a subscriber today and you’ll receive our Free Financial Planning Dashboard. This tool allows you to enter your income and expenses to create a detailed budget. You can use it to track your spending habits over time or just to get an idea of where your money is going each month. Take a look at the automatically generated charts and you may discover you have a little more cash to invest than you thought.

If you’re interested in detailed instructions on how to budget, save, pay off debt, and invest, check out The 6 Phases of Building Wealth. This book provides step-by-step instructions for working through each “Phase” in the process of achieving Financial Freedom. If you're just starting out, the information in this book will provide you with an invaluable resource. You can pick up the digital version for only $2.99 on Amazon.

Disclosure: Some of the links found on this website may be affiliate links. Affiliate links pay GGD a small commission when you click through and/or make a purchase. This is at zero additional cost to you.

Full Disclaimer/Disclosure

Related Posts

-

The Basics: Setting Up An Investment Account

By now, it’s pretty obvious that I believe investing is vitally important to your future financial success. As you've also probably gleaned from my writings, the stock market is, by far, my favorite investment option.…

-

The Magical Penny

Imagine this: a rich and eccentric old man has just approached you with a job opportunity. He needs someone to watch his mansion for the next 30 days while he’s out of town. All you’ll…

-

Time Is Your Most Powerful Investing Tool

If you’ve been consistently following the posts on GoGreenDollar you know that there are a multitude of resources for the aspiring early retiree. We’ve broken down the process of setting up an investment account into step-by-step…