“The stock market is dropping like a rock!”

“We are entering a bear market! No, it’s even worse than I thought, a recession!”

“Oh. My. Gosh! It’s a DEPRESSION!! I’m losing all my money!”

“I’ve got to get out of the market before I lose everything!”

At some point, every investor has found herself having thoughts like these. When the market drops, it can be extremely difficult not to panic, even for experienced investors. The fact is, sitting by, as the value of your investment portfolio plunges is nerve-racking for anyone. The instinctual reaction is to sell your holdings and get out of the market as soon as possible. While it is oftentimes good in life to “follow your gut” (aka listen to your instincts), when it comes to investing, this is usually not the best course of action. Instead, you should follow your head and think about things logically. We’ve done just that in this article, and the correct response is quite clear. You should treat your stocks like real estate during a market crash.

The Real Estate Investor

Although my stance on your personal home being an investment is well documented (it is not an investment), I don’t believe real estate itself is necessarily a bad asset class to allocate some of your investment dollars to. In fact, investing in real estate can be one of the fastest and most effective ways to grow your wealth. That being said, this article isn’t about real estate investing. Instead, we will use real estate, a physical asset that most people have at least a general understanding of, as a proxy for other, more complicated (misunderstood?) investments, in order to demonstrate that investments that seem very different on the surface may, in fact, have quite a bit in common. With that in mind, I’d like to present the following story:

After reading the book Rich Dad Poor Dad, Judy felt inspired to begin investing in real estate. Being a woman of action, it didn’t take her long to conduct adequate research, save the required money, and find the perfect 4-unit rental property to buy. She purchased the property for $300,000 and quickly rented out all four apartments to tenants. The rents were set high enough to cover all of the property’s expenses plus provide her with a reasonable amount of passive income. After only six months of owning the property, its “paper value” (the value it would be appraised and/or sold at) had grown a full 5% to $315,000! Her decision to invest in real estate seemed to really be paying off! Or so she thought…

Exactly two years after Judy acquired the property, the housing market experienced a massive decline and the paper value of her investment dropped all the way down to $200,000. Although the 4 tenants were still in place and paying rent on time, the property’s value was now over 33% below what Judy paid for it! Should Judy quickly sell in order to avoid any more large blows to the value of her investment? Once she sells, she could simply wait for the market to improve and then get back in, right?

Let’s see.

- The drop in value is only on paper.

- Judy still owns the property.

- The rent money from the tenants is still enough to cover all of the property’s costs.

- Judy is still receiving monthly passive income from her renters to spend however she pleases.

- Due to her research, Judy knows that, historically, the housing market has always eventually recovered from all previous market declines, usually within a relatively short amount of time.

Would it make sense for Judy to sell her investment property for an actual loss of $100,000 in order to avoid additional losses on paper?

The answer seems pretty obvious. There's very little incentive for Judy to sell the property, especially at a loss. The drop in value is clearly temporary and maintaining ownership doesn’t cost her anything out of her own pocket. On top of that, she’s receiving regular passive income. The right course of action is clear. Judy should continue holding the investment property, continue collecting the periodic passive income, and sit back as the market recovers and, eventually, increases further over the long term.

Are Stocks Any Different?

While it’s evident that Judy should hold onto her investment property through a market decline, what about stock investments? What if instead of real estate, Judy had invested in a stock market index fund? How would things be different…

Judy is in a panic. It’s been a full two years since she invested her money into the stock market and her investment is showing nothing but red. She is down by a whopping 33%, and has no idea what to do! Should Judy quickly sell in order to avoid any more large blows to the value of her investment? Once she sells, she could simply wait for the market to improve and then get back in, right?

Let’s see.

- Although it may feel different, the drop in Judy’s stock investment’s value is only on paper, just like it was for her real estate investment.

- Judy still owns every share of the stock fund that she purchased.

- There’s essentially no cost* associated with simply owning stocks, so holding this investment doesn’t cost Judy anything.

- Judy is receiving regular passive income from dividends to spend however she pleases.

- Due to her research, Judy knows that, historically, the stock market has always eventually recovered from all previous market declines, usually within a relatively short amount of time.

(*Some index funds do have fees associated with owning them called "expense ratios". These fees tend to be extremely low, ranging from a high of around 0.2% all the way down to 0.04% or less. The dividend income from an index fund will typically be orders of magnitude higher than any fees.)

Hmmm. This all sounds pretty familiar…

That’s right, this situation is almost identical to that of the real estate investment! Therefore, just like we concluded with her real estate investment, it is obvious that Judy should hold onto her stock investment during a market decline. The alternative is to lock in an actual loss (as opposed to a loss on paper) and lose out on the dividend income and other benefits of the investment. Once again, the right course of action is quite clear.

Final Thoughts

Real estate and stocks are very different investments. However, when it comes to market declines (or crashes, or corrections, or pullbacks, or bear markets, or recessions, etc.) they should be treated exactly the same. Just like you shouldn't (and probably wouldn't) consider selling your investment property (or personal home for that matter) every time the housing market gets shaky, you shouldn’t consider selling your stock holdings just because the stock market has experienced some fluctuations or has a large temporary drop. As scary as it can be to watch the value of your stock portfolio decline, you’ve got to remember: the drop in value is only on paper, you still own the same number of shares after the drop that you did before the drop, owning those shares doesn’t cost you a penny, you’re still collecting regular passive income from dividends, and, with a little patience, the stock market always goes back up.

Tools To Get You Started

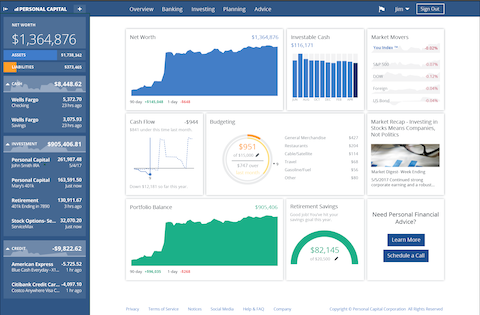

Get a head start on your journey toward achieving financial independence by analyzing and tracking your income, expenses, investment performance, and overall net worth with the free online wealth management tool Empower Personal Dashboard.

We use Empower Personal Dashboard regularly to analyze our investment fees, track our investments, and project our net worth. We also periodically review our progress toward retirement with their retirement planning calculator.

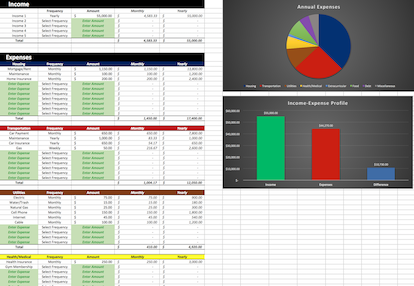

If you’d rather do things on your own, become a subscriber today and you’ll receive our Free Financial Planning Dashboard. This tool allows you to enter your income and expenses to create a detailed budget. You can use it to track your spending habits over time or just to get an idea of where your money is going each month. Take a look at the automatically generated charts and you may discover you have a little more cash to invest than you thought.

If you’re interested in detailed instructions on how to budget, save, pay off debt, and invest, check out The 6 Phases of Building Wealth. This book provides step-by-step instructions for working through each “Phase” in the process of achieving Financial Freedom. If you're just starting out, the information in this book will provide you with an invaluable resource. You can pick up the digital version for only $2.99 on Amazon.

Disclosure: Some of the links found on this website may be affiliate links. Affiliate links pay GGD a small commission when you click through and/or make a purchase. This is at zero additional cost to you.

Full Disclaimer/Disclosure

Related Posts

-

Investing In Stocks Is The Opposite Of Gambling

I was in my early 20s when I booked my first trip to Las Vegas. Some friends and I wanted to try our hands at a little gambling (and a little partying…) and Vegas seemed…

-

The Stock Market Always Goes Up

My first taste of investing came after graduating from college and starting my first “real” job. This initial experience consisted of picking which funds–from a list of 10 or 15–I would invest in, in my…

-

Put Your Money To Work With The Power Of Dividends

In a previous article, I mentioned that I view my investment portfolio as my own personal financial firm. Each share of stock I hold is one of my employees within this firm. Once I've hired them (i.e.…

Good comparison. I read that even though the market has historically gotten 10% gains, most folks get less than half that by investing in it – because they jump in & out of the market as it rises and falls. We are primarily index fund “buy and hold” investors – and it has served us well for the last 15+ years.

Yep! Buying and selling in an attempt to “beat the market” will usually only result in lower than expected returns.