Believe it or not, I’m not against purchasing a home. I know I’ve expounded on the fact that, in many cases, renting is better than buying and have shown that paying off a house quickly can potentially reduce your wealth by hundreds of thousands of dollars, but I didn’t write those articles because I think buying a house is a bad idea. On the contrary, I think owning a home is a great idea if it helps to fulfill your desired standard of living.

If you’re someone who prefers to live the lifestyle associated with owning a home, then you should buy a home. Conversely, if you prefer the lifestyle that comes with being a renter, then you should rent. It’s that simple.

We all need somewhere to live. Where each of us chooses to settle is purely a matter of preference. However, things get a bit more complicated when we start referring to the places we choose to live as investments.

Although, real estate as an investment vehicle can be extremely lucrative (e.g. flipping, rental properties, REITs, etc), buying a home to live in is generally not a good investment. Let’s break it down.

A Once In A Lifetime Opportunity

Darius: Man oh man, I just came across the greatest investment opportunity. You’re going to love it!

Aubrey: Oh really? What’s the investment?

Darius: It’s an appreciating asset. All you’ve got to do is buy it and sit back as it grows in value over time!

Aubrey: Wow, sounds pretty lucrative. Is it expensive?

Darius: Well, it typically costs a few hundred thousand dollars, but don't worry, you only have to come up with about 20% of the value as a down payment and then you can get a 15-30 year loan to pay for the remainder.

Aubrey: A few hundred thousand??? That's pretty steep. 20% of $200,000 is $40,000…that’s quite a bit. It would take me a while to save that much.

Darius: Don’t worry. It will be worth it, this is a GREAT investment, trust me.

Aubrey: Ok, so how do I buy it? Can I make the purchase quickly online like a stock or bond?

Darius: Actually…no, it’s a bit more involved. You’ll have to work with multiple people and business/government entities to negotiate and finalize a deal, fill out tons of paperwork, hire specialists to inspect the asset and verify the numbers, and pay large fees/commissions, all before completing the purchase. The process could take days or even months. It’s all worth it though in the end.

Aubrey: What about if I want to sell? Is that process any easier?

Darius: The process of selling is just as complicated as buying. Perhaps even a bit more complicated in fact. If you find yourself in a bad market, it could potentially take years to find a buyer. But that’s only in some rare cases. Trust me, this is all a great deal.

Aubrey: I don’t know, this isn’t sounding too good so far. What about the 15-30 year loan you mentioned? Is the interest rate low at least? How much do you think I'll end up paying in interest?

Darius: You’ll definitely get a reasonable interest rate. Assuming you have good credit…and you work with a good broker…and your interest rate isn’t variable. The amount of interest you pay should only be a few hundred thousand dollars or less.

Aubrey: Wait. I’ll have to pay hundreds of thousands in interest as well??

Darius: I said, or less…

Aubrey: Ok…but once it’s paid off I’ll own this great asset outright. I guess that’s good at least.

Darius: Well…actually you’d still have to pay taxes on it every year for as long as you own it. If you stop paying, the government will seize possession of it from you. I should also note that the government technically has the authority to confiscate it at any time, even when you’ve paid the required taxes. But that almost never happens.

Aubrey: Taxes? So, hypothetically, I’d have to pay taxes on $200,000 every year?? And the government could take it away?!?

Darius: No, no, you misunderstand. You wouldn’t owe taxes on the $200,000 purchase price. You would owe taxes on the value of the asset. So as its value appreciated over time, your tax bill would also increase. You might pay taxes on $200,000 at first, but that tax bill would steadily increase over time as the value of the asset rose. And like I said, the government almost never confiscates them.

Aubrey: <blank stare>...

Darius: I’m telling you. It’s all worth it. This is a great investment, for sure.

Aubrey: Ok, maybe I’m missing something. It must have a high rate of return, right? If the return is large enough I guess I could see how it would be worth pursuing.

Darius: Under the right market conditions the growth in value can be huge! But…on average, over the life of the investment, the rate of return is about the same as inflation.

Aubrey: Wow, only the rate of inflation? I have to say, that’s pretty underwhelming. Does it at least pay a dividend?

Darius: No it doesn’t pay any dividends or interest. In fact, you will be required to pay for insurance and additional fees in order to own the asset. You’ll also need to pay for regular maintenance.

Aubrey: Wait, wait, wait. So instead of this “asset” paying me dividends, I actually have to pay for insurance and fees just to own it!? And what do you mean by “regular maintenance”?

Darius: You need to pay for insurance so that when things are damaged by weather, fire, vandalism, or other factors, you won’t have a problem getting them fixed. The fees are required to help maintain and improve your asset and the ones around it. The regular maintenance is required to keep the asset in good condition. If you don’t do regular physical maintenance, it would deteriorate severely over time.

Aubrey: Weather? Maintenance? Vandalism?? You make it seem like this investment is locked into one specific location.

Darius: Bingo! That’s exactly right. It is tied to one geographic location and cannot be relocated.

Aubrey: So let’s say I agreed to make this investment. I negotiate a deal, put down 20%, pay off the principal and interest over 30 years, and pay all the taxes, maintenance costs, and fees. At that point how do I access the wealth I’ve saved up?

Darius: Well, it’s kind of difficult to actually get cash out of the investment. You’d have to fill out lots of paperwork and work with a bank to access the money. You’d also be required to pay the money back eventually. Alternatively, you could put it on the open market and seek out a buyer who is willing to pay your asking price. However, this could potentially take quite a while. There would be lots of paperwork and fees associated with this transaction.

Aubrey: ok, so let me summarize what you’ve just told me about this investment…

- It is prohibitively expensive, potentially costing hundreds of thousands of dollars.

- It requires a large upfront down payment, maybe as much as 20%, followed by a decades-long loan which will require me to ultimately pay much more than the initial purchase price when interest is factored in.

- It is difficult to both buy and sell, and requires lots of time, paperwork, fees, specialists, and business/government entities to complete the transaction.

- I will owe taxes on the value of the investment, so as it appreciates in value each year, my tax burden will continually increase.

- If I fail to pay my taxes, the government can seize it.

- The government can also seize it for no reason at all.

- Its value only grows at approximately the rate of inflation.

- It doesn’t pay any dividends or interest.

- It is easily damaged and must be insured.

- There are unavoidable fees that must be paid in order to own it.

- If it is not provided with regular physical maintenance it will deteriorate over time.

- It is locked to one specific geographic location.

- It’s very illiquid. In fact, you’d need to work with a bank to get any cash out and whatever you take out will have to be paid back. The only way to get money out permanently is to go through an arduous and expensive selling process.

Darius: Yep, that sounds about right. So when do you want to sign up?

Aubrey: Honestly, I’m not so sure I do. What did you say the name of this investment was again?

Darius: It’s called a house…

Final Thoughts

By no means do I think purchasing a house is a bad idea. If it is your dream, or even just your desire to live in a house, then you should do just that (within budget of course). The purpose of this article is not to disparage current or aspiring homeowners. Owning a home can be a very fulfilling and rewarding experience and it may be the perfect lifestyle choice for you and your family.

I wrote this article to change the narrative that suggests buying a house to live in is a good investment decision. The key word here is "investment". The reality is, houses (that you live in) are pretty crappy investments. They have high upfront costs, large transaction fees, low liquidity, high maintenance costs, low returns, no interest or dividend payments, are locked to a specific geographic location, are difficult to purchase, are even harder to sell, and you never actually truly own them since the government will quickly step in after just a few missed tax payments. Not only does all this add up to a bad investment, I’d go as far as saying the house you live in is not really an investment at all...Let's discuss it in the comments.

Tools To Get You Started

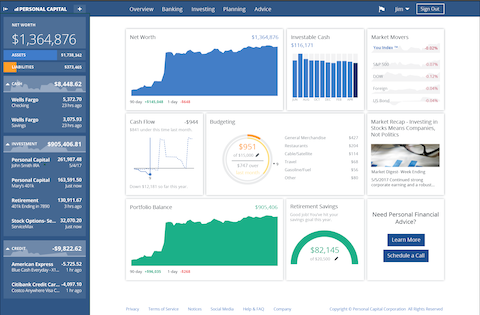

Get a head start on your journey toward achieving financial independence by analyzing and tracking your income, expenses, investment performance, and overall net worth with the free online wealth management tool Empower Personal Dashboard.

We use Empower Personal Dashboard regularly to analyze our investment fees, track our investments, and project our net worth. We also periodically review our progress toward retirement with their retirement planning calculator.

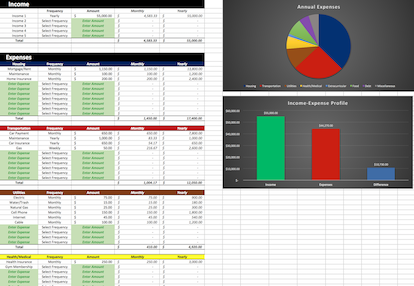

If you’d rather do things on your own, become a subscriber today and you’ll receive our Free Financial Planning Dashboard. This tool allows you to enter your income and expenses to create a detailed budget. You can use it to track your spending habits over time or just to get an idea of where your money is going each month. Take a look at the automatically generated charts and you may discover you have a little more cash to invest than you thought.

If you’re interested in detailed instructions on how to budget, save, pay off debt, and invest, check out The 6 Phases of Building Wealth. This book provides step-by-step instructions for working through each “Phase” in the process of achieving Financial Freedom. If you're just starting out, the information in this book will provide you with an invaluable resource. You can pick up the digital version for only $2.99 on Amazon.

Disclosure: Some of the links found on this website may be affiliate links. Affiliate links pay GGD a small commission when you click through and/or make a purchase. This is at zero additional cost to you.

Full Disclaimer/Disclosure

Related Posts

-

Renting Is Better Than Buying

You know renting is the same as throwing money away, right? 30 years from now you’ll look back and regret not purchasing a home sooner. Why haven’t you bought a house yet??? My mortgage payment…

-

Paying Off Your Mortgage Early Could Cost You $100,000...Or More

If you’re a homeowner, at some point, someone has undoubtedly advised you to pay off your mortgage early. They’ve probably suggested early payoff techniques like paying bi-weekly instead of monthly, allocating extra funds directly to…

-

What Does It Take To Become A Millionaire?

One. Million. Dollars. It’s the holy grail of saving. At some point, we've all imagined obtaining the title of “Millionaire”. But what does it take to save $1,000,000? Is it actually an attainable goal for…

I agree its not an investment. Its where you live. Like you, I am not against owning (We own ours free & clear) but it does cost us each year (taxes, insurance, upkeep) so it isn’t really an asset.

Still, there is something nice about owning your own property.

I agree 100%. This article is not to fault anyone for where they choose to live. Houses are great places to reside. They just aren’t really great investments…

Loved the dialogue presentation. It was informative, revealing AND fun to read! What about the money you save on rent? How does that factor into this?

Renting vs Buying is a whole different topic. However, I have covered it in the past. Check this out: https://gogreendollar.com/renting-is-better-than-buying/. Thanks for reading!

Agree. Robert Kiyosaki also agrees. Many times, people do not do a proper analysis of their own situation and think that buying is better than renting. Many times, wrong.

Yep, It’s not always as clear as it seems.