One. Million. Dollars. It’s the holy grail of saving. At some point, we've all imagined obtaining the title of “Millionaire”. But what does it take to save $1,000,000? Is it actually an attainable goal for a normal person or is it just a fun fantasy to play out in our heads? Let’s run the numbers and see just how achievable a $1,000,000 savings really is!

Traditional Career Path

Traditionally, we are expected to begin working in our late teens/early 20's and continue well into our 60’s, laboring for 40 or more years before reaching retirement. What would it take for someone on this path to amass a savings of $1,000,000 over a 40-year career? Since we know the length of time (i.e. 40 years), we just need the rate of return and we can calculate the rest.

The rate of return changes drastically depending on the type of account the money is deposited in. Let's analyze 3 of the most common account types.

Traditional Savings Account (0.01% rate of return)

High-Yield Savings Account (2.0% rate of return)

Stock/Bond Investment Account (8.5% rate of return)

The table below shows the amount you would need to save each week or month for each account in order to become a millionaire by the end of a 40-year career.

Required Saving Rate To Reach $1,000,000 In 40 Years

Account Type Rate Of Return Weekly Saving Monthly Saving

Traditional Savings Account 0.01% $480 $2,080

High-Yield Savings Account 2.0% $315 $1,365

Stock/Bond Investment Account 8.5% $60 $250

If you were to invest in a mix of stocks and bonds, over a 40-year career you would only need to save about $60 per week or $250 per month in order to accumulate $1,000,000. Not bad! For folks just getting started in their careers, establishing and maintaining a weekly $60 saving rate should be relatively easy to do. Anything saved/invested in excess of this amount would only increase their eventual account balance even further (multi-millionaire?). If this is the path you are currently on congratulations, you are on your way to becoming a millionaire.

A Smaller Time Horizon

What about those of us who don’t plan on working for 40 years or who have already been in the workforce for a significant number of years but haven't accumulated a large savings? Can we still become millionaires? How much would someone need to save in order to become a millionaire in 30 years? How about 20? What about 10? I've crunched the numbers and laid out the results in the tables below.

Required Saving Rate To Reach $1,000,000 In 30 Years

Account Type Rate Of Return Weekly Saving Monthly Saving

Traditional Savings Account 0.01% $645 $2,775

High-Yield Savings Account 2.0% $470 $2,030

Stock/Bond Investment Account 8.5% $140 $605

Required Saving Rate To Reach $1,000,000 In 20 Years

Account Type Rate Of Return Weekly Saving Monthly Saving

Traditional Savings Account 0.01% $965 $4,165

High-Yield Savings Account 2.0% $785 $3,395

Stock/Bond Investment Account 8.5% $370 $1,590

Required Saving Rate To Reach $1,000,000 In 10 Years

Account Type Rate Of Return Weekly Saving Monthly Saving

Traditional Savings Account 0.01% $1,925 $8,330

High-Yield Savings Account 2.0% $1,740 $7,535

Stock/Bond Investment Account 8.5% $1,225 $5,310

Clearly, the smaller the time window, the greater the financial commitment required to save $1,000,000. But don’t feel bad if you’re unable to hit the necessary saving rate to become a millionaire. Even if you can only afford to save at half or even a quarter of the million dollar rate for one of these time periods, you’d still end up with a significant nest egg. If the consolation prize for “failing” to become a millionaire is a half or quarter million dollars, I’d say sign me up!

Another thing to remember is that each of these projections assumes you start with $0 saved. If you've already managed to put away some money, you've got a huge leg up on hitting our million dollar target. For example, let's say you're currently 35 years old and have accumulated $50,000 in invested savings in your 401k. With that as your starting point, how much do you think you would need to save/invest each week to have $1,000,000 by the time you turn 65 (assuming 8.5% average annual return)? Answer: $50.

That's it. You'd only need to invest $50 each week and you would retire as a millionaire!

Final Thoughts

As you can see, becoming a millionaire is a much more achievable goal than it may have initially seemed. Time is still your most powerful investing tool, so in order to accumulate such a large nest egg, getting started early is definitely important. However, an even more important step than getting started early is simply to get started in the first place. Those who fail to save or choose to dump all of their money into savings accounts instead of investing it will have an extremely hard time accumulating much savings at all, let alone $1,000,000. It is imperative that you get started today. Even if you fail to ever hit $1,000,000 in savings, forming the habits of consistent saving and regular investing is guaranteed to leave you in a much better place than you started. All you have to do is maintain these habits over time and compound growth will take care of the rest. Your first million dollars may be right around the corner.

Tools To Get You Started

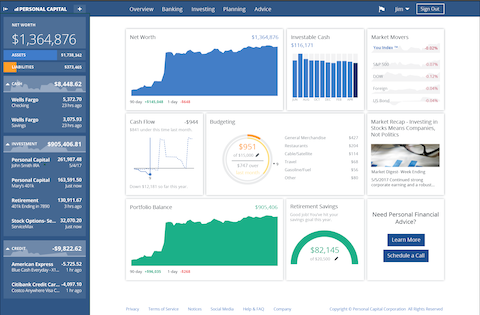

Get a head start on your journey toward achieving financial independence by analyzing and tracking your income, expenses, investment performance, and overall net worth with the free online wealth management tool Empower Personal Dashboard.

We use Empower Personal Dashboard regularly to analyze our investment fees, track our investments, and project our net worth. We also periodically review our progress toward retirement with their retirement planning calculator.

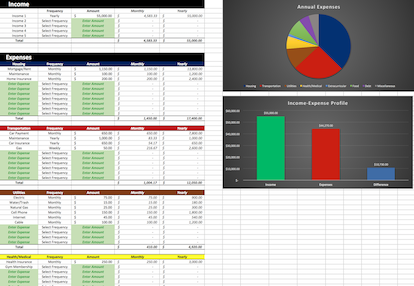

If you’d rather do things on your own, become a subscriber today and you’ll receive our Free Financial Planning Dashboard. This tool allows you to enter your income and expenses to create a detailed budget. You can use it to track your spending habits over time or just to get an idea of where your money is going each month. Take a look at the automatically generated charts and you may discover you have a little more cash to invest than you thought.

If you’re interested in detailed instructions on how to budget, save, pay off debt, and invest, check out The 6 Phases of Building Wealth. This book provides step-by-step instructions for working through each “Phase” in the process of achieving Financial Freedom. If you're just starting out, the information in this book will provide you with an invaluable resource. You can pick up the digital version for only $2.99 on Amazon.

Disclosure: Some of the links found on this website may be affiliate links. Affiliate links pay GGD a small commission when you click through and/or make a purchase. This is at zero additional cost to you.

Full Disclaimer/Disclosure

Related Posts

-

Why Saving Money In The Bank Will Leave You Broke (Part 2)

In Part 1, we discussed the role inflation plays in the deterioration of wealth over time. As we demonstrated, when money is not growing at a faster rate than that of inflation, its purchasing power…

-

Time Is Your Most Powerful Investing Tool

If you’ve been consistently following the posts on GoGreenDollar you know that there are a multitude of resources for the aspiring early retiree. We’ve broken down the process of setting up an investment account into step-by-step…

-

The Stock Market Always Goes Up

My first taste of investing came after graduating from college and starting my first “real” job. This initial experience consisted of picking which funds–from a list of 10 or 15–I would invest in, in my…