If you’ve been consistently following the posts on GoGreenDollar you know that there are a multitude of resources for the aspiring early retiree. We’ve broken down the process of setting up an investment account into step-by-step instructions. We’ve mapped out how to allocate investment capital and exactly what to invest it in. We’ve shown how to access retirement accounts early without facing penalties. We’ve even demonstrated how to cash in on investment earnings without owing any taxes. It could be argued that all of the tools one needs to begin working toward financial independence are just a click away on this site, and yet some readers still hesitate to get started.

This hesitation may end up being the most financially costly mistakes of many people’s lives. I say that because the most powerful investing tool at your disposal is not money or knowledge or experience or luck. It’s simply, time.

Perhaps a story will illustrate this idea best…

The Story Of Scott And Charles

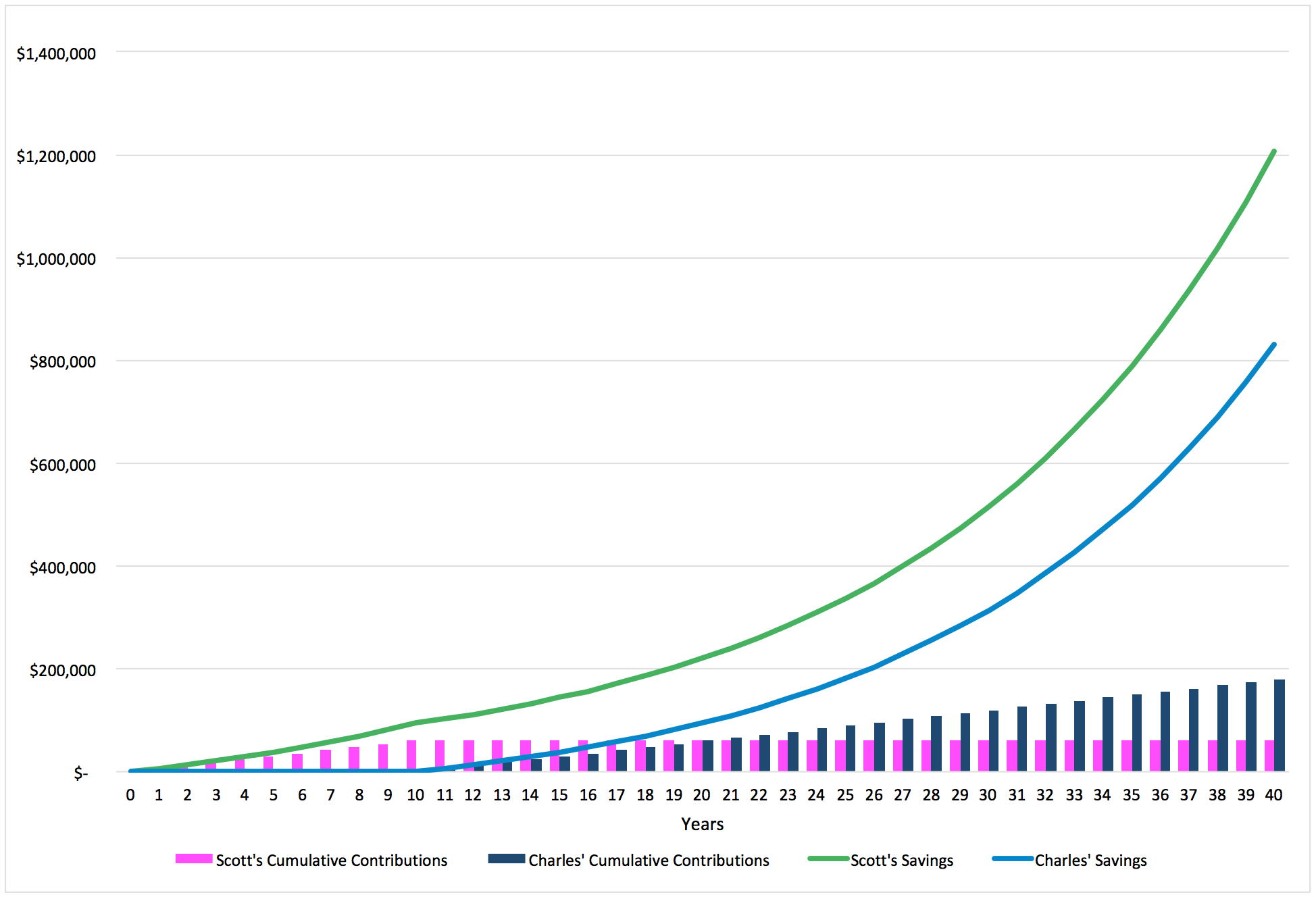

Scott and Charles, both 20 years old, have recently been hired for their first job. Scott is a big fan of GoGreenDollar and so on his very first day of work, he decides that each month he will contribute $500 of his paycheck to an investment account in preparation for retirement. Charles, on the other hand, is not interested in saving. He decides he’d rather spend all his income on expensive activities and items.

After 10 years Scott and Charles’ savings look vastly different.

Charles hasn’t saved any money for retirement. Now 30 years old, he realizes he’ll need to save something if he ever wants to stop working. He commits to reducing his spending and begins depositing $500 per month into his investment account.

After 10 years of investing, Scott has amassed a sizable nest egg. In total, he invested $60,000 of his own money (i.e. $500 x 12 months x 10 years) and averaged an 8.5% annual return. This has allowed Scott to save $94,223! Scott’s expenses have recently increased, however. Consequently, he has decided to stop making contributions to his investment account.

30 more years pass. Scott and Charles are now both 60 years old and preparing for retirement.

Charles has been investing $500 a month for the last 30 years and it has paid off big time. In total, he contributed $180,000 of his own money (i.e. $500 x 12 months x 30 years) and averaged an 8.5% annual return. Charles’ consistent contributions paired with the power of compound growth have propelled his savings from the $0 he had when he was 30, all the way to $830,322.

Scott, on the other hand, stopped contributing to his investment account at the age of 30 after he had accumulated $94,223. He hasn’t contributed a single dollar since then. He also hasn’t withdrawn any money. Over the last 30 years, Scott’s investments have continued to compound at an average rate of 8.5% per year. Having ignored his investment account for over 30 years, Scott is a bit worried that he hasn’t saved enough for retirement. He logs into his account and is shocked by what he sees. His balance has grown to a massive $1,206,361!!

| Year | Scott's Contributions | Scott's Savings | Charles' Contributions | Charles' Savings |

|---|---|---|---|---|

| 0 | - | $0 | - | $0 |

| 1 | $6,000 | $6,240 | $0 | $0 |

| 2 | $6,000 | $13,034 | $0 | $0 |

| 3 | $6,000 | $20,430 | $0 | $0 |

| 4 | $6,000 | $28,483 | $0 | $0 |

| 5 | $6,000 | $37,250 | $0 | $0 |

| 6 | $6,000 | $46,794 | $0 | $0 |

| 7 | $6,000 | $57,185 | $0 | $0 |

| 8 | $6,000 | $68,498 | $0 | $0 |

| 9 | $6,000 | $80,815 | $0 | $0 |

| 10 | $6,000 | $94,223 | $0 | $0 |

| 11 | $0 | $102,581 | $6,000 | $6,240 |

| 12 | $0 | $111,681 | $6,000 | $13,034 |

| 13 | $0 | $121,588 | $6,000 | $20,430 |

| 14 | $0 | $132,272 | $6,000 | $28,483 |

| 15 | $0 | $144,115 | $6,000 | $37,250 |

| 16 | $0 | $156,899 | $6,000 | $46,794 |

| 17 | $0 | $170,817 | $6,000 | $57,185 |

| 18 | $0 | $185,970 | $6,000 | $68,498 |

| 19 | $0 | $202,466 | $6,000 | $80,815 |

| 20 | $0 | $220,426 | $6,000 | $94,223 |

| 21 | $0 | $239,980 | $6,000 | $108,822 |

| 22 | $0 | $261,267 | $6,000 | $124,715 |

| 23 | $0 | $284,443 | $6,000 | $142,018 |

| 24 | $0 | $309,675 | $6,000 | $160,857 |

| 25 | $0 | $337,145 | $6,000 | $181,366 |

| 26 | $0 | $367,052 | $6,000 | $203,694 |

| 27 | $0 | $399,612 | $6,000 | $228,003 |

| 28 | $0 | $435,060 | $6,000 | $254,469 |

| 29 | $0 | $473,652 | $6,000 | $283,282 |

| 30 | $0 | $515, 668 | $6,000 | $314,651 |

| 31 | $0 | $561,411 | $6,000 | $348,803 |

| 32 | $0 | $611,212 | $6,000 | $385,984 |

| 33 | $0 | $665,430 | $6,000 | $426,463 |

| 34 | $0 | $724,458 | $6,000 | $470,533 |

| 35 | $0 | $788,722 | $6,000 | $518,512 |

| 36 | $0 | $858,686 | $6,000 | $570,748 |

| 37 | $0 | $934,857 | $6,000 | $627,617 |

| 38 | $0 | $1,017,784 | $6,000 | $689,531 |

| 39 | $0 | $1,108,068 | $6,000 | $756,936 |

| 40 | $0 | $1,206,361 | $6,000 | $830,322 |

| Final Total = | $60,000 | $1,206,361 | $180,000 | $830,322 |

Even though Charles contributed $120,000 more (i.e. $180,000 - $60,000 = $120,000) and continued making deposits over a much longer period, Scott still ended up with a significantly larger nest egg. $376,039 larger to be exact (i.e. $1,206,361 - $830,322 = $376,039). This difference demonstrates the powerful effect time has on the growth of an investment. Simply by starting early and letting his money grow over a longer duration of time, Scott was able to massively out-save Charles.

Investment Contributions and Growth

The surprising difference between the final value of Scott and Charles’ savings demonstrates how important it is to begin investing as soon as possible. Maximizing the time you have available to allow your investments to grow can be more powerful than contributing tens or even hundreds of thousands of additional dollars. The later you start the higher the cost of catching up will be.

In the case of Scott and Charles, it would have taken an additional $226 per month on top of the original $500 ($726 total), invested over 30 years, for Charles to catch up to Scott’s savings. Charles would have had to invest a total of $261,360 of his own money (i.e. $726 x 12 months x 30 years). That’s over $200,000 more than the $60,000 Scott contributed to his investment account. Let me state that again. Charles would have needed to contribute over TWO-HUNDRED-THOUSAND-DOLLARS more than Scott just to catch up (i.e. $726 per month, invested over 30 years with 8.5% growth = $1,205,627)! All because Charles waited to invest.

If that doesn’t convince you to start investing today I don’t know what will.

Final Thoughts

While it is possible to begin investing later in life and still achieve a sizeable nest egg by the time you are ready to retire, it will most likely require a much larger financial contribution than if you had started earlier. Investing as early as possible and using time to your advantage is one of the most powerful things you can do to positively affect the growth of your retirement savings.

So, if you haven’t opened an account and begun investing, today is the day. Each day you wait may affect your financial future far more than you realize.

Tools To Get You Started

Get a head start on your journey toward achieving financial independence by analyzing and tracking your income, expenses, investment performance, and overall net worth with the free online wealth management tool Empower Personal Dashboard.

We use Empower Personal Dashboard regularly to analyze our investment fees, track our investments, and project our net worth. We also periodically review our progress toward retirement with their retirement planning calculator.

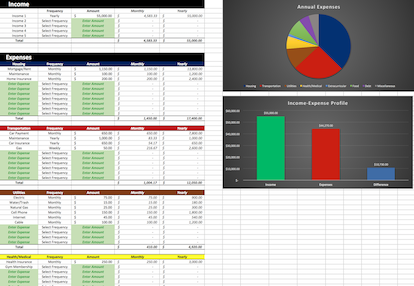

If you’d rather do things on your own, become a subscriber today and you’ll receive our Free Financial Planning Dashboard. This tool allows you to enter your income and expenses to create a detailed budget. You can use it to track your spending habits over time or just to get an idea of where your money is going each month. Take a look at the automatically generated charts and you may discover you have a little more cash to invest than you thought.

If you’re interested in detailed instructions on how to budget, save, pay off debt, and invest, check out The 6 Phases of Building Wealth. This book provides step-by-step instructions for working through each “Phase” in the process of achieving Financial Freedom. If you're just starting out, the information in this book will provide you with an invaluable resource. You can pick up the digital version for only $2.99 on Amazon.

Disclosure: Some of the links found on this website may be affiliate links. Affiliate links pay GGD a small commission when you click through and/or make a purchase. This is at zero additional cost to you.

Full Disclaimer/Disclosure

Related Posts

-

The Basics: Setting Up An Investment Account

By now, it’s pretty obvious that I believe investing is vitally important to your future financial success. As you've also probably gleaned from my writings, the stock market is, by far, my favorite investment option.…

-

The Basics: Compound Growth

In the previous installment of “The Basics” series, we presented a step-by-step guide on how to set up your first investment account. Hopefully, that post will help some of the investment beginners out there conquer…

-

Surprisingly Simple Investment Strategy For Retiring Early

The other day, while browsing through YouTube videos, I came across one that featured Tony Robbins discussing investing. I watched the video and found it had some good, if not groundbreaking, suggestions. There was one…

[…] Time Is Your Most Powerful Investing Tool […]