My first taste of investing came after graduating from college and starting my first “real” job. This initial experience consisted of picking which funds–from a list of 10 or 15–I would invest in, in my 401k. I spent about 30 minutes "analyzing" the historical performance of the funds and then settled on a few that I thought looked good. I literally had no idea what I was doing.

A few months later I expanded my experience further when my younger sister introduced me to a quick and easy method of making large gains in the stock market. The investments were called "penny stocks" and many of them made massive moves over very short periods of time. All I had to do was figure out which ones were about to shoot up and I’d make a huge profit. I was on my way to riches!

Needless to say, after a series of missteps, my penny stock investing career ended just about as quickly as it had begun (by the end I was stuck with 100,0000 shares of some company trading for a few cents. I literally could not execute a sell order, as there were no buyers in the market!). At around this same time, I also came to realize that just because a fund is available in your 401k doesn't mean it's a good investment (oh the fees!).

These are examples of some important investing lessons I was lucky enough to learn relatively early. As a result, I was able to avoid some of the pitfalls that cost many investors a great deal of time and money over their lifetimes.

One lesson that I didn’t pick up as early as I would have liked and which actually has cost me a great deal of money is this: "don’t panic, the stock market always goes up". I learned this rule the hard way.

Sell Low, Buy High

I was still relatively early into my career (professional and investing) in 2008-09, so when the financial crisis, hit I was mostly clueless about how to respond. All of my investments were tanking. I was "losing" all of my hard-earned savings, I had to act fast! I sold everything and patted myself on the back. My accounts had dropped significantly but I had gotten out. No further damage could be done. Then the recovery began. I watched as everything I had been invested in surged passed its former high. I scrambled to get back into the market. The end result was that I sold low, locking in my losses, and then bought high, missing out on all the gains.

Investing at its most basic level, consists of purchasing an asset, waiting for its value to grow, and eventually selling it for a profit. Essentially, you “buy low and sell high”. What I did during the financial crisis was the exact opposite of this.

So how should I have responded? I couldn’t have known that the market would rebound and return to profit, right? Wrong. If I had known then what I know now, I would have continued to invest regularly and done nothing else. That’s because the stock market always goes up. What makes me so confident?

Let’s investigate.

Investing In "The Market"

When you invest in an index fund, you are purchasing an ownership stake in each of the companies that make up that particular index. For example, an investment in Vanguard’s Total Stock Market Index Fund (VTSAX) would give you an ownership stake in every publicly traded company in the US since the index it follows is made up of the entire US market. Investing in the “stock market” is as simple as investing in an index fund which represents all of the companies in the market (...like VTSAX).

What happens when one of the companies in the stock market isn’t productive/profitable? If the company maintains this status long enough, it may eventually go out of business. If you happen to own individual shares of such a company, it’s possible you could lose 100% of your investment. But what if the portion of the company you own is within an index fund? In that the case, things may work out a bit differently…

Example

Imagine it’s the mid-80’s and you’ve just heard about an exciting new business venture that’s on the verge of exploding, video rentals. Now, instead of being required to drive to a movie theater to take in a film, you can drive to your local video store, rent a movie, and watch it from the comfort of your own home. This is a breakthrough! You have $10,000 saved that you’ve been wanting to invest in something and this seems like the perfect opportunity. What should you do?

Assumptions

Money To Invest = $10,000

Time to Hold Investment = 20 years

Scenario 1 - Individual Stock

You decide to use your $10,000 to purchase shares of the new video rental business. The company trades under the stock symbol BLCKB 😀 and costs $10 per share. You purchase 1000 shares and sit back to watch your money grow.

5 Year Results

Your initial feeling was right, the video rental business is a huge success! After just 5 years the stock price has doubled to $20 per share. Your investment has grown 100% to $20,000! BLCKB is now the #1 video rental business in the US and it looks like they’ll continue to grow, far into the future. Early Retirement here we come!

10 Year Results

BLCKB has suffered some losses due to competition in the market. Other companies are beginning to offer video rentals by mail and some have even developed cutting-edge online video streaming services. BLCKB is still the #1 video rental provider, however, so they stick to what they know and try to maintain the dominance they’ve enjoyed for the past decade. The current stock price is $17.50, making your investment worth $17,500.

20 Year Results

BLCKB has filed for bankruptcy. They failed to adapt to the changing industry and their customers went elsewhere. After holding your investment for 20 years the stock is now virtually worthless. The current stock price is $0.10, giving you a grand total of $100.

After investing $10,000 and holding on for 20 years, the total value of your investment is $100.

Note: If this scenario seems far-fetched, check out the real-life story of Blockbuster Video Inc.

Scenario 2 - Index Fund

You like where the video rental industry, and the technology behind it, is headed so you decided to invest in an index fund which tracks an index related to the video and technology sector. You find an index fund called TECH which is comprised of a diversified portfolio of video and technology stocks. One of the fund's small, but growing, holdings is BLCKB. TECH currently trades at $50 per share. Using the $10,000 you’ve saved, you buy 200 shares of TECH.

5 Year Results

The video rental business, as well as the technology industry in general, has done very well over the last 5 years. Although TECH has not doubled in value like BLCKB, it has seen steady growth of about 7% per year as a result of the overall growth of the industry. The current price for one share of TECH is $70. Your 200 shares are now valued at $14,000.

10 Year Results

While BLCKB has begun to see some pull-back in its stock price due to increased competition, the video and technology industry as a whole is thriving. Multiple companies are in varying stages of releasing new, innovative technologies that have the potential to revolutionize the industry for years to come. Since you are partially invested in all of these companies via the TECH index fund, all of those advancements directly benefit you. The price of TECH has risen to $100 per share, bringing the value of your investment to $20,000.

20 Year Results

The bankruptcy of BLCKB was no surprise to anyone. Over the last 10 years, they had continually failed to adjust their business model to the changing market. Lucky for you, the TECH index fund you are invested in, no longer holds any BLCKB stock. Its previous BLCKB holdings were slowly replaced over time as BLCKB’s performance faltered and its business shrunk. The video and technology industry as a whole has continued its strong growth. TECH now trades at $200 per share.

After investing $10,000 in an index fund for 20 years, your investment has grown to $40,000!

For simplification purposes, the example above uses only one specific product/industry, but the exact same ideas apply to the overall stock market. In the stock market, as bad and underperforming companies fail, they will be automatically replaced with better performing, more profitable, more innovative businesses. When you have a diversified investment, spread across the entire market, you’ll avoid most of the losses when companies fail and benefit from the growth as other companies succeed and expand. In addition, your potential downside is always limited by simple math. The maximum amount of value any company can lose is 100% while the maximum gain is virtually infinite (e.g. 100%, 200%, 1,000%, 1,000,000%...).

The “self-renewing” nature of the stock market (i.e. the losers are constantly being eliminated and replaced with winners), paired with its nearly unlimited potential for additional gains, creates an environment that is highly conducive to growth. This is one of the primary reasons the stock market always goes up.

So what are some other reasons?

More Reasons The Stock Market Goes Up

Corporate Greed

This will probably come as a shock to absolutely no one, but corporations are in it for the money. Approximately 99.999% of the decisions made at any large corporation are made with profit in mind. While this fact may not always lead to the best choices with regard to our precious environment or society as a whole, it does mean that every corporation is constantly working to create wealth for its owners (i.e. shareholders). Each and every one of the executives, directors, managers, and low-level employees within a business are working every day toward this goal. For successful companies, the result is increased profitability and growth which ultimately leads to value being returned to shareholders via increases in the stock price and/or dividend.

Population Growth

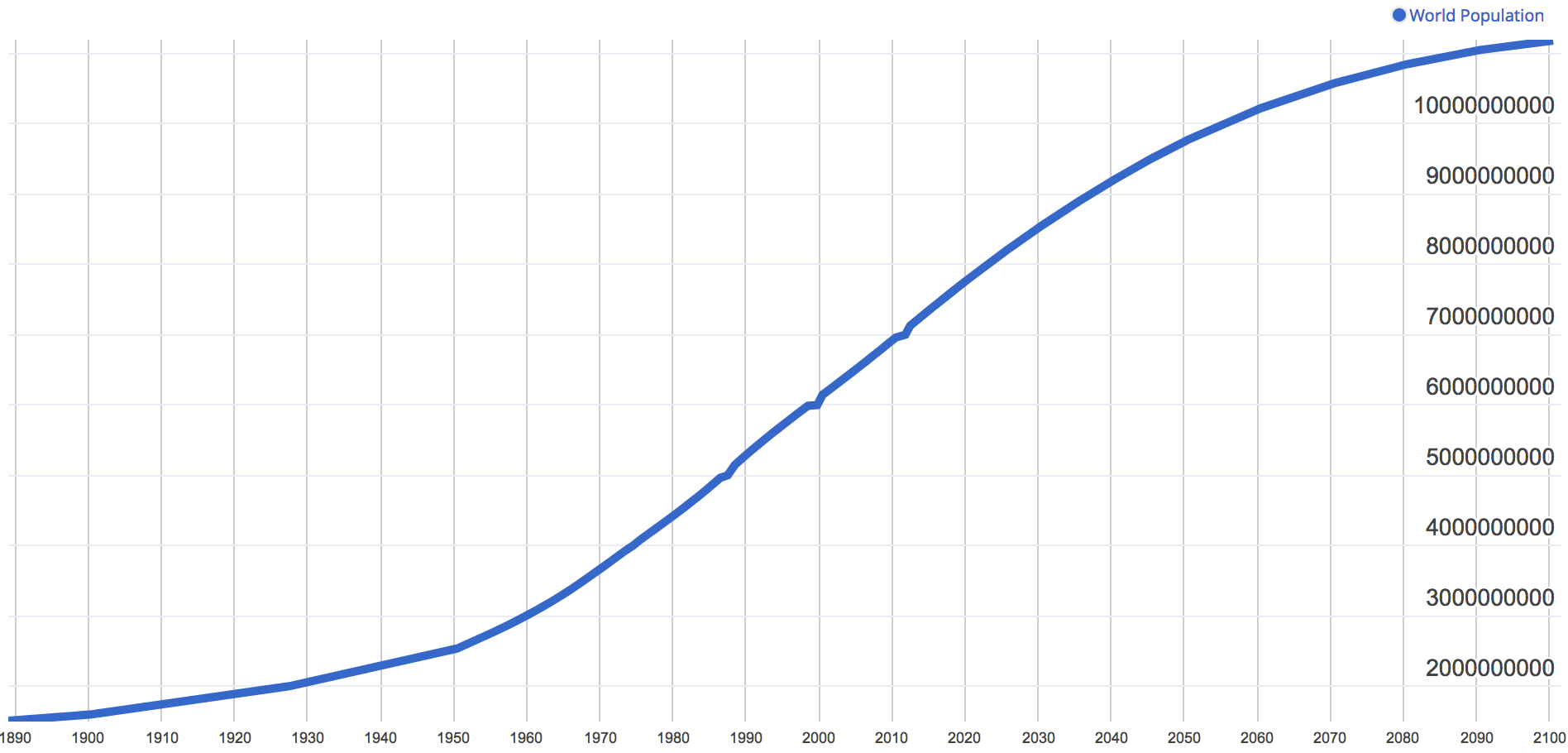

Worldwide Population Growth Over Time

Worldwide Population Growth Over Time

Currently, the population of earth increases at a rate of about 83 million people per year. Each of these new individuals will eventually become a consumer who, at some point, will be looking for products and/or services to buy. While having a growing customer base doesn’t guarantee the success of a business, it does increase the likelihood of achieving success as a result of the rise in demand. Thus, as the population grows so does the overall success of businesses.

In addition to increasing the demand for products and services, a larger population means there are more brilliant minds working to invent, innovate, and compete. This leads to new businesses being formed and existing businesses becoming more efficient/profitable.

As the population of the world continues to increase, so does the value that is created. This additional value eventually translates to growth in the stock market.

Technological Innovation

Over time, technology improves. This has been true for all of human history and will continue to be true for the foreseeable future. As humanity advances technologically, the average quality of life and the productivity of society tend to increase as well. Greater technology allows us to produce more “stuff” while putting in less effort. Likewise, improvements in technology allow us to consume more stuff with less effort.

Today robots build our cars and electronics, our transportation is controlled via artificial intelligence, and everyone carries around a palm-sized personal assistant in their pocket. When we want something we can search for it, purchase it, and have it delivered to our doorstep within a few hours, all without ever leaving the comfort of our home or dealing with physical currency. Buying and selling things has become easier than ever due to the influence of technology. As the trend of technological progress continues, so too does the growth of the economy. This economic growth is a large contributor to the upward movement of the stock market.

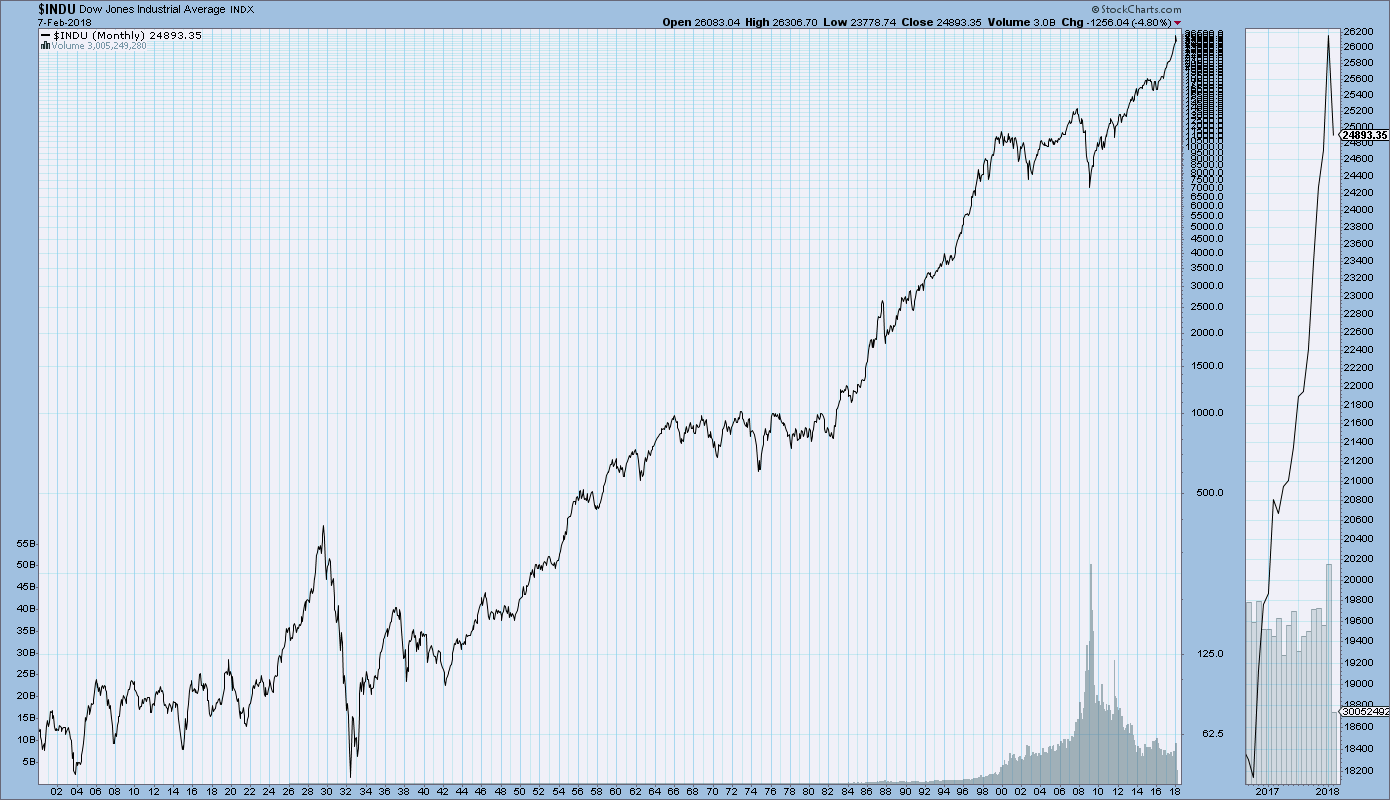

A Little Supporting History

As I’ve mentioned before, there has never been a long-term period where an investment in the US stock market would have decreased in value. In fact, the absolute worst performance seen over any 20-year period was the 2.5% annual gain investors experienced from 1928-1948. On the other end of the spectrum, the highest return realized over a 20-year period was 18% per year and was seen from 1979-1999. Both of these are outliers, however. On average, the stock market grows at about 7-10% per year. To put that in perspective, an investment compounded at this rate will double in value every 7-10 years.

100+ Years Of Stock Market Growth

Final Thoughts

While the events of the past do not determine what will happen in the future, I believe we can (and should) use history as a guide to help us prepare for things to come. It is a fact that in the past, the stock market has always increased in value over the long-term. That fact, combined with the other reasons listed in this post, gives me the confidence to say, "the stock market always goes up"!

Note: To read a similar take on this topic (and to see where I was first introduced to the idea) check out this post by J.L. Collins.

Tools To Get You Started

Get a head start on your journey toward achieving financial independence by analyzing and tracking your income, expenses, investment performance, and overall net worth with the free online wealth management tool Empower Personal Dashboard.

We use Empower Personal Dashboard regularly to analyze our investment fees, track our investments, and project our net worth. We also periodically review our progress toward retirement with their retirement planning calculator.

If you’d rather do things on your own, become a subscriber today and you’ll receive our Free Financial Planning Dashboard. This tool allows you to enter your income and expenses to create a detailed budget. You can use it to track your spending habits over time or just to get an idea of where your money is going each month. Take a look at the automatically generated charts and you may discover you have a little more cash to invest than you thought.

If you’re interested in detailed instructions on how to budget, save, pay off debt, and invest, check out The 6 Phases of Building Wealth. This book provides step-by-step instructions for working through each “Phase” in the process of achieving Financial Freedom. If you're just starting out, the information in this book will provide you with an invaluable resource. You can pick up the digital version for only $2.99 on Amazon.

Disclosure: Some of the links found on this website may be affiliate links. Affiliate links pay GGD a small commission when you click through and/or make a purchase. This is at zero additional cost to you.

Full Disclaimer/Disclosure

Related Posts

-

Investing For Early Retirement - Historical Performance

We’ve been doing a lot of traveling this month so we haven’t had the usual amount of time to put together a detailed post. However, it’s important to us that we are consistent in releasing…

-

The Basics: Compound Growth

In the previous installment of “The Basics” series, we presented a step-by-step guide on how to set up your first investment account. Hopefully, that post will help some of the investment beginners out there conquer…

-

Retire Early And Pay Zero Income Taxes…Forever

Although your taxes may be lower than you think there's a good chance you still spend a significant portion of your income on taxes each year. Generally speaking, if you get a paycheck, a portion of it…

I would say “The stock mark always goes up, but it doesn’t only go up.” The down turns in the market are only temporary, even though they feel as if the world is ending when they do.

Great points Joe, I agree 100%.

Great article, and a great quote: “Investing at its most basic level, consists of purchasing an asset, waiting for its value to grow, and eventually selling it for a profit. Essentially, you ‘buy low and sell high’. Well, if that’s investing, then what I did during the financial crisis was the exact opposite of investing.” The natural bias of the stock market is always up, and you did a good job of explaining why. For risk-averse investors such as myself, this is a hard but important lesson to learn and remember. When it comes to personal finance, a tendency for… Read more »

I couldn’t agree more MrFFP. Investing can be tough (and stressfull)! I’m glad you enjoyed the post, thanks for the comment, and thanks for reading!