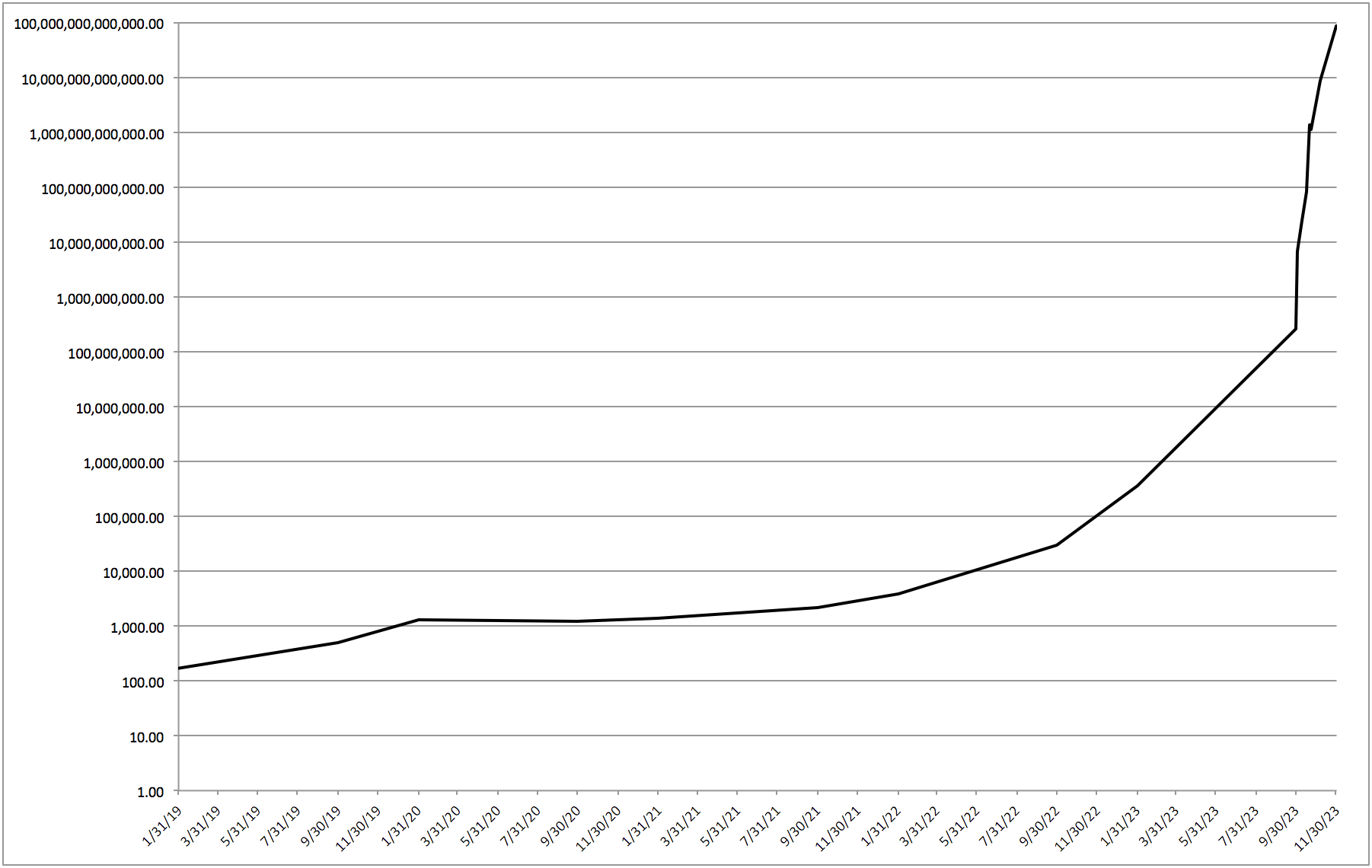

In 1923, Germany began printing and circulating two-trillion mark banknotes. That’s a “2”, followed by 12 zeros (i.e. 2,000,000,000,000) on each individual banknote! What would cause a country to print such a large denomination of their currency?

The answer is, Inflation.

Inflation is a sustained rise in the general price of goods and services across an economy. What Germany was experiencing in 1923, is an intensified form of inflation known as “hyperinflation”. It’s basically normal inflation on steroids. The inflation got so bad in Germany during that time that, at its peak, prices were doubling every few hours and one single US dollar could be exchanged for over 4 trillion German marks!

German Marks per Ounce of Gold

Why Be Concerned?

The situation in Germany happened a long time ago and is obviously a very extreme case, so why should you be concerned about inflation today?

Well, believe it or not, inflation is something that just about every economy—including the United States of America—experiences on a nearly constant basis. Though we’ve never been through a period of hyperinflation like that experienced in Germany, we do average a rate of inflation of about 3% per year. This means that, on average, the price of goods and services increases by 3% each year. This constant increase in prices translates directly to a reduction in the buying power of the money in your pocket (or bank account). Lets look at a real world example.

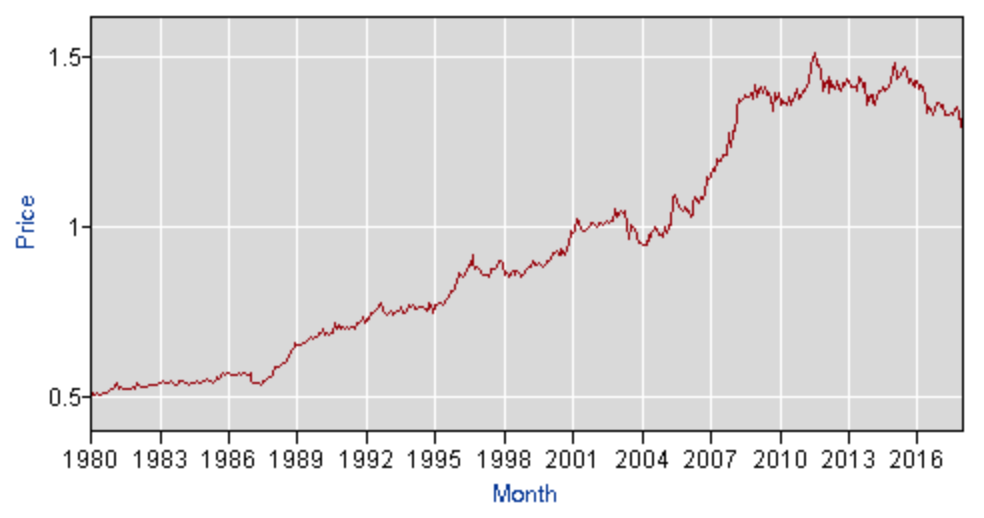

In 1987, the average price of a loaf of bread was about 55 cents. Today, that same loaf of bread would cost you approximately $1.33. In just 30 years, the price of bread has risen over 140%!

Historic Price Of Bread

If inflation maintains its historic rate, the price of bread—and most other products and services—will continue to increase. In 20-25 years you can expect to pay double the prices you pay today.

Over time, the increase in prices caused by inflation will continuously erode the purchasing power of your money. Every dollar you have saved will become less valuable with the passage of time. In order to negate the effects of inflation, you'd need to increase the value of your savings at an equivalent rate. Since inflation averages 3% per year, you would need to generate a constant 3% return on your savings in order to simply maintain the purchasing power of your funds.

Your Bank Account

So, what’s the current annual percentage yield (APY) of your bank account? I doubt that it’s out-pacing the rate of inflation. In fact, I highly doubt its even matching the rate of inflation. Even the best high-yield savings accounts available today only return about 1.5-1.75%. If you’ve got your money stashed in one of these accounts you’re “only” losing 1-2% in value every year due to inflation (APY – inflation rate = real return). If you keep the majority of your money in a normal, low (see no) yield bank account or *gasp* in cash, you’re losing value equivalent to the full rate of inflation, each and every year.

Example

Sarah just got a check for $20,000 from an inheritance left to her by her great aunt. Presently, she’s in pretty good shape financially, so she decides to save the money. Her plan is to use the funds in a few years to purchase her dream car, which currently costs $20,000.

Sarah has heard that there are many great investment vehicles available that can be utilized to help grow her money, but she feels they are all too complicated and risky to pursue. She decides to deposit the check into her savings account and leave it there until she needs it.

Five years later, Sarah is ready to purchase her new car. She looks at her bank account and finds that the $20,000 she deposited five years ago is now worth $20,010 (0.01% APY is about what most big banks offer at the time of this writing). Sarah then looks up the price of the car she wants and is surprised to find that the cost is now $23,200. In just 5 years the price has increased by 16%. The purchasing power of her money, which was previously enough to buy this car, now falls short.

Over a period of only five years, Sarah’s savings lost 16% of its real value simply by sitting in a bank account.

There Is A Solution

So how should you combat inflation? What’s a safe and effective way to grow your money faster than inflation can decrease its value? What is the alternative to storing money under your bed, in your closet, or in a bank account? The answer is surprising simple... (hint: it's investing)

Final Thoughts

Being that 63% of American’s don’t have $500 saved, if you’re doing any amount of saving, you’re probably ahead of the curve. Nonetheless, it is critical that you understand the full picture. Putting the majority of your savings into a bank account literally costs you money (at the rate of inflation). The longer it sits there, the less real value it has. The only way to combat this is to grow your money faster than the rate of inflation.

Additional Note

In addition to inflation, there’s also a huge opportunity cost tied to storing money in a bank account instead of investing it. We’ll talk more about that in Part 2.

Tools To Get You Started

Get a head start on your journey toward achieving financial independence by analyzing and tracking your income, expenses, investment performance, and overall net worth with the free online wealth management tool Personal Capital.

We use Personal Capital regularly to analyze our investment fees, track our investments, and project our net worth. We also periodically review our progress toward retirement with their retirement planning calculator.

If you’d rather do things on your own, become a subscriber today and you’ll receive our Free Financial Planning Dashboard. This tool allows you to enter your income and expenses to create a detailed budget. You can use it to track your spending habits over time or just to get an idea of where your money is going each month. Take a look at the automatically generated charts and you may discover you have a little more cash to invest than you thought.

If you’re interested in detailed instructions on how to budget, save, pay off debt, and invest, check out The 6 Phases of Building Wealth. This book provides step-by-step instructions for working through each “Phase” in the process of achieving Financial Freedom. If you're just starting out, the information in this book will provide you with an invaluable resource. You can pick up the digital version for only $2.99 on Amazon.

Disclosure: Some of the links found on this website may be affiliate links. Affiliate links pay GGD a small commission when you click through and/or make a purchase. This is at zero additional cost to you.

Full Disclaimer/Disclosure

Related Posts

-

Surprisingly Simple Investment Strategy For Retiring Early

The other day, while browsing through YouTube videos, I came across one that featured Tony Robbins discussing investing. I watched the video and found it had some good, if not groundbreaking, suggestions. There was one…

-

Investment Hierarchy: Top 7 Investments For Retiring Young

When you make the decision to become an early retiree, one of the first things you'll realize is that there are many, many different choices when it comes to investment accounts. 401(k), IRA, HSA, 457,…

-

Why Saving Money In The Bank Will Leave You Broke (Part 2)

In Part 1, we discussed the role inflation plays in the deterioration of wealth over time. As we demonstrated, when money is not growing at a faster rate than that of inflation, its purchasing power…

Thank you for these illustrations! I guess I need to get my money out of the bank, huh?

There’s nothing wrong with having a little bit of cash in the bank for emergencies, but the majority of your wealth should probably be invested if you’re looking to maintain its value over time.

I came across this hilarious (at least to me) video which does a great job of summing up how simply saving isn’t enough. The video is in Thai with English subtitles but it’s still well worth a watching. Check it out:

https://www.youtube.com/watch?v=a2lv_Xl1e4U