Although your taxes may be lower than you think there's a good chance you still spend a significant portion of your income on taxes each year. Generally speaking, if you get a paycheck, a portion of it will be going to the government in the form of taxes. In fact, the government usually gets its share even before you do!

Though there are many common deductions/credits that can greatly reduce your tax liability (e.g. retirement account contributions, child credits, small business deductions, real estate deductions, tax-loss harvesting, the standard deduction, etc.), as long as you have earned income you’ll most likely always owe some amount to the government. However, once you’ve achieved financial independence and chosen to retire early, it is possible to avoid paying income taxes, potentially, for the rest of your life…

Financial Independence/Early Retirement

You've done it!

You stumbled across GoGreenDollar after clicking on a post shared by a friend on Facebook and, after reading the articles on the site, realized that you are the master of your own financial future. This revelation inspired you to begin your journey towards financial independence and early retirement.

You applied the proper techniques and were able to erase your debt for good. You used your savings rate to calculate your retirement number and date. You withdrew the money that had been slowly wasting away in your savings account and used it to open an investment account. You started investing in your 401k at work. You took advantage of the many other great investment accounts that were available to you. You implemented a simple yet effective investment strategy to grow your money.

You followed all the recommendations and checked all the boxes. It wasn’t an easy journey, but you never wavered, and now you're on the verge of being able to retire early.

What if, after you've resigned from your job, you could spend $100,000, or more, each year and owe zero federal income taxes? Pretty sweet deal, right?

Capital Gains, Dividends, and Retirement Accounts

In early retirement, there is a high likelihood that the majority of your income will come from long-term capital gains (i.e. profit on an investment held for more than 1 year), qualified dividends, and retirement account distributions. Luckily, the IRS treats income from these sources much differently, and more favorably, than it does income earned from an employer. The key to avoiding income taxes in early retirement is to strategically take advantage of the favorable tax treatment of these sources of income.

Long-Term Capital Gains and Qualified Dividends

The tax rate you pay on long-term capital gains (LTCGs) and qualified dividends (QDs) depends on the tax bracket you fall into (with a little overlap).

Long-Term Capital Gains & Qualified Dividend Tax Rates

Long-Term Cap. Gains &

Qualified Div. Tax RatesSingle Filer Married Filing Jointly Head Of Household

0% $0-$38,600 $0-$77,200 $0-$51,700

15% $38,601-425,800 $77,201-$479,000 $51,701-$452,400

20% $425,801+ $479,001+ $452,401+

Comparing these rates with the normal income tax rates, you can see that, generally, anyone in the 12% tax bracket or lower, will have a long-term capital gain and qualified dividend tax rate of 0%.

2018 Tax Brackets

Rate Single Filer Married Filing Jointly Head Of Household

10% $0-$9,525 $0-$19,050 $0-$13,600

12% $9,526-$38,700 $19,051-$77,400 $13,601-$51,800

22% $38,701-$82,500 $77,401-$165,000 $51,801-$82,500

24% $82,501-$157,500 $165,001-$315,000 $82,501-$157,500

32% $157,501-$200,000 $315,001-$400,000 $157,501-$200,00

35% $200,001-$500,000 $400,001-$600,000 $200,001-$500,000

37% $500,001+ $600,001+ $500,001+

Based on these figures, a single person could have up to $38,600 in long-term capital gains and qualified dividend income and owe zero income taxes. For a married couple, the amount would be $77,200. This is before any deductions or credits are applied.

If we add in just the standard deduction ($12,000 for individuals; $24,000 for married couples filing jointly), these amounts increase to $50,600 and $101,200 respectively!

Let’s take it a step further.

Remember, a “capital gain” only includes the growth portion of your investment. The amount spent to purchase the investment (i.e. the “cost basis”) is not part of your capital gain and thus it is not counted as income. I’ll use an example to illustrate.

Example – Taxing Your LTCGs and QDs

5 years ago, while they were still working, Stewie and his wife Meg used their taxable investment account to purchased 1,000 shares of ABC stock for $100 per share. They believed the company had great long-term growth potential and also liked the fact that it yielded a 1.0% dividend each year. The total cost basis for their purchase was $100,000 (i.e. 1,000 shares x $100).

In the time since, ABC has performed very well and the stock price has risen significantly. Today, one share of ABC stock sells for $200 and still yields a 1.0% dividend.

Assuming Stewie and Meg are retired at this point, how many shares of ABC could they sell before owing income taxes?

Answer: 992 shares

They could sell almost every share, generating an income of around $200,000 and still, they would owe exactly $0 in taxes. Let’s crunch the numbers.

Taxable Income Calculations

Qualified Dividends = $200 x 1.0% x 1,000 shares = $2,000

Long-Term Capital Gains = 992 shares x $200 - (992 x $100) cost basis = $99,200

Tax Deductions = $24,000 standard deduction

Total Taxable Income = $2,000 + $99,200 - $24,000 = $77,200

With a total taxable income of just $77,200, Stewie and Meg fall just below the top of the 12% tax bracket. Since all of the money came from qualified dividends and long-term capital gains, it will be taxed at 0%!

Total Spending money = $2,000 dividends + $198,400 stock sales = $200,400

They have over $200,000 in spending money, yet owe exactly $0 in federal income taxes!

Retirement Account Distributions

Another potential source of tax-free income in early retirement is retirement account distributions.

All contributions to a Roth investment account can be withdrawn at any time, tax-free (the gains are not available until age 59.5).

If Stewie and Meg both maxed out their Roth 401(k) ($18,500 each) and Roth IRA ($5,500 each) contributions each year for 10 years, with 7% growth per year, they would have approximately $693,093 in their combined accounts. Assuming they rolled over their Roth 401(k) balances into their Roth IRAs after retiring, they would have $480,000 (i.e. their total contributions) available to withdraw, completely tax-free.

So what about non-Roth retirement accounts?

Although withdrawals from 401(k), 403(b), and 457 investment accounts are usually subject to income taxes (and early withdrawal penalties in the cases of 401(k)s and 403(b)s), it is possible to leverage deductions and credits to avoid paying taxes even on these accounts.

Circumventing taxes on withdrawals from these pre-tax accounts is especially valuable because the original contributions were made on a tax-deferred basis. Since these accounts are designed so that any taxes are delayed until the funds are withdrawn, being able to make tax-free withdrawals presents the rare opportunity to generate income that will never been taxed!

There is a limit to tax-free withdrawals for pre-tax retirement accounts, however. In order to keep your taxes at zero, the maximum you can withdraw each year must be less than or equal to the total of your tax deductions and credits. For example, Stewie and Meg would be able to withdraw a maximum of $24,000 per year without paying taxes since they use the standard deduction. Every dollar above this amount would be subject to income taxes.

Note: I realized I haven’t spent much time addressing the early withdrawal penalties associated with 401(k) and 403(b) accounts. That’s because you can easily avoid these penalties in early retirement by utilizing one of the simple techniques we've previously discussed (e.g. SEPP, Roth Conversion Ladder, etc).

Example – Hypothetical GGD Portfolio

If you’ve been following our monthly financial updates, you know that approximately 51% of our portfolio is held in 401(k)s and approximately 4% is held in IRAs. For this example, let’s assume the other 45% of our portfolio is invested in a taxable account (in reality it’s about 33% with the remaining 12% held across other investments and cash).

Assumptions

All investments are long-term and have grown by 100% (i.e. cost basis is half of each investment)

Yearly Living Expenses = $50,000

Total Portfolio = $1,250,000

401(k) Balance = $1,250,000 x 51% = $637,500

Roth IRA Balance = $1,250,000 x 4% = $50,000

Taxable Account Balance = $1,250,000 x 45% = $562,500

Yearly Qualified Dividends (1%) = $562,500 x 1% = $5,625

With yearly expenses of $50,000 and a total portfolio of $1,250,000, we’ve reached financial independence! After resigning from our corporate jobs we immediately rollover our 401(k)s to traditional IRAs. We plan to create Roth Conversion Ladders to slowly move all of these funds over to our Roth IRA accounts.

Using the assumptions above, how can we avoid paying income taxes?

Here's an example of how we might withdraw from our accounts.

Account Withdrawals

| Source Of Funds | Amount Withdrawn | Capital Gain | Purpose Of Funds |

|---|---|---|---|

| Taxable Account | $42,500 | $21,250 | Spending Money |

| Roth IRA | $1,875 | N/A | Spending Money |

| Traditional IRA | $24,000 | N/A | Roth Conversion Ladder |

| Qualified Dividends | $5,625 | N/A | Spending Money |

| Total = | $74,000 |

Our total income is $74,000, but how much of that is taxable? Let’s step through each source of income.

Since the actual capital gain is only half of our taxable account withdrawal (the other half being the cost basis, as stated in the assumptions above), we can subtract $21,250 from the total.

Taxable Income = $74,000 - $21,250 = $52,750

Roth IRA contribution withdrawals are always tax-free so we can subtract $1,875 from the total.

Taxable Income = $52,750 - $1,875 = $50,875

Any distributions from a traditional IRA (including conversions) are considered taxable income, but we can apply our $24,000 standard deduction to negate the impact.

Taxable Income = $50,875 - $24,000 = $26,875

After making all of the adjustments, we are left with $26,875 as our final taxable income. If you've been following along, you know that the source of this income is long-term capital gains ($21,250) and qualified dividends ($5,625). As we've learned, at this income level, the tax rate for these two sources is 0%. Our final tax bill is $0.

Final Tax Bill = $26,875 x 0% = $0

Note: Moving forward with this hypothetical scenario, we would continue to build our Roth Conversion Ladder by making traditional to Roth IRA conversions each year. Our taxable account would remain our main source of income in the initial years, but once the Roth Conversion Ladder was fully formed we would begin splitting our withdrawals between our Roth and taxable accounts more proportionately.

Final Thoughts

You may have thought it was impossible to avoid paying income taxes, but as you’ve just learned, it's simply a matter of strategic planning.

Tools To Get You Started

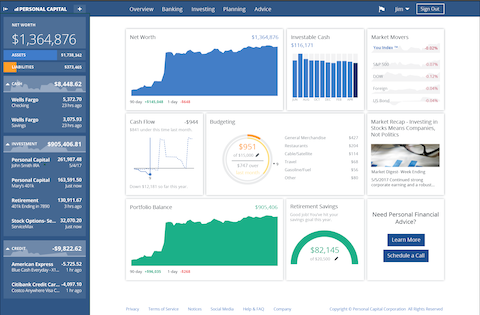

Get a head start on your journey toward achieving financial independence by analyzing and tracking your income, expenses, investment performance, and overall net worth with the free online wealth management tool Personal Capital.

We use Personal Capital regularly to analyze our investment fees, track our investments, and project our net worth. We also periodically review our progress toward retirement with their retirement planning calculator.

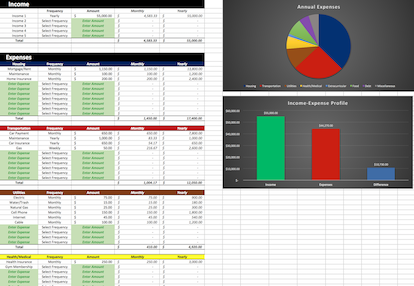

If you’d rather do things on your own, become a subscriber today and you’ll receive our Free Financial Planning Dashboard. This tool allows you to enter your income and expenses to create a detailed budget. You can use it to track your spending habits over time or just to get an idea of where your money is going each month. Take a look at the automatically generated charts and you may discover you have a little more cash to invest than you thought.

If you’re interested in detailed instructions on how to budget, save, pay off debt, and invest, check out The 6 Phases of Building Wealth. This book provides step-by-step instructions for working through each “Phase” in the process of achieving Financial Freedom. If you're just starting out, the information in this book will provide you with an invaluable resource. You can pick up the digital version for only $2.99 on Amazon.

Disclosure: Some of the links found on this website may be affiliate links. Affiliate links pay GGD a small commission when you click through and/or make a purchase. This is at zero additional cost to you.

Full Disclaimer/Disclosure

Related Posts

-

The Simple Formula I’m Using To Retire In My 30's

Wake up, go to work, spend a few hours with family, go to bed, rinse and repeat. Some form of this routine probably describes the typical day for most of us. Throughout our lives, we’re…

-

Penalty Free Early Access To Your Retirement Funds

As long-time readers probably know, 401(k)s are, by far, my favorite investment accounts. When it comes to allocating your investment funds, I believe dedicating money to a 401(k) with employer match should take priority over all other…

-

Your Taxes May Be Lower Than You Think

Why Taxes? I recently had a discussion (debate) with a friend of mine comparing the benefits of pre-tax investments to those of Roth investments. I argued that, while there are many cases where Roth investing…

[…] ★ Retire Early and Pay Zero Income Taxes…Forever […]

This doesn’t seem so magical when one considers that one could just spend $200K out of their savings account with no tax due. So it shouldn’t be surprising that you can get a very low or even zero tax bill even if you include some other assets and money from other accounts.

Sure, but as you probably know, savings accounts destroy wealth rather than create it (see: https://gogreendollar.com/saving-money-bank-leave-you-broke-part1/). In order to retire early, most people will need to create new (untaxed) money via investing. I think retrieving and spending that money without paying additional taxes is a pretty uncommon occurrence for most.

What if you have a pension that will pay you 24k a year?

While I’m not a pension expert, I believe the tax implications depend on the details of your particular plan. If we assume the worst case (i.e. 100% taxable as ordinary income), then your pension would basically eat up your entire standard deduction (assuming you are married, filing jointly). This would limit your ability to create a Roth conversion ladder without paying taxes, but you’d still have $77,200 of spending room to “fill up” with long-term capital gains and qualified dividends. In addition, you can always withdraw any Roth IRA contributions you may have made over the years.

So would you recommend investing in a taxable account rather than say a traditional 401k?

Typically, I recommend investing in taxable investment accounts only after you’ve filled up all of your tax-advantaged options (see: https://gogreendollar.com/investment-hierarchy-top-7-investments-for-retiring-young/). But there are cases where it may be a good idea to contribute some amount to a taxable account in preparation for early retirement. There are ways of getting to your retirement funds early however. I wrote up an article about it here: https://gogreendollar.com/penalty-free-early-access-retirement-funds/.

Just wanted to let you know you were featured in my grand rounds blog:

https://xrayvsn.com/2018/05/17/grand-rounds/

Nice! Thanks for the feature!

I’m doing this. I am living tax free on $600K I pulled out of a post tax account. I tax loss harvested aggressively during my accumulation phase, and I mixed my cap gains with cap loss for a tax bill of zero. I am using the time provided by this income to Roth convert my entire IRA before RMD kicks in. After age 70.5, I will be paying some taxes on 85% of my SS income but that generally will mostly be covered by the $26,600 deduction for married over 65. the remainder of my post tax account can be… Read more »

Amazing Gasem! I’m still in my accumulation phase so this is all “theory” to some degree for me. It’s great to hear you’ve put it into practice. I hope to be joining you soon!

[…] Retire Early And Pay Zero Income Taxes…Forever […]

Thanks for the feature!

[…] ★ Retire Early and Pay Zero Income Taxes…Forever […]

It appears you are double counting the LTCG in the hypothetical example. $21,250 is subtracted from total income at the beginning. Then at the end your net taxable income includes the same $21,250.

Hey Rick. So the initial $21,250 that is subtracted is the cost basis (i.e. the amount you paid to purchase the investment). The final $21,250 is your actual long-term capital gain. I assumed there was 50% from the initial investment just to keep the numbers simpler. Thanks for following along in detail, I enjoy the feedback. Thanks for reading Rick!

[…] out, I’m not full of it, because here’s another blogger explaining the same strategy. Mr. Go Green Dollar’s post dives into more detail behind the math of the strategy. He explains all the nitty gritty behind the […]

[…] Is it possible to have a $200k draw in retirement and have a tax bill of $0? Yeah that pretty much caught my eye too. Here’s how Go Green Dollar suggests doing it in Retire Early and Pay Zero Income Taxes….Forever. […]

Tax preparation is very important. You can both use software and service to have your tax report done.

I would like to ask if I can re-post your article at my blog with reference link? It will be helpful for my readers about source about tax preparation. Let me know. Thanks.

Glad you like the info. Feel free to re-post!