By now, it’s pretty obvious that I believe investing is vitally important to your future financial success. As you've also probably gleaned from my writings, the stock market is, by far, my favorite investment option. I've broken down the investment account hierarchy, mapped out a surprisingly simple investment strategy, declared 401(k)s the ultimate investment options, compared the performance of pre-tax investing vs Roth investing, and even given you the formula I’m following to retiring in my 30's. Each of these posts has given a detailed analysis or explanation of a particular investing concept that will be helpful to the aspiring early retiree. And yet, I think I may have overlooked the most important explanation of all...

The other day I was speaking with a coworker. She had recently finished reading The 6 Phases Of Building Wealth, which I had previously recommended, and was eager to begin her wealth-building journey. I pointed her to GoGreenDollar.com for some additional insight on investing. A few days later she approached me requesting my help. She told me that all of the information from the book and website was great and got her excited about putting her money to work, but as someone with zero experience investing, she still felt like she didn't know where to begin. I realized I had made a mistake.

Though I am absolutely not an investing expert, I have been an active participant in the investing world for years. I’ve read many investing books, written about many investing concepts, and done quite a bit of actual investing with my money. As a result, I can sometimes forget that not everyone has the same knowledge, experience, and interest that I have in investing. I try to make my posts as easy to understand as possible, but someone who has absolutely no experience, might still feel confused and intimidated by it all. Now that I've realized this, I've decided to periodically include posts that explain some of the basic concepts of investing with step-by-step instructions, where appropriate. This post will walk you through the process of setting up an investment account, funding it, and making your first trade.

Setting Up And Funding Your Account

There are many different investment brokerage options out there to choose from. They have varying fee schedules, investment options, investor tools, and levels of customer service. You should do your own research and decide which broker is best for you. My brokerage of choice is Vanguard. They are very low cost, have all the investment options I need and are known to provide great customer service. You can’t really go wrong with Vanguard, in my opinion. We’ll be using Vanguard in the examples below.

Step #1

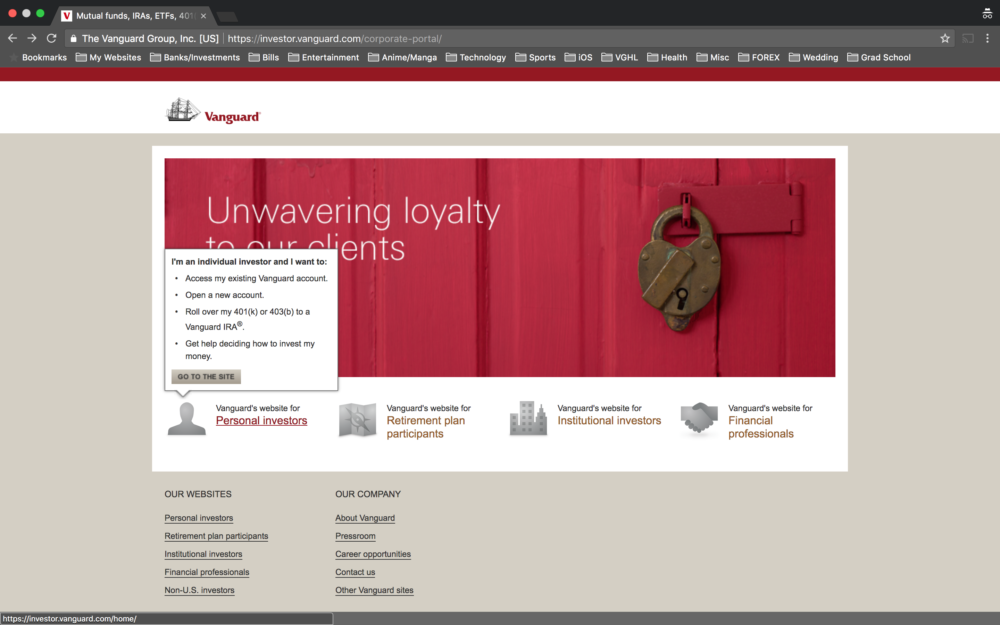

Go to Vanguard.com select “Personal Investor”, then select “Go To The Site”.

Step #2

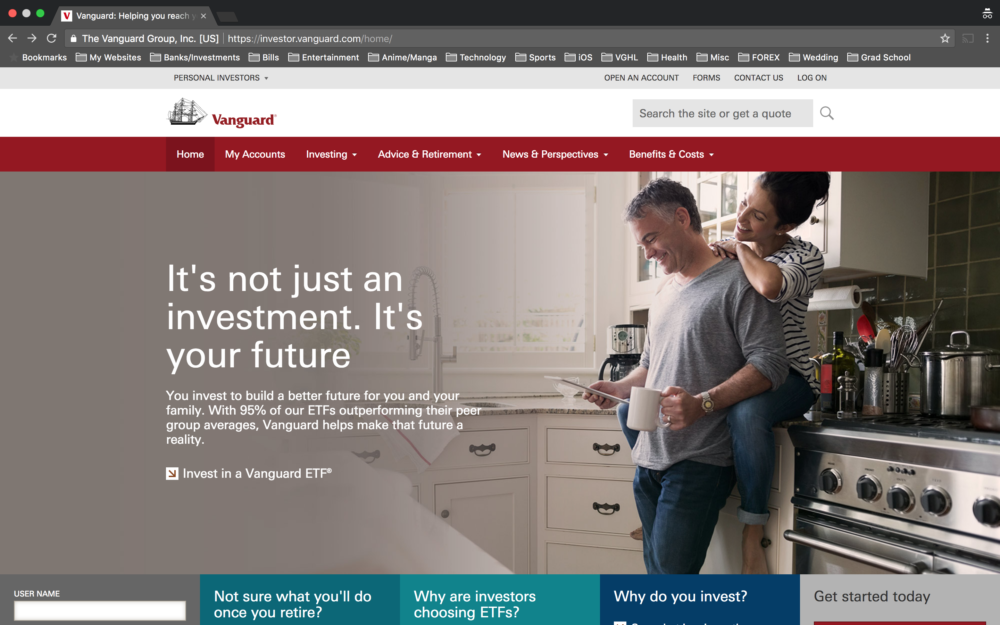

Select “Open An Account” at the top of the webpage.

Step #3

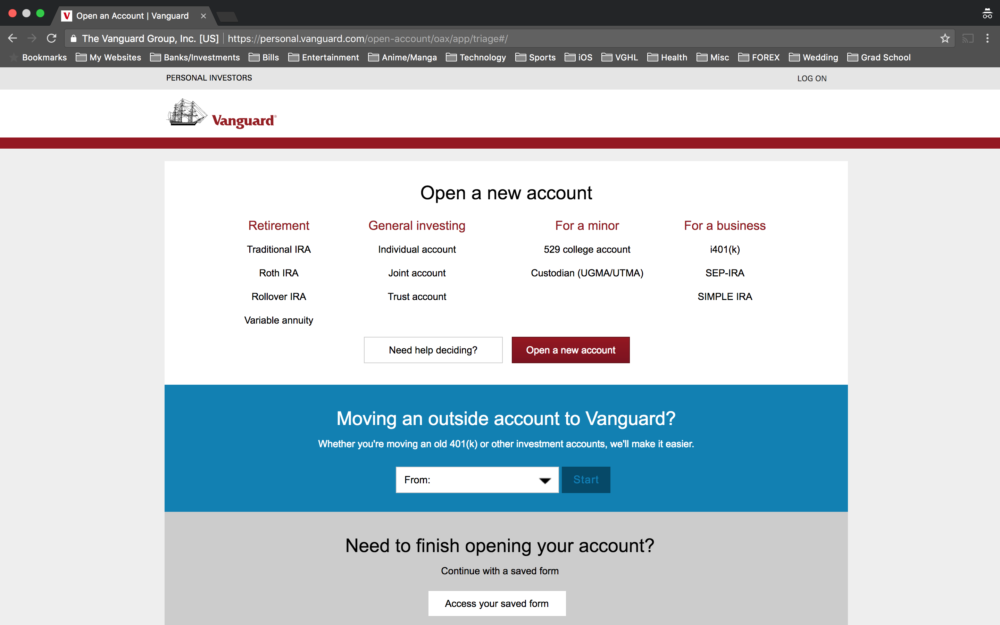

Select “Open a new account”.

Step #4

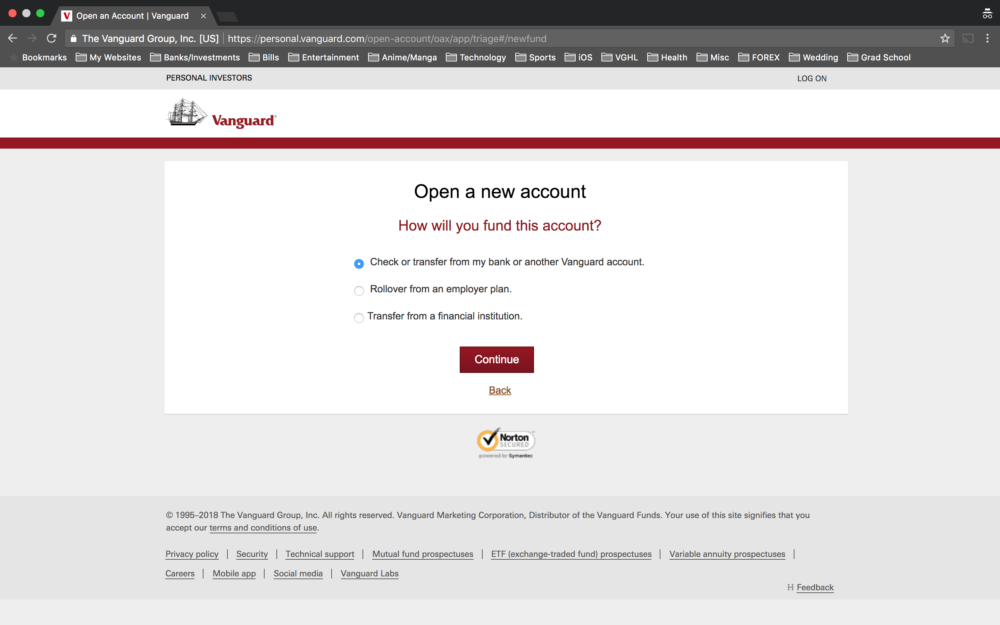

Select “Check or transfer from my bank or another Vanguard account”, then "Continue".

Step #5

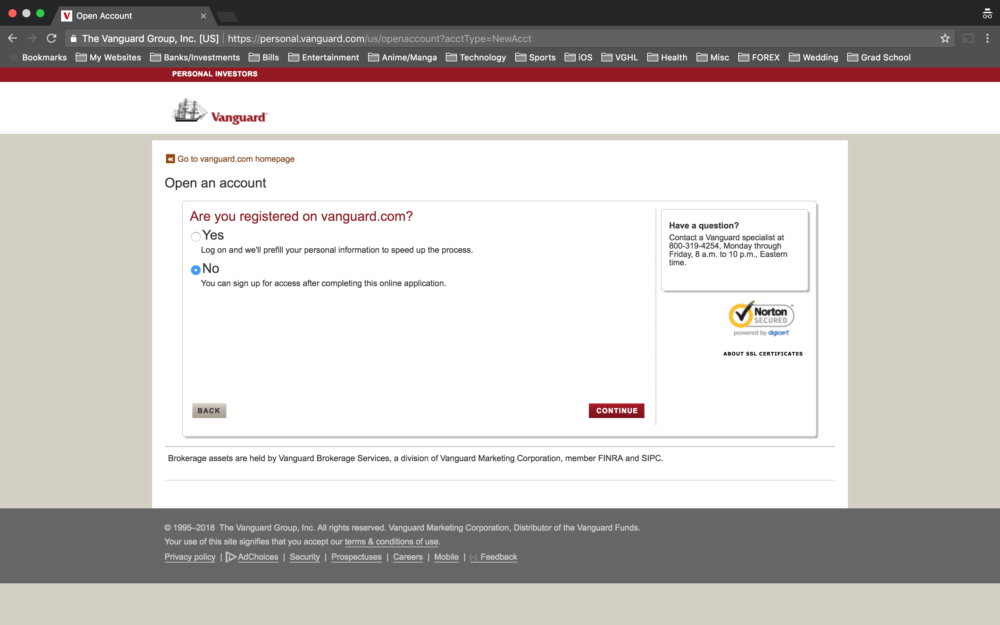

Select “No” (unless you are already registered with Vanguard; in that case, you'd select "Yes"), then "Continue".

Step #6

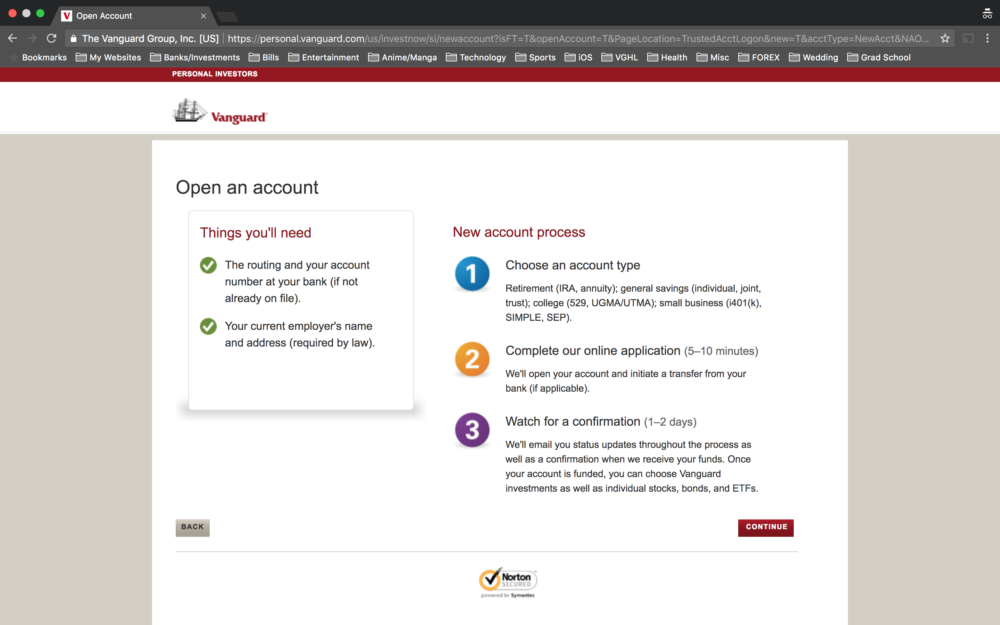

Read the information on the page, then "Continue".

Step #7

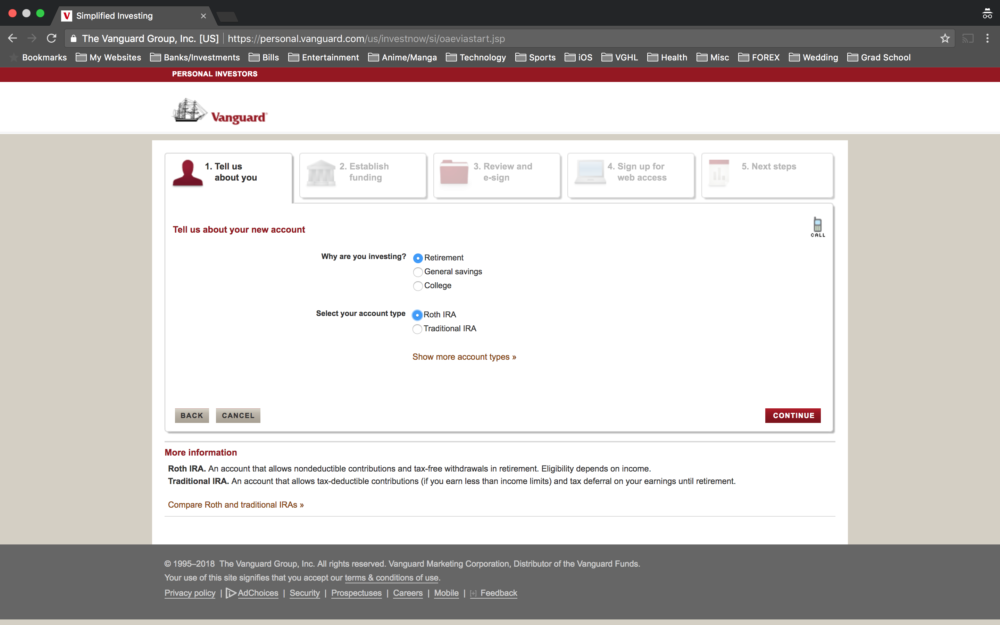

For this step, you will select an investment account type.

If you don’t currently have an IRA I’d recommend starting one now. For a beginner, I’d suggest a Roth IRA. As you learn more about maximizing your investments you may find that a different account is better suited to your needs, but a Roth IRA is a great account to start with.

If you’ve already maxed out your IRA contribution for the year you can select one of the General Savings account options.

Select your account type, then "Continue".

Step #8

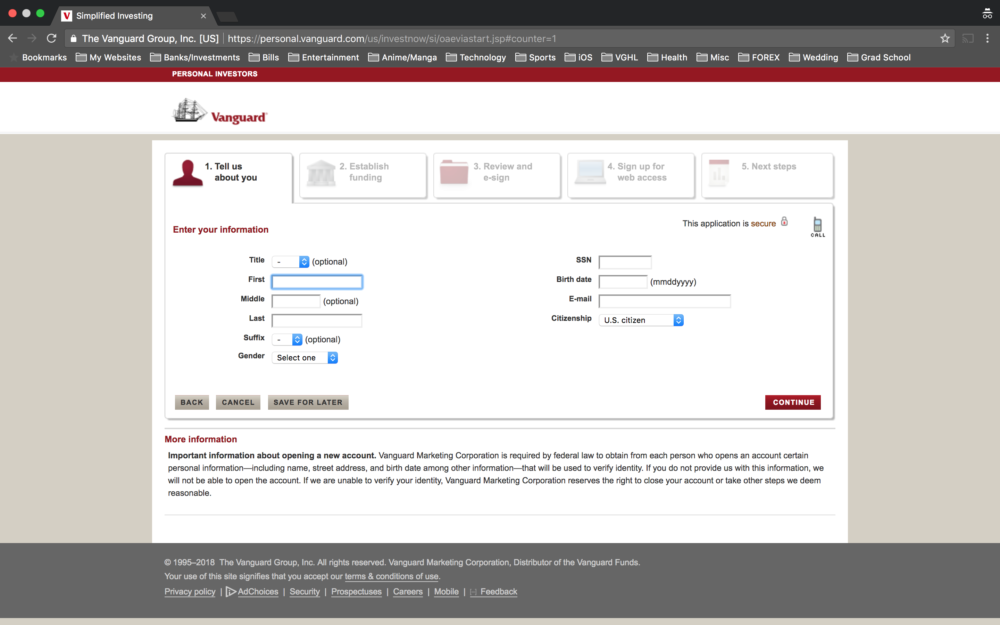

Enter the required information on the next two pages and "Continue".

Personal information:

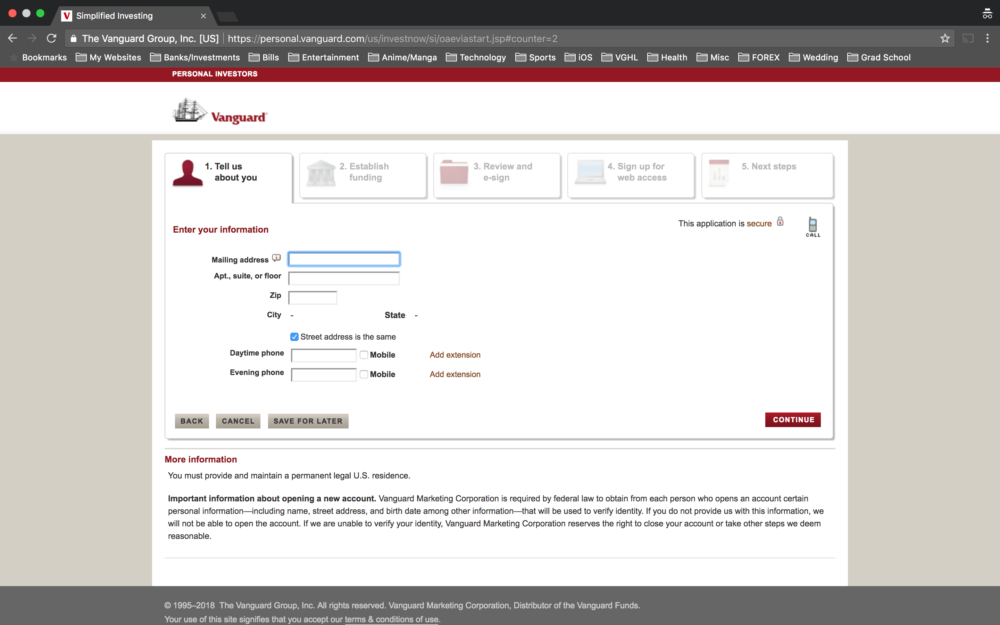

Contact Information:

Step #9

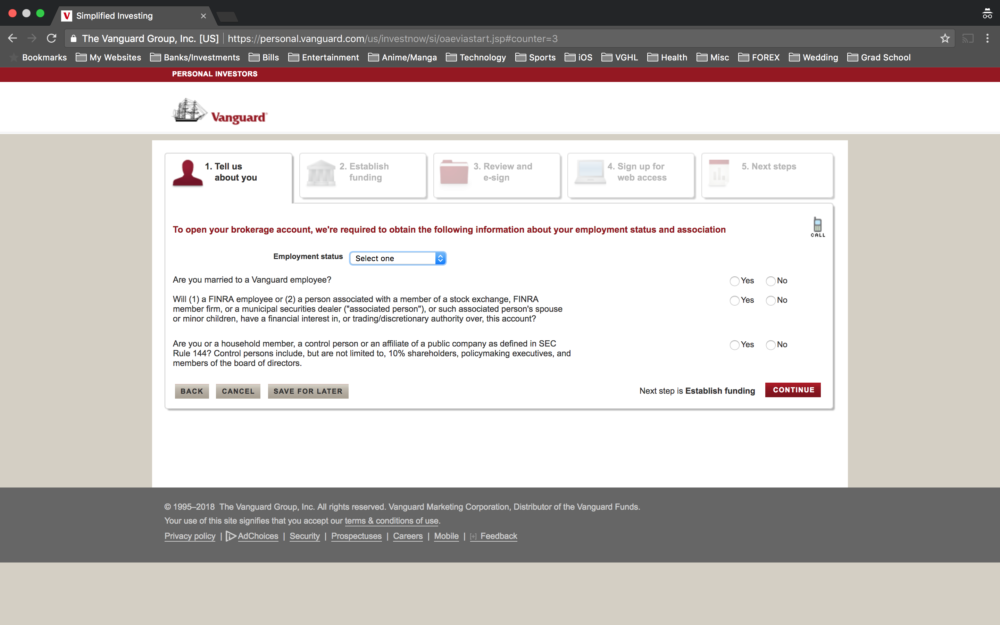

Select your employment status, enter your employer’s information (if required), and answer each question shown on the page by select “Yes” or “No” as appropriate. For most people, the answer to all of these questions will be “No”, however, you should answer honestly.

Select "Continue".

Step #10

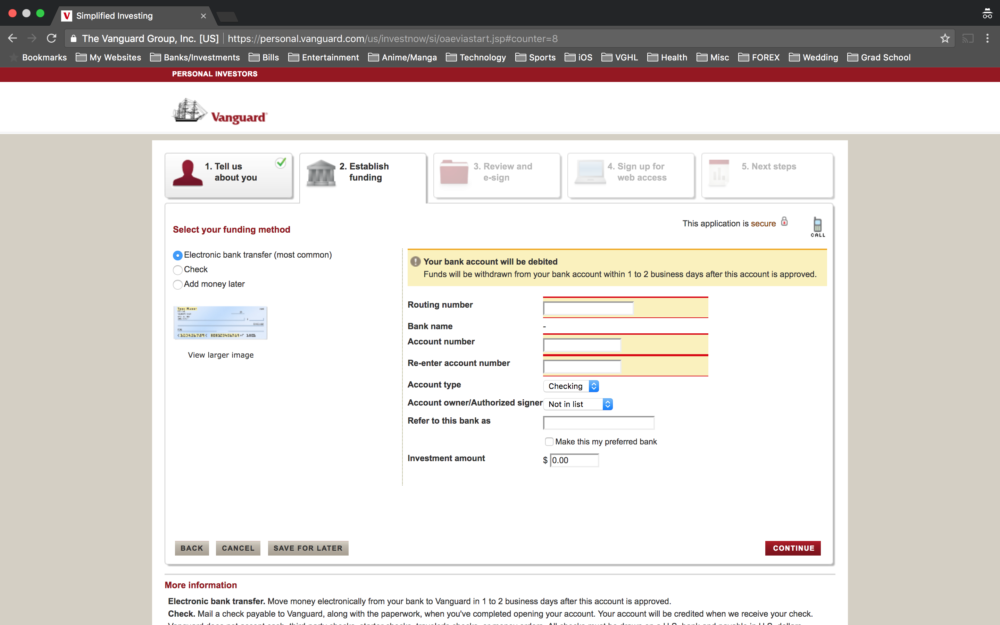

Decide how you will fund your account and fill in the appropriate information. Electronic Bank transfer is probably the easiest method.

If you’re not ready to fund your account yet, select “Add money later”.

Select "Continue".

Step #11

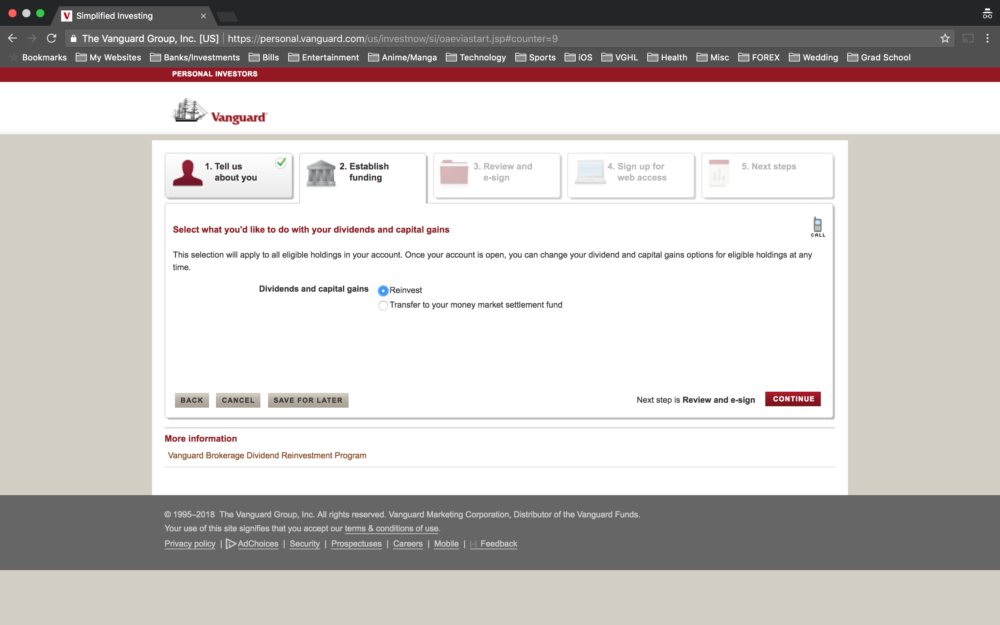

When you receive dividends on your holdings, you'll want to put them back to work growing your investment as quickly as possible. Selecting "Reinvest" makes this happen automatically, whenever dividends are distributed to your account.

Select "Continue".

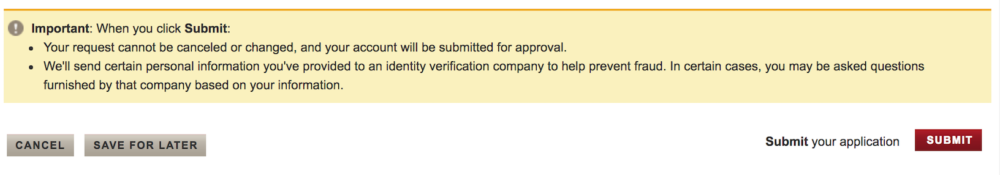

Step #12

Verify all of the information that you've entered is correct and submit your application.

Note: You may get a pop-up asking you to verify your identity. If so, simply answer each multiple choice question accurately and select "Continue".

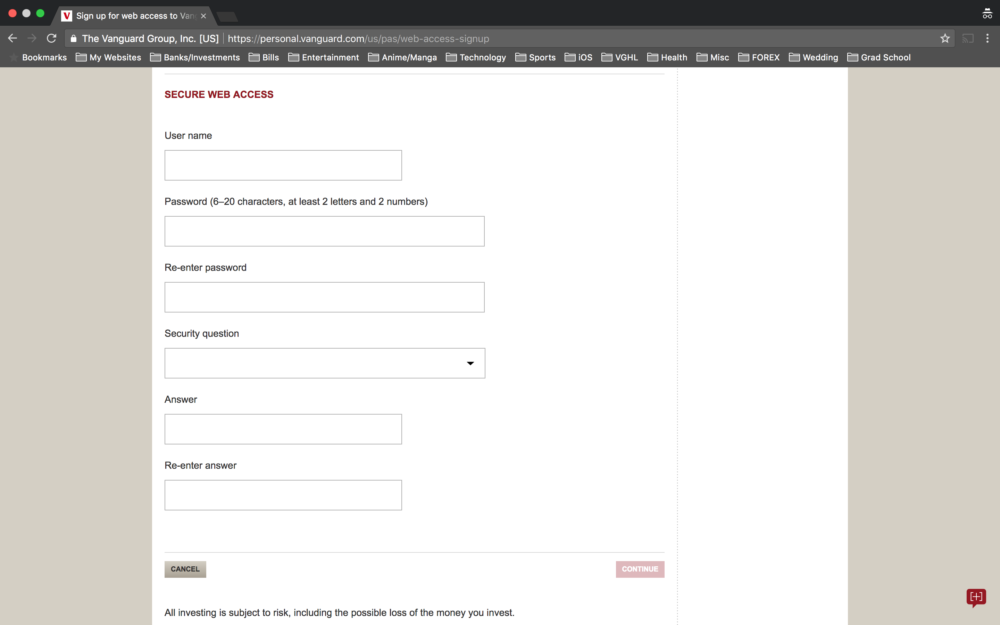

Step #13

Create your online login, then "Continue".

That's it, once your account has been approved and funded, you'll be ready to start investing!

Buying Stuff

Now that you've set up your investment account, it's time to start investing! Let's jump right in.

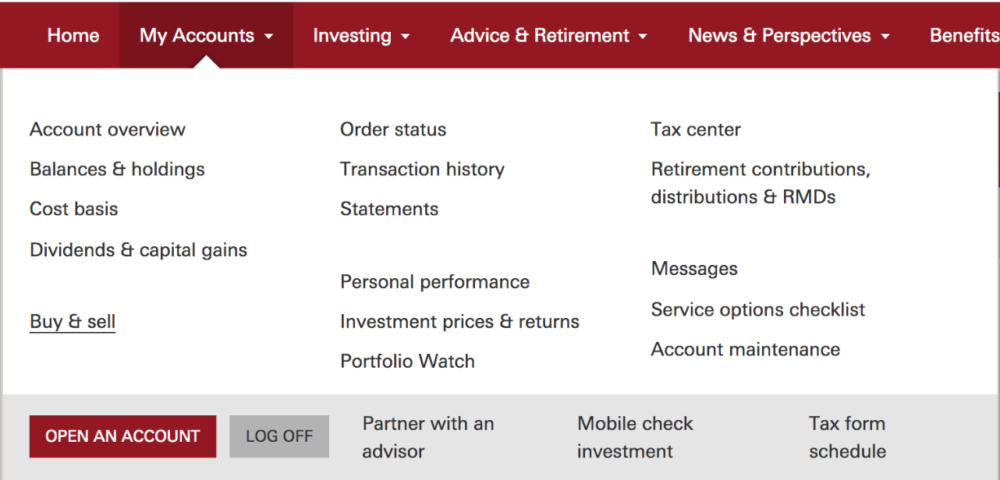

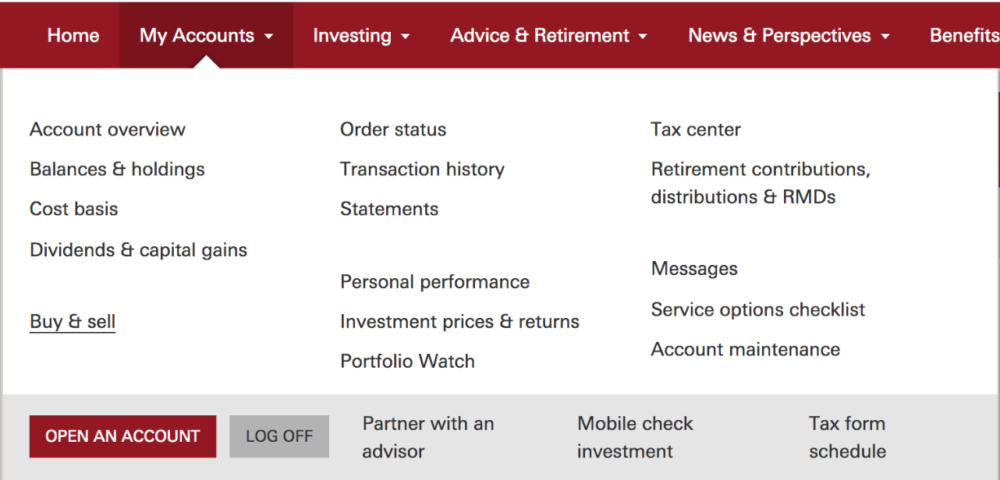

Step #1

Log into your new Vanguard account and select "My Accounts", then "Buy & Sell" from the top menu.

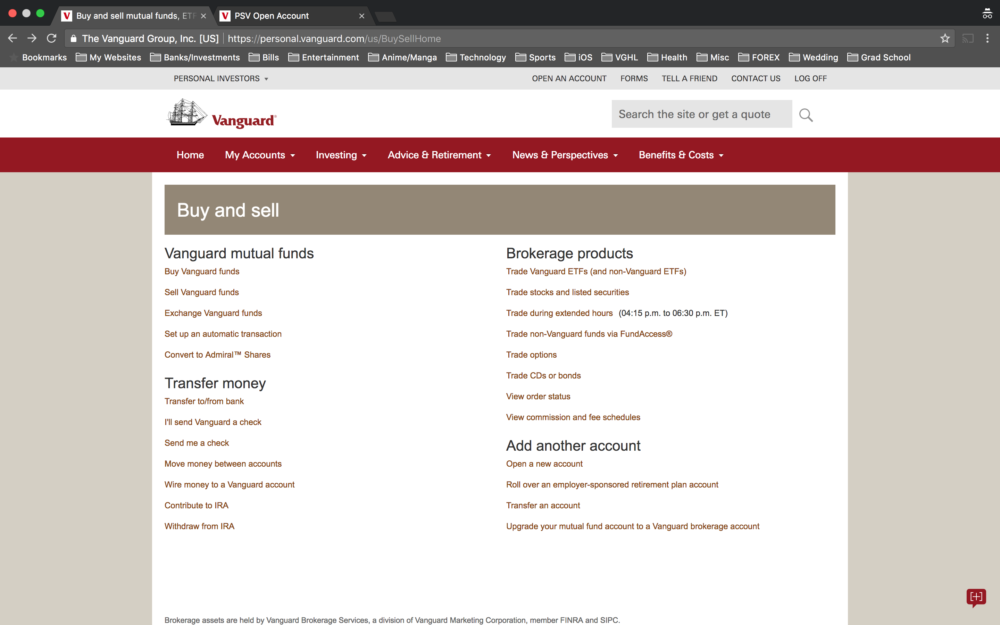

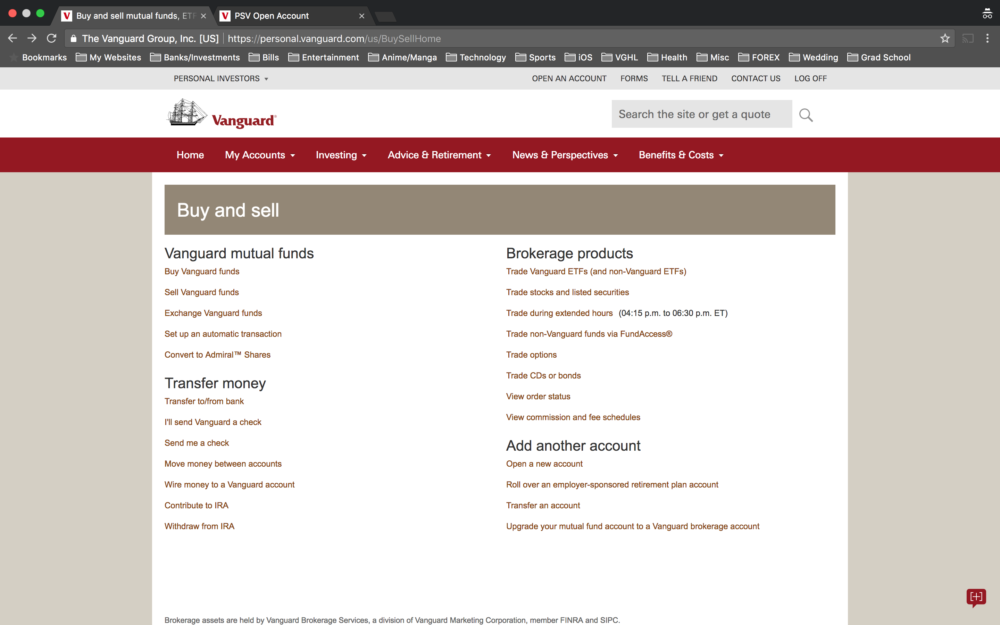

Step #2

Select "Trade stocks and listed securities".

Step #3

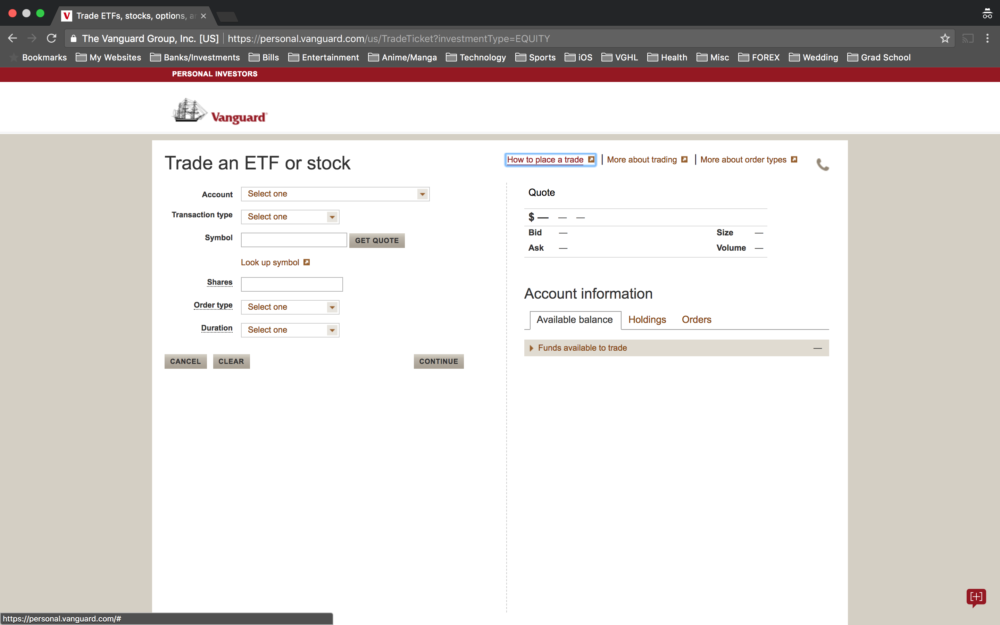

This is a page you want to get very familiar with. Whenever you trade (buy/sell) stocks or ETFs you will first be required to input your order into a form like this one. Regardless of what trading platform you decide to use, there will always be an interface similar to this.

Enter a stock or ETF into the "Symbol" field. I use VTI below, but you can enter any stock symbol you choose. Once you've entered a stock or ETF, select "Get Quote".

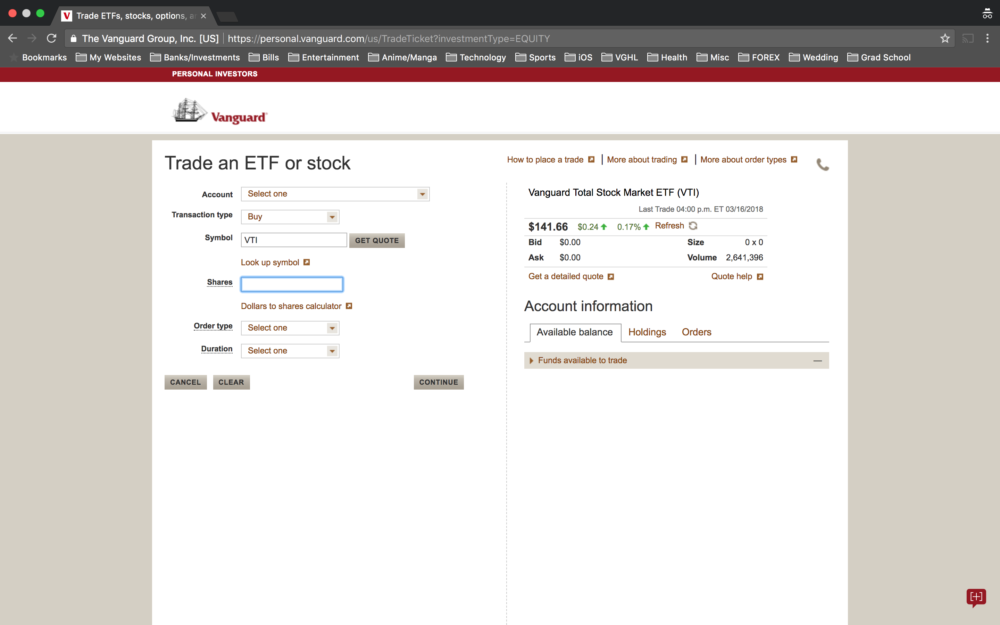

Step #4

Notice that the right half of the screen now gives you information about the stock or ETF you've selected. There are also additional links available for more detailed information, as well as help pages and a phone icon which provides a contact number to speak to a Vanguard employee who can help you with any questions/issues you may have.

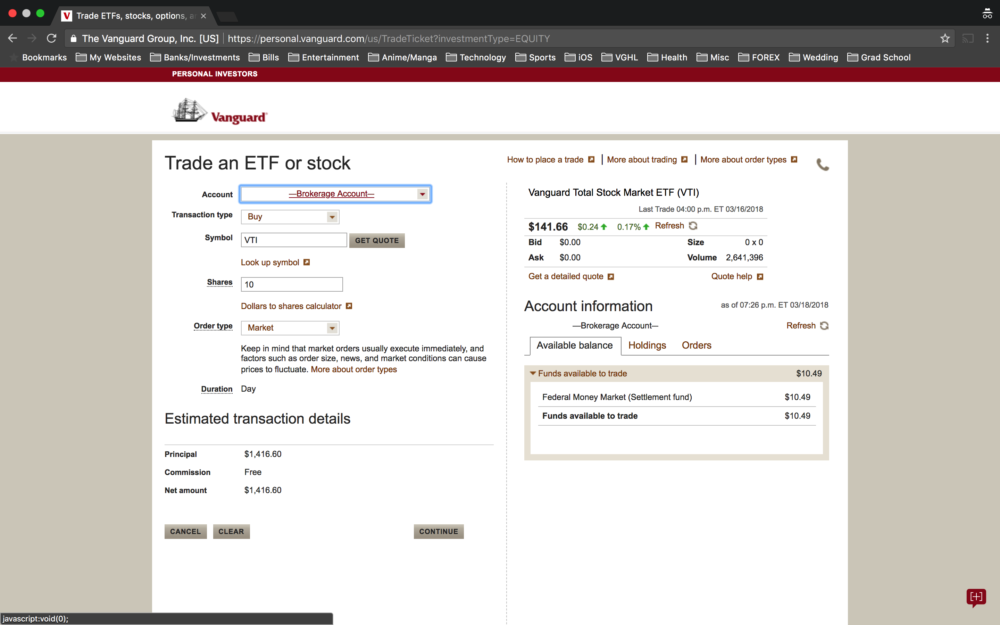

Step #5

Select your account from the drop-down, select "Buy" as your transaction type, select the number of shares you want to purchase and choose an order Type. I suggest selecting "Market" as your order type for now. You can read about all the order types here.

Make sure the Net amount listed under "Estimated transaction details" is less than the amount listed as "Funds available to trade" (under the "Available balance" tab on the right). If it isn't, you'll have to decrease the number of shares you're attempting to purchase, choose a different cheaper stock/ETF to buy, or deposit more money into your account.

Select "Continue".

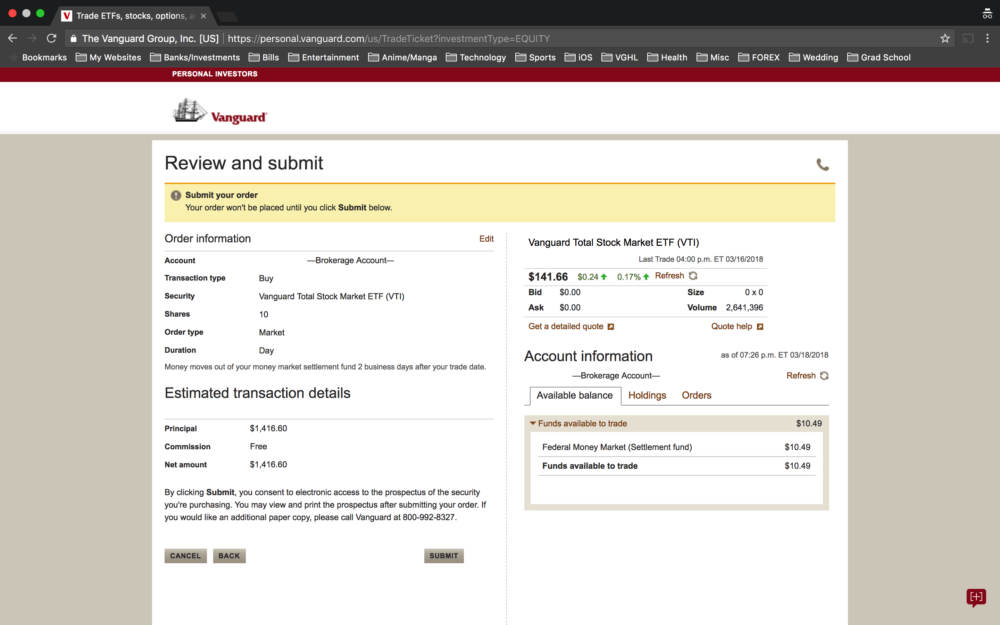

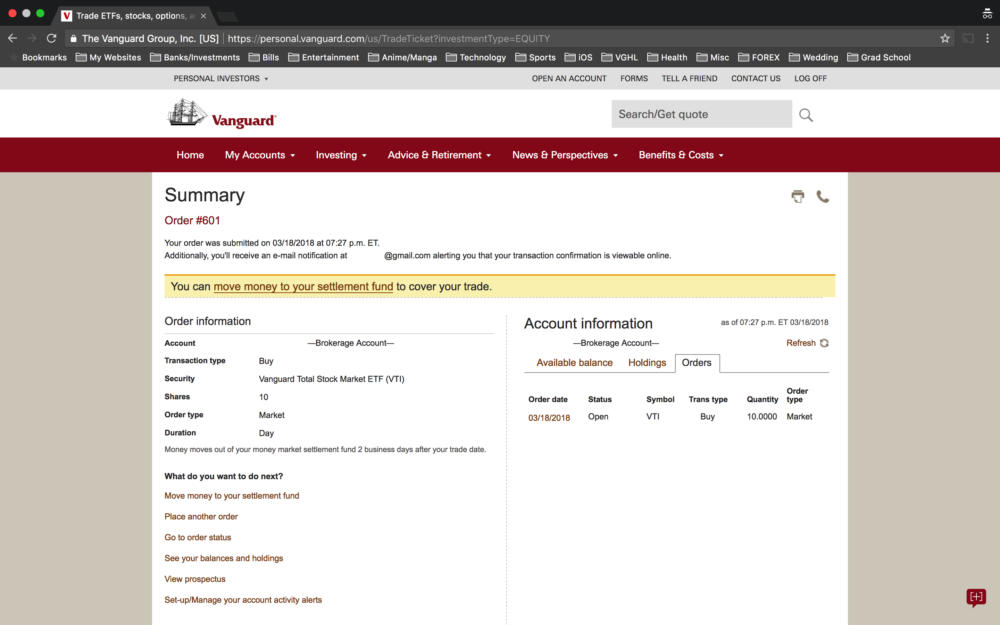

Step #6

Review your order. If everything looks as expected, select "Submit".

Step #7

Take a look at your order summary and make sure there are no issues.

You've just successfully executed your first stock trade!

You can use this exact same process to buy any stock or ETF you are interested in. It's that simple!

What About Mutual Funds?

If you're interested in investing in a mutual fund or index fund (an excellent idea indeed!), the process is a little different. Mutual funds aren't traded on an exchange like individual stocks and ETFs, so there's not as much flexibility when setting your orders. Here's how it's done.

Step #1

Log into your Vanguard account and select "My Accounts" and then "Buy & Sell" from the top menu.

Step #2

Select "Buy Vanguard funds".

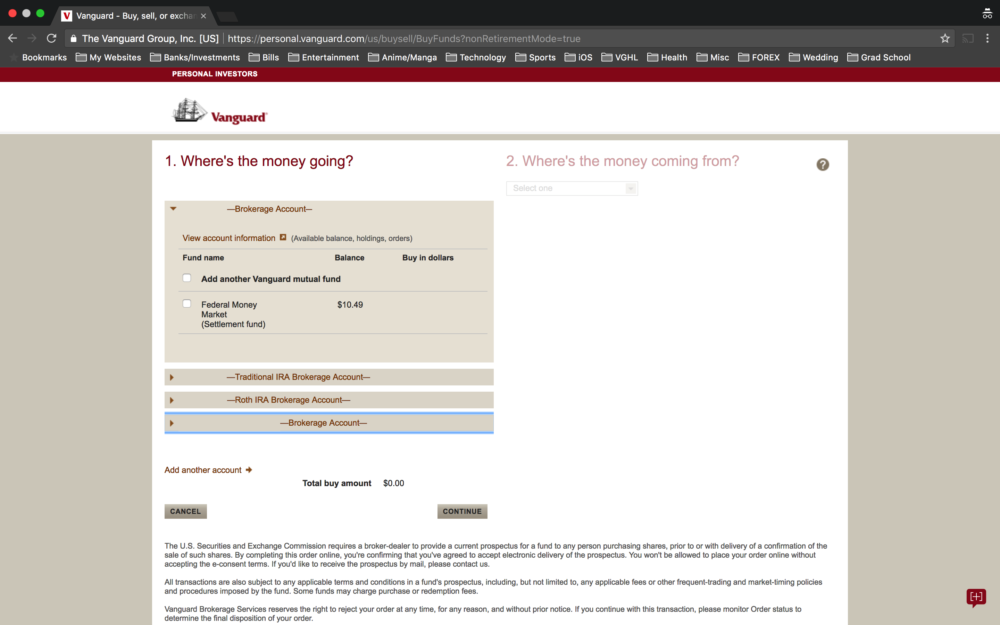

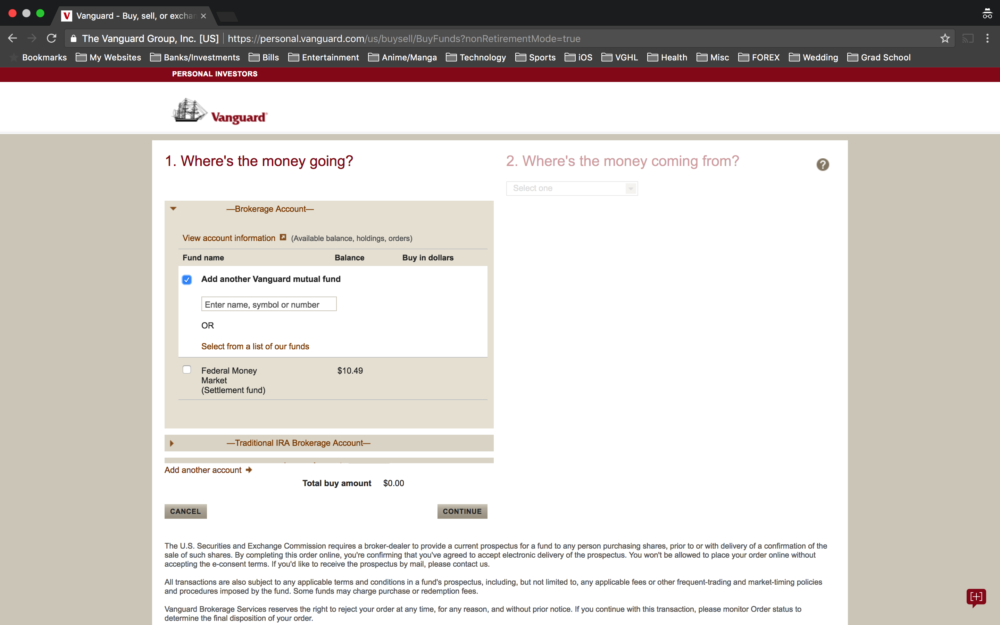

Step #3

Each of your accounts will be displayed with the funds you own underneath them. Notice the difference between this interface and the one used to trade stocks and ETFs.

Step #4

Under "Where's the money going?", select the checkbox next to "Add another Vanguard mutual fund".

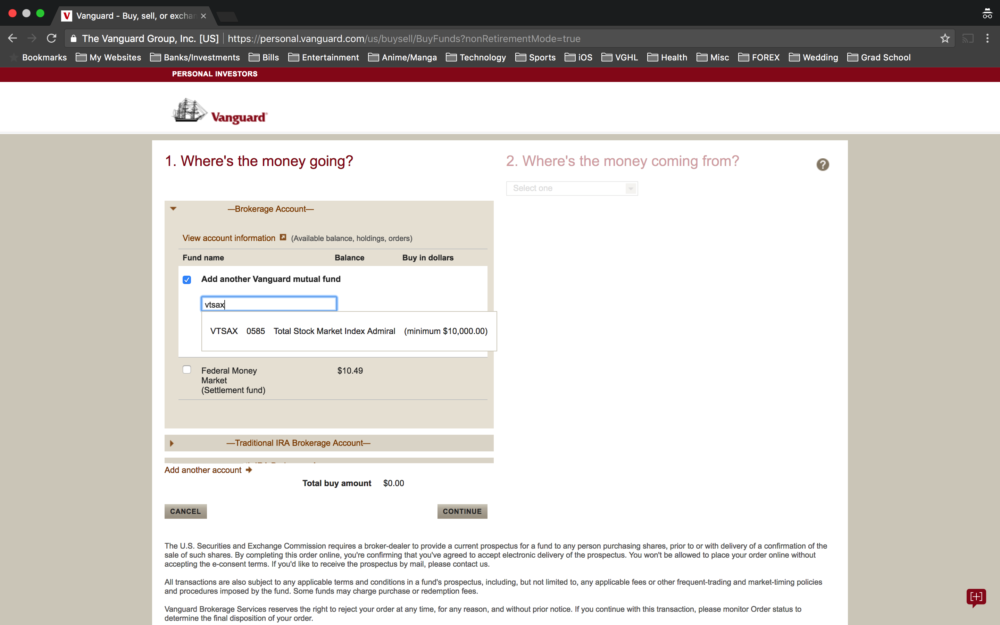

Step #5

Use the text entry field to enter the mutual fund you are interested in purchasing and press Enter.

Note: Many of the funds have minimum purchase requirements.

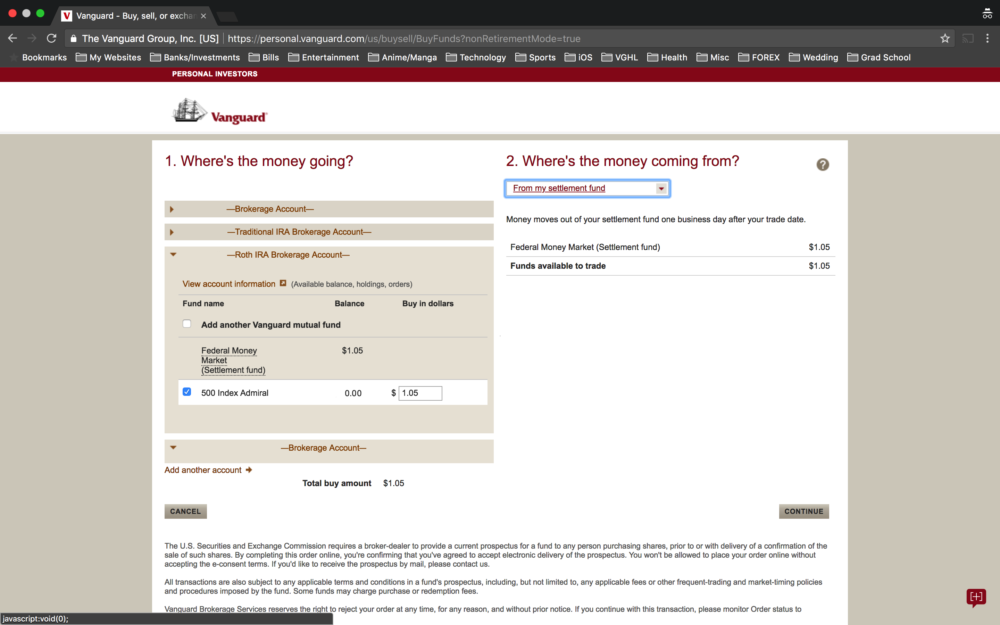

Step #6

Enter the amount you want to invest in the text entry field next to the fund you just added and select "Continue".

Select where your investment funds will be withdrawn from using the drop-down under "Where's the money coming from?"

Be sure that the amount of "Funds available to trade" is higher than the "Total buy amount". If it isn't, you'll have to decrease the amount you are attempting to invest, select a different mutual fund, or deposit more money into your account before completing your transaction.

Select "Continue".

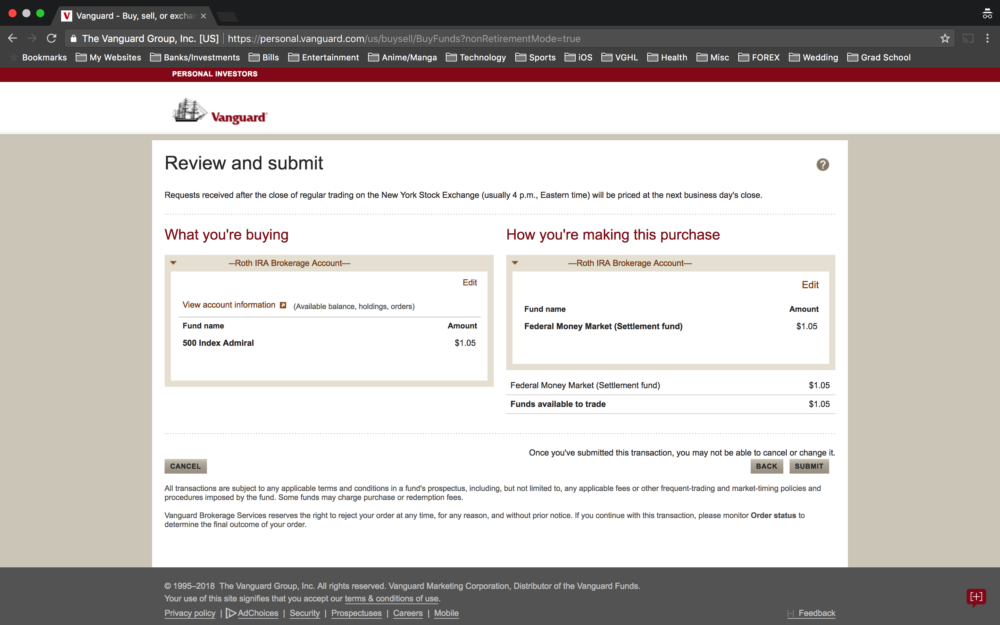

Step #7

Review your order. If everything looks as expected, select "Submit".

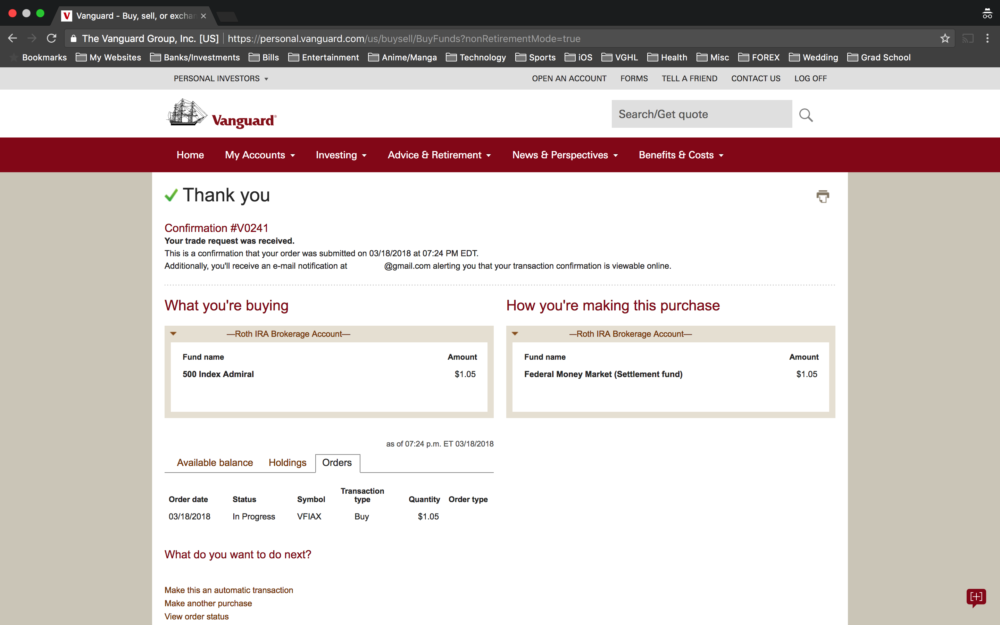

Step #8

Take a look at your order summary and make sure there were no issues.

You're now the proud owner of your very own mutual fund!

Congratulations, you are now an investor!!!

Final Thoughts

The most accessible method of achieving financial freedom is through investing. Many of us are intimidated by the process, however. I hope that this first entry in The Basics series will help to change that fact.

This article was written for anyone who feels a bit apprehensive about investing. I'm hoping that breaking down the steps and showing that it's not as complicated as it seems, will be the push they need to jump in and begin investing towards their future.

Tools To Get You Started

Get a head start on your journey toward achieving financial independence by analyzing and tracking your income, expenses, investment performance, and overall net worth with the free online wealth management tool Personal Capital.

We use Personal Capital regularly to analyze our investment fees, track our investments, and project our net worth. We also periodically review our progress toward retirement with their retirement planning calculator.

If you’d rather do things on your own, become a subscriber today and you’ll receive our Free Financial Planning Dashboard. This tool allows you to enter your income and expenses to create a detailed budget. You can use it to track your spending habits over time or just to get an idea of where your money is going each month. Take a look at the automatically generated charts and you may discover you have a little more cash to invest than you thought.

If you’re interested in detailed instructions on how to budget, save, pay off debt, and invest, check out The 6 Phases of Building Wealth. This book provides step-by-step instructions for working through each “Phase” in the process of achieving Financial Freedom. If you're just starting out, the information in this book will provide you with an invaluable resource. You can pick up the digital version for only $2.99 on Amazon.

Disclosure: Some of the links found on this website may be affiliate links. Affiliate links pay GGD a small commission when you click through and/or make a purchase. This is at zero additional cost to you.

Full Disclaimer/Disclosure

Related Posts

-

Why 401(k)s Are The Best Investments, Period

There are plenty of great investment options out there to choose from, but very few can compete with the advantages of a 401(k). When you add in employer matching to the equation, I believe 401(k)s…

-

Investment Hierarchy: Top 7 Investments For Retiring Young

When you make the decision to become an early retiree, one of the first things you'll realize is that there are many, many different choices when it comes to investment accounts. 401(k), IRA, HSA, 457,…

-

Monthly Financial Update - March 1, 2018

The Monthly Financial Update gives our readers an inside look at the allocation and performance of our personal portfolio. At the beginning of each month, we share a snapshot of our investments and highlight their…

This really helped! Really good step by step instructions here. Vanguard seems kind of overwhelming but with the pictures it really helps. For example, I didn’t know about the reinvest thing you could select. Good stuff!

Yep, automatic reinvesting can be a great tool. Glad the post was helpful!

This article kinds of bums me out that I hadn’t already done this. The steps seems easier than I assumed. It’s just a matter of doing it!

It’s never too late to get started!

I love how simple these steps make investing!

Thanks, Pam. I tried to make it as straightforward as possible. Hopefully, these steps will help some beginners start investing!