In the previous installment of “The Basics” series, we presented a step-by-step guide on how to set up your first investment account. Hopefully, that post will help some of the investment beginners out there conquer their fears and open an account to begin investing.

For this new entry, I decided to examine one of the main principles that make investing worthwhile, to begin with. Without this principle, it would be almost impossible to retire early. In fact, it would be quite difficult for most of us to ever stop working.

The principle I’m referring to is called “compound growth”.

Compound Growth

Famed theoretical Physicist, Albert Einstein is said to have once stated,

Compound growth is the most powerful force in the universe.

(It is actually highly disputed as to whether Einstein actually said these words but it gets the point across.)

Though I don’t know if I’d go as far as comparing it to universal forces, compound growth is definitely a powerful tool for growing money exponentially over time.

So, what exactly is compound growth and how does it work?

Compound growth is the process by which the gains you earn on an investment are reinvested to produce more gains that are also reinvested. This process repeats itself continuously, compounding the magnitude of your ultimate return.

Put simply, compound growth is making gains on your gains all while still making gains on your original investment as well.

Let's break it down visually.

What Does It Look Like?

Initial Investment

The image below represents your initial investment.

Growth Cycle #1

After one cycle of growth, your initial investment has generated some gains.

Growth Cycle #2

After the second cycle of growth we can see that, not only has your initial investment produced additional gains, but also your previous gains have generated their own gains.

Growth Cycle #3

Each cycle of growth, your initial investment produces more gains and every previous gain produces its own gains as well.

You can see how, over time, the growth really explodes. This is the power of compound growth.

Now imagine if you could apply this concept to your finances…

Taking Advantage Of Compound Growth

When you invest in the stock market over long periods of time, history suggests your money will grow. In fact, you’re likely to average a yearly return of 7-10%. But, it's not only your original investment that grows over time, all of the gains you earn along the way will grow as well. If that sounds familiar to you, then you’ve been paying attention because this is exactly the process we’ve been describing. Investing is the key to taking advantage of compound growth.

How about an example to demonstrate?

Example

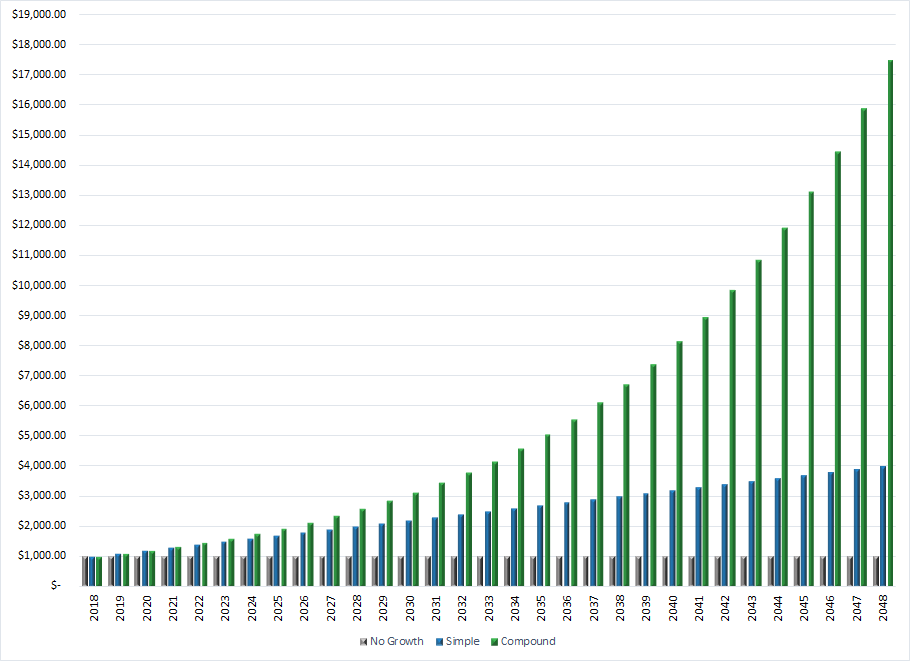

Peter has recently repaid all his debt using the strategies he learned on GoGreenDollar. As a result, he has decided to make a one-time payment of $1,000 towards his retirement savings. After 30 years, how will that $1,000 have grown?

Had Peter chosen to pile his money into a low-interest savings account (a very, very bad idea), after 30 years he would still have only around $1,000 saved.

If Peter had used the $1,000 to purchase a bond with a 10% yearly coupon (i.e. the yearly income), after 30 years we would have accumulated $3,000 in gains ($1,000 x 10% = $100 x 30 years = $3,000) to add to his original $1,000, giving him $4,000 total. This is an example of what’s called simple growth (similar to compound growth in some ways, but much less effective over time).

Peter, being a GoGreenDollar reader, would obviously have chosen to invest his savings in a stock index fund (with a few bonds for proper balance, of course). Let's assume a 10% rate of return. How does the compound growth Peter experienced compare to the other two options?

No-Growth vs. Simple vs. Compound

By taking advantage of compound growth, Peter has turned his original $1,000 into $17,450!

Final Thoughts

I have no idea if Albert Einstein ever actually said those words about compound growth, but I do know when it comes to investing, compound growth is one of the most powerful things out there. Make sure to take advantage!

Tools To Get You Started

Get a head start on your journey toward achieving financial independence by analyzing and tracking your income, expenses, investment performance, and overall net worth with the free online wealth management tool Personal Capital.

We use Personal Capital regularly to analyze our investment fees, track our investments, and project our net worth. We also periodically review our progress toward retirement with their retirement planning calculator.

If you’d rather do things on your own, become a subscriber today and you’ll receive our Free Financial Planning Dashboard. This tool allows you to enter your income and expenses to create a detailed budget. You can use it to track your spending habits over time or just to get an idea of where your money is going each month. Take a look at the automatically generated charts and you may discover you have a little more cash to invest than you thought.

If you’re interested in detailed instructions on how to budget, save, pay off debt, and invest, check out The 6 Phases of Building Wealth. This book provides step-by-step instructions for working through each “Phase” in the process of achieving Financial Freedom. If you're just starting out, the information in this book will provide you with an invaluable resource. You can pick up the digital version for only $2.99 on Amazon.

Disclosure: Some of the links found on this website may be affiliate links. Affiliate links pay GGD a small commission when you click through and/or make a purchase. This is at zero additional cost to you.

Full Disclaimer/Disclosure

Related Posts

-

Surprisingly Simple Investment Strategy For Retiring Early

The other day, while browsing through YouTube videos, I came across one that featured Tony Robbins discussing investing. I watched the video and found it had some good, if not groundbreaking, suggestions. There was one…

-

Investment Hierarchy: Top 7 Investments For Retiring Young

When you make the decision to become an early retiree, one of the first things you'll realize is that there are many, many different choices when it comes to investment accounts. 401(k), IRA, HSA, 457,…

-

The Simple Formula I’m Using To Retire In My 30's

Wake up, go to work, spend a few hours with family, go to bed, rinse and repeat. Some form of this routine probably describes the typical day for most of us. Throughout our lives, we’re…