You know renting is the same as throwing money away, right?

30 years from now you’ll look back and regret not purchasing a home sooner.

Why haven’t you bought a house yet???

My mortgage payment is less than your monthly rent! You could own a home for what you’re paying.

For someone who claims to be a financial expert (I don’t…), you sure are wasting a lot of money by renting instead of buying.

I’ve been hearing statements like these for as long as I can remember. With each passing year, the horror seems to grow. Why do I “waste” all my hard earned money on rent?? Why not “invest” in a home to live in?? How can I be so informed about finances in some areas, but so unwise in others?? My response to this line of questioning is always the same.

The reason I haven't purchased a home is that renting is better than buying. That’s not a typo folks. Let me state it again, more clearly. Renting a house or apartment/condo to live in is a better option than buying a house or apartment/condo to live in. This is especially true for those of us who are seeking the freedom of financial independence and early retirement.

To Be Free Or Not To Be...

Why do you go to work every day? Is it because you love your job? Does the work you do help to fulfill your life? If so, my hat goes off to you. It has got to be one of the greatest feelings in the world to be paid for doing something you love to do. You are lucky to have found such rewarding work. I tend to feel a little differently. For me, a job has always been just a means to an end. I go to work for exactly two reasons.

- To cover the expenses of life (bills, travel, food, stuff, etc.).

- To eventually compile enough money that continuing to go to work becomes a choice rather than a necessity (i.e. financial independence).

These are the two things that motivate me on a daily basis. No more and no less. Freedom is my goal and just about everything I do (including going to work) is done with that goal in mind. I want the freedom to decide how I want to spend my time, where I want to spend my time, and with whom I want to spend my time. When you become a homeowner a significant portion of your freedom is stripped away.

Mobility

Once you’ve purchased a home, your mobility is immediately limited. It becomes much more difficult to pursue opportunities in different geographic locations. What if you get a higher paying job offer in a different state? What if you want to move closer to family or friends? Perhaps you decide you’d prefer to live somewhere with more sun or trees or hills or better schools or less crime or a lower cost of living or more space? All of these moves become harder to make when you own a home. Even simply moving to the other side of your own town becomes an arduous and expensive process. This lack of mobility severely reduces your overall freedom. Still, it’s only one of the ways your freedom is restricted as a homeowner.

Upkeep, Repairs, and Upgrades

Raise your hand if you enjoy mowing the lawn, raking and bagging leaves, shoveling snow, landscaping, waiting around for repairmen, buying new appliances or replacing roofs. I think most of us can agree that these are not tasks we relish. I’ve got good news, however. When you rent, your landlord will typically take care of each and every one of these things for you. If a pipe bursts, they will fix it. When the grass grows, they will cut it. If the furnace goes out, they will replace it. You don’t have to waste time or money doing any of these things yourself. As a result, you can spend more time doing the things you want to do (e.g. reading, traveling, sleeping, golfing, eating, relaxing, etc.). You could even spend the extra time doing a side hustle to increase your acceleration towards achieving financial independence (I highly recommend this option)!

A homeowner will spend countless hours and tens of thousands of dollars on upkeep (e.g. cutting grass, raking leaves, shoveling snow, replacing air filters, cleaning gutters, etc.), repairs (e.g. painting stuff, fixing stuff, replacing stuff), and upgrades (e.g. new countertops, upgraded appliances, a better lawn mower (I don’t like cutting grass, if you haven’t picked up on that yet), etc.) over time. Worse, as the house ages, the time and money required to maintain it will continue to increase.

When you agree to buy a home you aren’t just getting a place to live. You’re also signing away a sizeable portion of your overall freedom (i.e. mobility, time, money). If like me, you value your freedom over just about anything else, this is an unacceptable compromise.

The Many Risks Of Buying

In addition to limiting your freedom, buying a home also increases your risk in multiple ways.

Liquidity And Opportunity Cost

Even though many homeowners view the equity in their home as part of their wealth, there is no way to quickly access this perceived wealth. In a financial emergency, taking on debt may be their only option. They may be forced to miss out on great investment opportunities due to lack of funds. On paper, their net worth may be high, but their homes have almost zero liquidity.

Liquidity is the speed at which one asset can be converted into another. Cash is considered to be the most liquid asset, as it can be “converted” into almost any other asset instantly. When the bulk of your money is contained in your home, you are in a highly illiquid position.

The large upfront costs of home ownership (e.g. deposit, closing costs, etc.) don’t just limit your liquidity; they also increase your opportunity cost. We’ve discussed opportunity cost before, so I won’t expand upon it in great detail, but the gist is that you are taking a large sum of money that could be invested, and instead choosing to use it to purchase a place to live. The “lost” investment gains are the opportunity cost.

Unpredictable Cashflow

Life is full of unplanned expenses. Cars break down. People get sick. Friends invite us to their far-off weddings. Due to the unplanned nature of these types of events, it can oftentimes be difficult to secure the required funds to pay for them without dipping into your savings or generating debt. This can create a great deal of financial stress and has the potential to ruin both short and long-term budgetary plans/savings goals. For an aspiring early retiree, this is especially worrisome. One of the keys to achieving and sustaining early retirement is the ability to fairly accurately determine the level of spending you need to maintain your lifestyle. If you frequently encounter unexpected expenses, this becomes much harder to do. To compensate you may need to delay early retirement in order to allow for a higher level of spending.

Owning a home makes the problem of unplanned expenses exponentially worse. The constant maintenance houses require makes it very difficult for homeowners to consistently predict their month-to-month expenses. Here is a short list of just a few things you might encounter as a homeowner that could result in unplanned expenses: leaking roof, damaged fence, electrical wiring issue, frozen/burst/leaky pipes, defective air conditioning unit, malfunctioning garage door, peeling paint, clogged toilet, groundhogs or other rodents digging through trash or ruining lawn, faulty septic system, flooding, blocked chimney, insufficient insulation, fire, cracked windows, shifting foundation, roach/mouse/rat/termite infestation, fallen trees, miscellaneous weather damage/natural disaster, faulty/damaged sprinklers…and on and on and on…

Luckily, there is an easy way to avoid just about all of these unplanned and unpredictable expenses: rent instead of buy. Renters can easily predict their month-to-month expenditures. Unplanned expenses will still arise, but they will be few and far between. If a renter were to encounter any of the issues from the list above, the landlord would be the one responsible for addressing them. A renter could also simply choose to move to a new home and instantly remedy any issues they were having.

Fluctuating Value

While it is true that most homes increase in value over time, the rate of growth is typically not much more than the rate of inflation. Consequently, the “real value" remains about the same in terms of current dollars. Some homeowners may disagree with this analysis because they’ve personally seen the value of their home jump by large amounts over relatively short periods of time. I don’t dispute that during a strong housing market a homeowner might find the value of their home has risen by double-digit percentages or more. This can and has happened many times throughout history. However, the housing market isn’t always strong. Just ask the 23% of homeowners whose homes were worth less than their mortgages (i.e. they owed more than the house was worth) following the housing crash of the mid-2000’s. The point is, you never know how the value of your home will change. It should go up at about the rate of inflation over the long-term but its value could fall drastically at any given time. When you purchase a home you are locking up hundreds of thousands of dollars into one single asset with nearly zero diversification that has the potential to plummet in value if market conditions change, or crime increases in your area, or a disaster occurs. Even having a bad neighbor can reduce the value of your home.

But, let's forget all of those negative factors for a second and assume you are lucky enough to enjoy relatively steady growth in value over the life of your home. Even in that case, a portion of your gains will be consumed by property taxes as government assessors increase the amount you owe each year to match the rise in your home's value.

A Few More Risks

If the above risks aren’t enough to make you reconsider your stance on buying, here are a few more for good measure:

Loss Of Income – When a homeowner finds herself in a tough financial position she can’t just go to the bank and ask for a reprieve. The same mortgage payment will continue to be due each and every month. If she is unable to pay for an extended period, the bank may choose to foreclose on the home. A renter would be able to quickly downsize to more affordable housing until their financial situation improved.

Eminent Domain – If the government determines your property can be better used for some public project, the Fifth Amendment gives them the authority to take it away from you as long as you receive “just compensation”. This is an actual constitutional law.

Family Growth – As a family grows in size a homeowner may find the size of his home insufficient. The only ways to fix this problem would be to either add an extension to his current home (a very expensive proposition) or begin the arduous process of searching for and buying a new home (and most likely selling the current one). When a renter needs more space they can simply move to a place with…more space.

Shifting Government Policy – The government has the power to change laws and regulations at any time. Many of the changes they make can directly or indirectly affect the value of your home. In fact, just this year the government instituted new policies reducing the property tax and mortgage interest deduction limits. Perhaps next year a change in education policy will deteriorate the quality of your local schools, thus reducing the value of your home or maybe a proposal to build a new highway will increase traffic in your area, something that can also lower your home’s value. A shifting political climate can be a huge headache for a homeowner.

The Showdown

If the arguments above haven’t convinced you that renting is the better option don’t worry; I’ve saved the best for last. It’s been ingrained in us for our entire life that buying is always better, so this may come as a shock, but renting is actually cheaper than buying. But don’t take my word for it, let's run the numbers.

*I’ve attempted to use current and historical data to select reasonable and realistic numbers. Click the link associated with each number to view the data supporting it.

Renting vs. Buying

Bill and Ted are both looking for a place to live. Bill wants to purchase a home while Ted would prefer to rent. They each have $57,500 in available cash to spend. Bill plans to use the money for his down payment and closing costs. Ted, on the other hand, has been reading about investing on GoGreenDollar and has decided that he’d like to invest his money in a total US stock market index fund. His landlord requires one month of rent as a deposit but he plans to invest the rest. Bill and Ted each plan to live in their home for the next 30 years.

Assumptions:

Home Value = $250,000

Available Cash = $57,500

Stock Investment Growth Rate = 9.25% per year

Property Value Growth Rate = 3.5% per year

Rent Growth Rate = 1.15% per year

Bill's Numbers:

Down Payment (20%) = $50,000

Closing Costs (3%) = $7,500

Mortgage Term = 30 years

Mortgage Rate (fixed) = 4.25%

Monthly Mortgage Payment = $984 per month

Monthly HOA Fees = $50 per month

Property Taxes (1%) = $2,500 = $208 per month

Maintenance/Renovation (1.5%) = $3,750 = $313 per month

Homeowner Insurance (0.5%) = $1,250 = $104 per month

Bill's Total Monthly Cost = $984 + $50 + $208 + $313 + $104 = $1,659 per month

Ted's Numbers:

Price-To-Rent Ratio = 17

Rent = $250,000 / 17 = $14,706 / 12 months = $1,226 per month

Deposit (1 months rent) = $1,226

Renters Insurances = $240 = $20 per month

Ted's Total Monthly Cost = $1,226 + $20 = $1,246 per month

Initial Monthly Spending Difference (Renting vs. Buying) = $1,659 - $1,246 = $413 per month

*The total difference in monthly expenses will be added to Ted’s investment account at the end of each year.

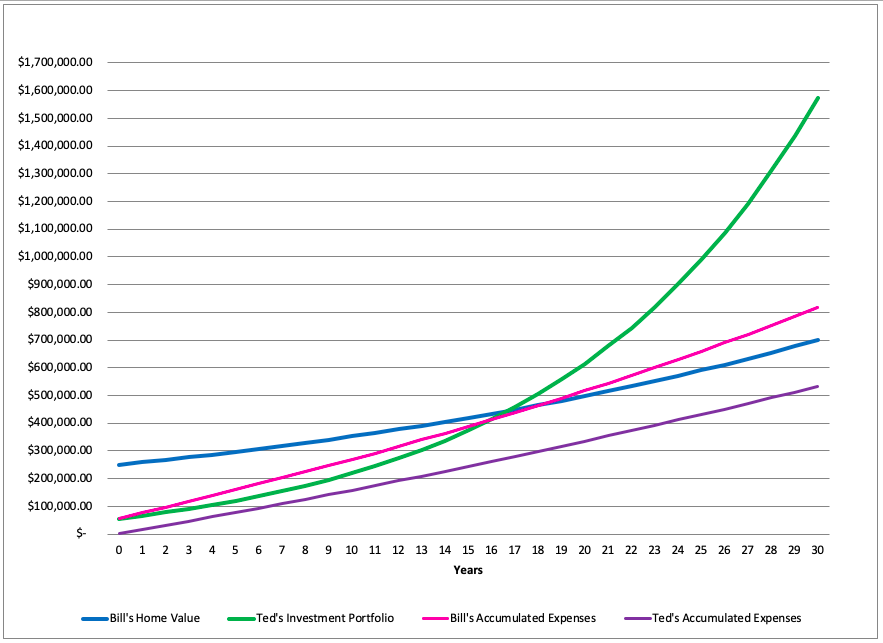

When we graph all of the data over a 30-year period we get the following:

All I can say is, WOW. As you can see from the chart, over a 30-year period, renting thoroughly defeats buying. It’s not really even close.

After 30 years, the value of Bill’s home has grown considerably, going from a starting value of $250,000 to an ending value of $701,698. That’s a huge increase of over 180%! When we compare this growth to that of Ted’s portfolio, however, it begins to seem pretty paltry.

By investing the remaining cash after paying his deposit (i.e. $57,500 - $1,226 = $56,274) in addition to the money he saved each year by being a renter, over a 30-year period, Ted was able to accumulate well over $1.5 million! That’s more than double the value of Bill’s home! I think it's safe to say that Ted has done pretty well for himself.

Note: Obviously, there are specific cities and neighborhoods around the nation where these numbers are drastically different. You may live in an area with hugely inflated rental rates and greatly undervalued home prices. If that happens to be your situation, it is possible you may find the difference between renting and buying to be less pronounced. Even in these cases, however, purchasing a home would still severely limit your freedom and significantly increase your risk.

Still Don't Buy It?

Even though every number used in the example was based on real data, I know some will still argue that the numbers are skewed. So let’s make it super simple. I’ll throw out all of the additional costs associated with owning a home and assume that Bill’s monthly payment is exactly the same as Ted’s. Now, the only difference between their circumstances is that Bill is buying his home while Ted is only renting his.

In order to buy his new home, Bill pays $57,500 for his down payment and closing costs.

Ted must deposit one month of rent, or $1,246, in order to move into his new place. He will invest the remainder (i.e. $56,254).

Assumptions:

Bill’s Home's Initial Value = $250,000

Ted’s Initial Investment Value = $56,254

Property Value Growth Rate = 3.5%

Stock Investment Growth Rate = 9.25%

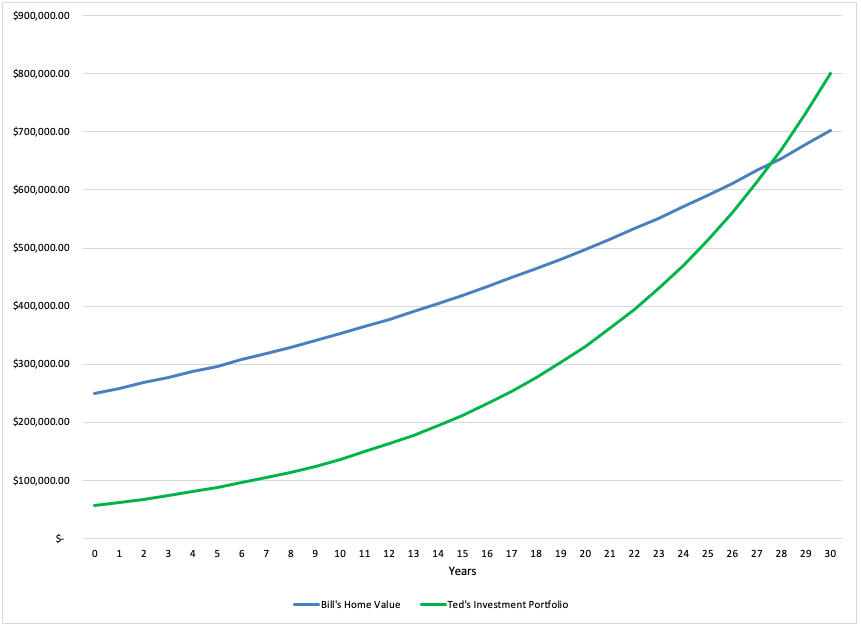

Just like in the previous example, after 30 years of steady growth, the value of Bill’s home has grown from $250,000 to $701,698. How has Ted fared?

Since the monthly expenses for Bill and Ted were exactly the same, Ted received no additional savings from renting. His initial investment of $56,274 was the total amount he invested. Over the entire 30-year period he never contributed any additional money. Still, the power of compound growth triumphs once again. After 30 years, the value of Ted’s investment portfolio has grown to $799,744! How about that…

Final Thoughts

I hope this article has provided a bit of verbal ammunition for my fellow renters out there who are constantly being pressured to buy a home. As I’ve shown above, things are not quite as black and white as some may think. There are many, many factors to consider when deciding whether to rent or buy and each of us must consider our own unique situation and needs before making a choice. In order to achieve my personal goals (i.e. increased free time, financial liquidity, mobility, financial Independence, early retirement, etc.) I have found that renting is the better option. After reading this article, maybe you will too…?

Additional Notes

The primary goal of this post is not to prove that buying a home is a terrible idea. It isn’t. Depending on the specifics of your situation, buying may be the perfect choice for you. The true goal of this post is simply to illustrate that renting doesn’t equate to throwing away money. In fact, there are many perks associated with it, both financial and non-financial. When all of these advantages are considered, it’s easy to see that renting can be a great option.

Tools To Get You Started

Get a head start on your journey toward achieving financial independence by analyzing and tracking your income, expenses, investment performance, and overall net worth with the free online wealth management tool Empower Personal Dashboard.

We use Empower Personal Dashboard regularly to analyze our investment fees, track our investments, and project our net worth. We also periodically review our progress toward retirement with their retirement planning calculator.

If you’d rather do things on your own, become a subscriber today and you’ll receive our Free Financial Planning Dashboard. This tool allows you to enter your income and expenses to create a detailed budget. You can use it to track your spending habits over time or just to get an idea of where your money is going each month. Take a look at the automatically generated charts and you may discover you have a little more cash to invest than you thought.

If you’re interested in detailed instructions on how to budget, save, pay off debt, and invest, check out The 6 Phases of Building Wealth. This book provides step-by-step instructions for working through each “Phase” in the process of achieving Financial Freedom. If you're just starting out, the information in this book will provide you with an invaluable resource. You can pick up the digital version for only $2.99 on Amazon.

Disclosure: Some of the links found on this website may be affiliate links. Affiliate links pay GGD a small commission when you click through and/or make a purchase. This is at zero additional cost to you.

Full Disclaimer/Disclosure

Related Posts

-

Why Saving Money In The Bank Will Leave You Broke (Part 1)

In 1923, Germany began printing and circulating two-trillion mark banknotes. That’s a “2”, followed by 12 zeros (i.e. 2,000,000,000,000) on each individual banknote! What would cause a country to print such a large denomination of…

-

The Simple Formula I’m Using To Retire In My 30's

Wake up, go to work, spend a few hours with family, go to bed, rinse and repeat. Some form of this routine probably describes the typical day for most of us. Throughout our lives, we’re…

-

The Stock Market Always Goes Up

My first taste of investing came after graduating from college and starting my first “real” job. This initial experience consisted of picking which funds–from a list of 10 or 15–I would invest in, in my…

Great article! I think I’m convinced.

In the Bill and Ted part, I initially I missed the part where Ted is investing his extra money each year. That’s a big deal! I went back over it and saw the asterisks though. So the whole thing for that section is basically to make sure you’re investing the leftover cash, I guess!

Absolutely, you’ve got to invest those savings! Also, notice in the second example, even when there where no monthly savings, Ted still came out on top due to the higher return he got from his stock investments.

I completely agree with you on renting and love how detailed your post was. The only thing preventing me from renting and cashing in on our mortgage equity is the volatile rental market. There is such a spike in real estate where we live for the entire region, homes are being bought and sold rapidly creating a volatile rental market. A landlord selling your rental while in a low vacancy market is troubling for many.

Yep. The realities of the housing market you actually live in may determine what the most profitable course of action is. The analysis I did simply show’s averages over time. The specifics of your situation may be completely different. Thanks for the comment!

The rent vs buy discussion has always intrigued me. I like to go into it open-minded and to see it from both viewpoints. Each side makes compelling arguments. It just comes down to personal preference. I see the renting side of things by having a set payment that you know what you can budget for. Then I see buying as a form of owning and it’s yours. I’m more in the middle and would rather have a duplex rental property I own and the renter paying the mortgage. It’s the best of both worlds.

I think the main point is that (for the most part) buying a home to live in is a lifestyle choice and not necessarily a good investment. That doesn’t make it a bad decision. On the contrary, it might be a great decision for you and your family. It’s just not the best use of funds you’d like to invest, on average.

I think that whether you rent a house or buy a house, people are comfortable with the layout of the house and the cleanliness in the house, the money for the house is worth it. I’m in a rented house and I always keep it clean with a cleaning tool like vacuum, mop, … because for me a clean house always brings the highest comfort.