As I’ve admitted in the past, I don’t keep track of my finances with a conventional budget. Instead, I have implemented a system in which everything happens automatically. Bills are paid automatically, funds are saved/invested automatically, and money that is free to be spent is automatically allocated to specific accounts. If a setup like that sounds attractive to you then be sure to check out my full, step-by-step, break down. However, if you’re interested in a more traditional budgeting approach but aren’t sure where to start, today is your lucky day! Let me introduce you to the 50/30/20 budget.

50, 30, 20

The 50/30/20 budget is a budgeting system that breaks down your expenditures into 3 broad spending categories and assigns a percentage of your income to each of them. The categories are Fixed Expenses, Flexible Spending, and Wealth Building. Based on this budgeting system these spending categories should represent 50%, 30%, and 20% of your expenditures respectively. The categories are defined as follows:

Fixed Expenses (50%) – Expenses that are necessary and/or unavoidable including housing, basic clothing, groceries, utilities, prescriptions, transportation, insurance premiums, minimum debt payments, etc.

Flexible Spending (30%) – Non-essential spending like monthly memberships, eating out, cable television, vacations, subscriptions, excessive shopping, etc.

Wealth Building (20%) - Money that will be used to build wealth and achieve financial goals including debt elimination, saving, and investing.

The percentage assigned to the first 2 categories should be viewed as the maximum for spending of that type. In other words, no more than 50% of your income should go towards Fixed Expenses and no more than 30% should go toward Flexible Spending. The Wealth Building category is slightly different, however.

Since the ultimate goal of any financial plan is to build wealth, the percentage associated with Wealth Building is not a cap on spending. Instead, it represents the minimum that should be allocated. So at least 20% of your income should be going toward wealth building activities.

Setting Up Your 50/30/20 Budget

Step #1

Determine your income by examining your paychecks and adding up the amount you bring in each month (after taxes). Don’t forget to include any additional regularly occurring income you may receive from other sources. Money that is automatically deducted from your paycheck for health insurance or retirement savings should also be included in this total.

Step #2

Begin creating your initial budget by writing down everything you currently spend money on as well as the amount you spend on it in a typical month. Include monthly bills, expenses, saving, investments, and any other regular expenditure. The goal is to determine where every dollar you make is going each month so don’t leave anything out. You should be able to gather this information by reviewing your bank and credit card statements. Since expenses can fluctuate a bit from month to month, look at 60-90 days of data then average it out to a monthly total.

If you’d rather not do this part manually, try using a financial tracking website/software like Personal Capital, Mint, or QuickBooks to help speed things up.

Step #3

Organize each item in your budget into one of the three spending categories (Fixed Expenses, Flexible Spending, or Wealth Building). Every single dollar spent should be marked as either a Fixed or Flexible expense. Every single dollar saved or invested should be marked as a Wealth Building expenditure.

The required minimum monthly payment on any debt should be considered a Fixed Expense. Any money you are contributing in excess of the minimum payment should be assigned to the Wealth Building category. This may not seem like a wealth building activity but erasing debt is definitely one of the keys to building wealth.

Step #4

Once you’ve grouped your spending into one of the three categories and added everything up, determine how close you are to a 50/30/20 budget allocation. If your expenditures in each group are already within range, great! Looks like you were already maintaining a 50/30/20 budget and didn’t even know it! Now all you’ve got to do is continue tracking your spending, being sure to keep each expense category within its associated threshold over time. If you find that your spending habits don’t quite meet the 50/30/20 budget criteria, it’s time to get to work.

-- 50 --

First, let’s look at your Fixed Expenses. If you are currently spending more than 50% of your income in this area, you must take steps to lower those expenses. I know what you’re thinking, “These are FIXED expenses. By definition, they are unavoidable. I need these things just to live. There’s no way I can lower them.” Not so fast. I never said this would be easy. In fact, reducing excess Fixed Expenses is probably the hardest part of this process. However, it is far from impossible. You simply have to be willing to make the necessary changes/sacrifices. Here are some examples.

You can lower rent or mortgage payments by refinancing your home or finding a less expensive place to live. I know moving seems like a really big change, but I think you’ll find it’s not as life-altering as it seems. People move all the time. I’ve moved 5 times in just the last 12 years!

Reduce your utility bill by being more conscious and deliberate in how you use your utilities. For example, you can use electricity more efficiently by turning off and unplugging things that aren’t in use, modify your thermostat settings so that the AC only runs when it needs to, or apply conservation techniques to reduce your water bill.

If your car payment, insurance, or gasoline expenses are too high, consider swapping your car for a more cost-effective vehicle with low or no payment, cheaper insurance, or better gas mileage. You could also start occasionally walking/biking instead of driving (increase your wealth and your health!).

To reduce grocery cost, make sure to avoid shopping when you are hungry (people tend to purchase more junk food when they are hungry), take advantage of coupons and discounts, and always create and stick to a shopping list.

It should be noted that making these types of changes is no small feat. These are things that affect our very lifestyle, things that many of us will be unwilling to change. But, before making up your mind, ask yourself a few questions:

- “Would I rather live in a big house/luxurious apartment or be able to retire at the age of 55 instead of 75?”

- “Is taking shorter showers and turning off the lights when I’m done with them too much to ask if it will help me achieve my financial goals?”

- “Does driving a fancy car give me more pleasure than watching my savings and investments grow?”

- “What am I willing to sacrifice in order to reach financial independence?”

-- 30 --

In comparison to the potential life-altering changes required to lower some Fixed Expenses, reducing your Flexible Spending below the 30% limit shouldn’t be too difficult. It’s mostly a matter of remaining disciplined and cutting back on impulse buys. Reducing your Flexible Spending will mean scaling back the amount you spend on things like eating out, online shopping, vacations, cable TV, subscriptions, junk food, expensive hobbies/pastimes, and other things you buy but don’t really need. By simply developing a plan for what you will purchase and not deviating from it, you can instantly modify your Flexible Spending to fit within your budget. Living without some of your favorite Flexible Spending items might be difficult at times, but you must decide if enjoying these luxuries is more important to you than your financial freedom.

-- 20 --

Once your spending habits have been adjusted to align with the 50 and 30 portions of the budget, all remaining income should go towards the Wealth Building category. When your budget is fully implemented, 20% should be the MINIMUM you have allocated to Wealth Building. Ideally, 20% will be just the start. As your wealth grows over time, you will hopefully be inspired to increase your Wealth Building allocation even further. As this number grows, so will the speed at which you approach financial independence. You’ll be there before you know it!

Step #5

Once you’ve made the proper adjustments to your spending habits, all that’s left is to continue maintaining your budget over time. Say goodbye to stress about money. Sit back, relax, and watch as your nest egg grows. All while your bills are paid on time each month and you know where every dollar you make is being spent. Who’d have ever thought a budget could be so rewarding?

Tools To Get You Started

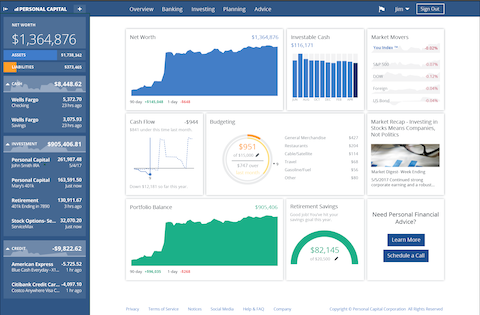

Get a head start on your journey toward achieving financial independence by analyzing and tracking your income, expenses, investment performance, and overall net worth with the free online wealth management tool Personal Capital.

We use Personal Capital regularly to analyze our investment fees, track our investments, and project our net worth. We also periodically review our progress toward retirement with their retirement planning calculator.

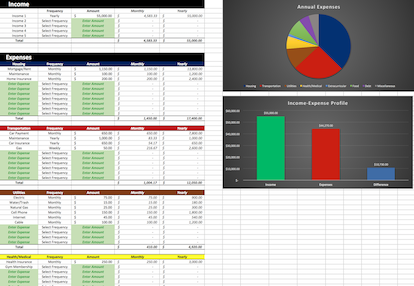

If you’d rather do things on your own, become a subscriber today and you’ll receive our Free Financial Planning Dashboard. This tool allows you to enter your income and expenses to create a detailed budget. You can use it to track your spending habits over time or just to get an idea of where your money is going each month. Take a look at the automatically generated charts and you may discover you have a little more cash to invest than you thought.

If you’re interested in detailed instructions on how to budget, save, pay off debt, and invest, check out The 6 Phases of Building Wealth. This book provides step-by-step instructions for working through each “Phase” in the process of achieving Financial Freedom. If you're just starting out, the information in this book will provide you with an invaluable resource. You can pick up the digital version for only $2.99 on Amazon.

Disclosure: Some of the links found on this website may be affiliate links. Affiliate links pay GGD a small commission when you click through and/or make a purchase. This is at zero additional cost to you.

Full Disclaimer/Disclosure

Related Posts

-

Save Energy. Save The Planet. Save Money.

When you need light in a dark room, the solution is usually to flip the light switch. It’s something we do—probably multiple times—every day. But have you ever considered where the electricity to power that…

-

The Simple Formula I’m Using To Retire In My 30's

Wake up, go to work, spend a few hours with family, go to bed, rinse and repeat. Some form of this routine probably describes the typical day for most of us. Throughout our lives, we’re…

-

Monthly Financial Update - February 1, 2018

The Monthly Financial Update gives our readers an inside look at the allocation and performance of our personal portfolio. At the beginning of each month, we share a snapshot of our investments and highlight their…