When you need light in a dark room, the solution is usually to flip the light switch. It’s something we do—probably multiple times—every day. But have you ever considered where the electricity to power that light comes from? Sure, you get a monthly bill from your power company, and as long as you pay on time, the energy keeps on flowing. But how do they generate that energy to sell you?

Fossil Fuels And Their Impacts

Though reusable/clean energy sources are becoming more prevalent every day, the vast majority of electricity in the U.S. is still generated by fossil fuels. In a nutshell, fossil fuels such as coal, oil, and natural gas, are drilled or mined from the earth, refined into purer forms, transported to power plants, burned to heat water thus creating steam, the steam turns turbines to generate electricity, which then flows through power lines to our homes.

While fossil fuels are currently the more affordable resource, they are not sustainable long-term. In addition, burning them has detrimental ecological and health effects. For example, burning coal releases a variety of toxic byproducts into the atmosphere, including sulfur dioxide, nitrogen oxides, carbon dioxide, mercury, and fly ash. These toxic byproducts are devastating to our environment (contributing to smog, acid rain, global warming, pollution, and water contamination) and mining and drilling for the limited natural resources that produce them, contributes to deforestation and the destruction of natural habitats. Further, the atmospheric contamination they cause can have damaging effects on our health, triggering asthma, causing respiratory and lung disease, and impact neurological development.

The significance of these impacts really started to hit home for me during my time living in Texas. I recall seeing large road signs warning "Code Orange. Pollution Levels High. Stay inside." The Texas heat combined with air pollutants had created conditions where it was actually dangerous for some individuals to be active outdoors. This was truly stunning for me to witness. I was, and still am, appalled that this was considered "normal".

Energy Consumption

Did you know that using 1 kilowatt-hour (kWh) of energy requires about 1 pound of coal to be burned? In other words, a pound of coal must be burned to power one 100-watt light bulb for 10 hours. To put that in perspective, the average person in the United States uses 4,500 kWh of electricity per year (about 375 kWh per month) with the largest contributor to this average being home cooling/heating. Of course, these numbers will vary by the size of your home and where you live, but every single pound of coal burned pumps more toxic chemicals into our atmosphere. Keep these numbers in mind the next time you leave a light on that you're not using.

As long as humans are around, we will always require energy, but it is our responsibility to be conscientious about how we consume that energy. Being wasteful literally hurts us all.

Our Usage

So how do we (i.e. Mr. and Ms. GGD) compare to the US average?

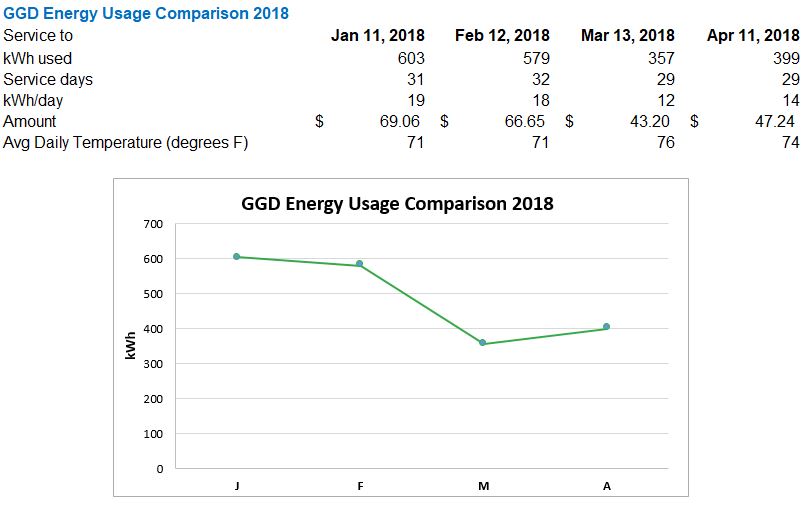

Between January 11, 2018, and April 11, 2018, we collectively used an average of 485 kWh per month. This equates to about 242 kWh per person. Our data shows that as the outside temperature went up, our energy consumption fell and vice versa.

The average temperature from January to February was 71 degrees and during this time we used about 18.5 kWh/day. For March through April, the average temperature rose to 75 degrees and our average daily energy consumption dropped to 13 kWh/day.

According to these numbers, we are consuming energy at a lower-than-average rate, nonetheless, we think we can do better! After auditing our apartment, we have found a few ways to reduce our energy footprint including, unplugging electronic devices when they are not in use (many devices continue to suck energy even while they are powered "off"), opening up windows and turning on the ceiling fan to bring in and circulate fresh air instead of using the central air conditioner, and adjusting our heat/air conditioner appropriately when we are away for more than a few hours.

We are pledging to reduce our footprint and will aim to use no more than 400 kWh, between the two of us, per month, moving forward. Let's see how we do!

How You Can Help And Save Money In The Process

So, what can you do to help?

Take a close look at your energy bill to see how much you are using each month – The bill typically shows your household energy consumption per month in kWh, the amount due, and monthly averages. Below, we’ve listed some suggestions to help lower your usage:

- Be sure to turn off the lights when you leave a room.

- Adjust the thermostat when you are not home or expect to be away for an extended period of time (5°-8° higher in the summer and 5°-8° lower in the winter).

- When possible, unplug electronic devices such as computers/laptops, monitors, printers, and televisions. Keeping these items plugged in typically creates a low electricity charge and contributes to the consumption of our limited natural resources.

- Seal any drafts around your doors or windows to stabilize your home's temperature.

- Dress appropriately for the weather instead of using the heat or AC. In other words, when its chilly in the house, grab a sweater and sweatpants or, conversely, a tank top and shorts when it's warmer.

- Wash your clothes in cold water – using warm/hot water takes extra energy for heating.

- Understand the energy options in your area. You may be able to choose cleaner energy options such as wind or solar.

Interesting Facts

- Recycling one aluminum can saves enough energy to run a 100-watt bulb for 20 hours, a computer for 3 hours or a TV for 3 hours. The energy saved is equivalent to the energy of half a gallon of gasoline.

- Recycling 125 aluminum cans, saves enough energy to power one home for a day.

- Approximately 75% of the electricity used in most American homes is used while the product is turned off. Idle power is a major energy consumer, with the average desktop computer using 80 watts of electricity while turned off.

Tools To Get You Started

Get a head start on your journey toward achieving financial independence by analyzing and tracking your income, expenses, investment performance, and overall net worth with the free online wealth management tool Personal Capital.

We use Personal Capital regularly to analyze our investment fees, track our investments, and project our net worth. We also periodically review our progress toward retirement with their retirement planning calculator.

If you’d rather do things on your own, become a subscriber today and you’ll receive our Free Financial Planning Dashboard. This tool allows you to enter your income and expenses to create a detailed budget. You can use it to track your spending habits over time or just to get an idea of where your money is going each month. Take a look at the automatically generated charts and you may discover you have a little more cash to invest than you thought.

If you’re interested in detailed instructions on how to budget, save, pay off debt, and invest, check out The 6 Phases of Building Wealth. This book provides step-by-step instructions for working through each “Phase” in the process of achieving Financial Freedom. If you're just starting out, the information in this book will provide you with an invaluable resource. You can pick up the digital version for only $2.99 on Amazon.

Disclosure: Some of the links found on this website may be affiliate links. Affiliate links pay GGD a small commission when you click through and/or make a purchase. This is at zero additional cost to you.

Full Disclaimer/Disclosure

Related Posts

-

Water Conservation: Your Life Depends On It

With major environmental threats to our planet, fresh, clean water is becoming increasingly difficult to access. So many people and creatures rely on this precious, life-sustaining fuel, and we must pay attention…NOW. The increase in…

-

All That Glitters, Isn't Gold

Gold Impacts on the Environment A few years ago, my heart sank when I saw trees and lush vegetation torn from the ground, tons and tons of earth gutted and displaced...I was watching Gold Rush…

-

Why Saving Money In The Bank Will Leave You Broke (Part 2)

In Part 1, we discussed the role inflation plays in the deterioration of wealth over time. As we demonstrated, when money is not growing at a faster rate than that of inflation, its purchasing power…