The Monthly Financial Update gives our readers an inside look at the allocation and performance of our personal portfolio. At the beginning of each month, we share a snapshot of our investments and highlight their performance over the previous month. In addition, we compute our progress towards achieving our retirement number.

The Big Mistake

I posted the very first Monthly Financial Update article on January 1, 2018. Since then, I’ve posted a new update summarizing our current financial picture each and every month. In these posts, I analyze the preceding month’s performance, break down how our investments are being allocated, and show the progress we've made toward achieving our financial goals.

While thinking about what to put in the monthly update for September 1st, I had an epiphany. I realized that I'd been analyzing our financial progress all wrong. Specifically, the amount of money I chose as a savings goal is not the value I should have selected. Instead of using our total yearly expenses to calculate the amount it would take to achieve financial independence via the 4% rule (i.e. 25 x expenses), I selected a number that would allow us to spend about 1.25x our current expenses each year (i.e. 25 x expenses x 1.25). At the time this seemed like a good idea. Saving a higher amount would allow us to increase spending in retirement and enjoy things we had gone without while still working. We'd also have a large buffer of additional funds to rely on during any market downturns that might arise early in our retirement. These are perfectly valid reasons to save more money, however, I think it was a mistake to artificially increase our retirement number.

What I realized is that, for me, the main goal of reviewing our finances is to determine how close we are to reaching financial independence. I want to know the moment when the investments we've made grow large enough to sustain our lifestyle. I want to have the peace of mind to know that even if I was laid off from my job tomorrow, we could keep living at the standard that we are used to. Having a little extra definitely wouldn’t hurt, but the extra is just icing.

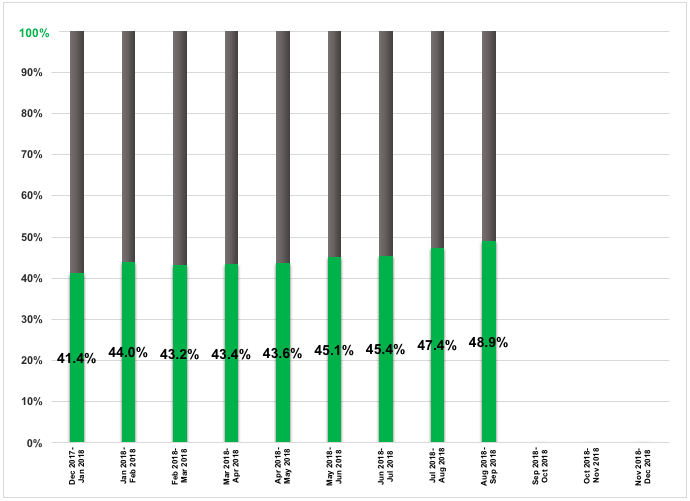

So how do I fix this mistake? Simple, I’ve decided to shift our savings goal to an amount that is more in line with what it would actually take to maintain the lifestyle that we currently live (a pretty good lifestyle if you ask me). When you look at the progress chart below you may notice that the percentages have all increased from what they were last month. Now you know why. We are closer to financial independence than we suspected!

Oh, by the way, we had a rocking month of growth! The stock market has begun to hit all-time highs once again. Time is certainly on our side!

Results:

3.35% month-over-month growth

48.9% of retirement number saved

Check out our performance in the table below.

The Numbers

Accounts Portfolio Allocation Change In Value (August-September)

Liquid Funds 1.36% 2.80%

High-Yield Savings 7.06% 1.44%

REITs 0.98% -3.93%

401(k)s 51.68% 3.29%

IRAs 3.61% 3.34%

HSA 0.48% 16.71%

Cryptocurrencies 0.03% -14.70%

P2P Lending 0.26% 0.63%

Taxable Stock Investments 34.45% 3.84%

Debt 0.09% -28.97%

Total = 100%

Portfolio Allocation = Current asset distribution of our portfolio

Investment Performance = Change in account value due to asset appreciation/depreciation, deposits, and withdrawals

Tools To Get You Started

Get a head start on your journey toward achieving financial independence by analyzing and tracking your income, expenses, investment performance, and overall net worth with the free online wealth management tool Personal Capital.

We use Personal Capital regularly to analyze our investment fees, track our investments, and project our net worth. We also periodically review our progress toward retirement with their retirement planning calculator.

If you’d rather do things on your own, become a subscriber today and you’ll receive our Free Financial Planning Dashboard. This tool allows you to enter your income and expenses to create a detailed budget. You can use it to track your spending habits over time or just to get an idea of where your money is going each month. Take a look at the automatically generated charts and you may discover you have a little more cash to invest than you thought.

If you’re interested in detailed instructions on how to budget, save, pay off debt, and invest, check out The 6 Phases of Building Wealth. This book provides step-by-step instructions for working through each “Phase” in the process of achieving Financial Freedom. If you're just starting out, the information in this book will provide you with an invaluable resource. You can pick up the digital version for only $2.99 on Amazon.

Disclosure: Some of the links found on this website may be affiliate links. Affiliate links pay GGD a small commission when you click through and/or make a purchase. This is at zero additional cost to you.

Full Disclaimer/Disclosure