The Monthly Financial Update gives our readers an inside look at the allocation and performance of our personal portfolio. At the beginning of each month, we share a snapshot of our investments and highlight their performance over the previous month. In addition, we compute our progress towards achieving our retirement number.

Slow And Steady Wins The Race...

Even though April was a month of relatively meager growth, I still feel good about the direction we're headed. The high volatility of the market, paired with the large lump sum we ended up owing in income taxes (being able to avoid taxes forever can't come soon enough!), definitely tempered my expectations. I honestly anticipated seeing little to no growth in our portfolio by the end of the month. Once I finished adding everything up and realized April's growth had outpaced last month's, I couldn't help but be excited. Slowly but surely, our portfolio is heading back to its high flying days!..at least that's the hope.

Results:

0.60% month over month growth

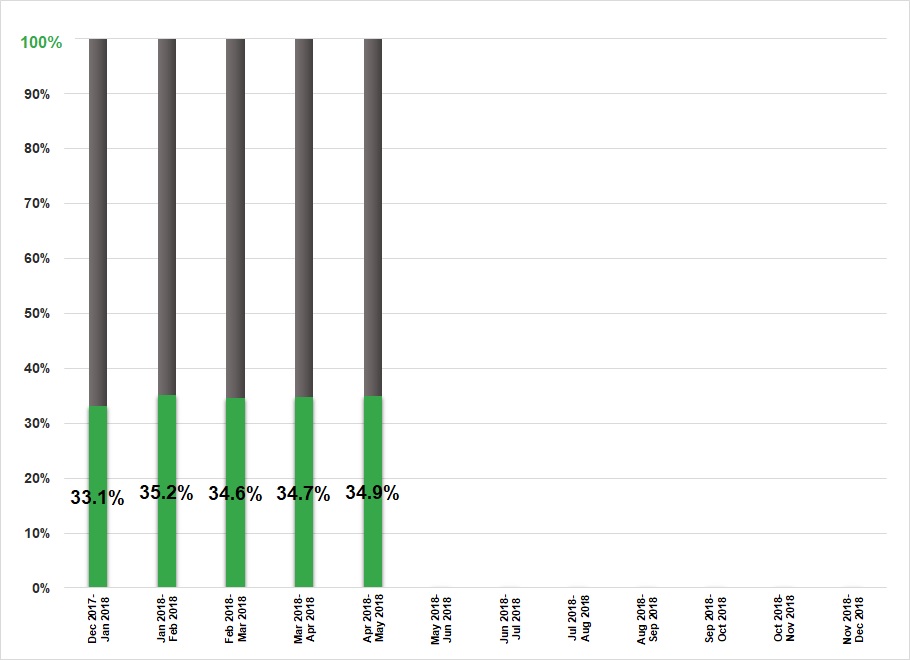

34.9% of retirement number saved

Check out our performance in the table below.

The Numbers

Accounts Portfolio Allocation Change In Value (April-May)

Liquid Funds 1.7% 8.5%

High-Yield Savings 7.5% -6.3%

REITs 1.1% -10.5%

401(k)s 51.5% 0.5%

IRAs 3.7% 0.6%

HSA 0.2% 35.0%

Cryptocurrencies 0.1% 37.4%

P2P Lending 0.3% -1.9%

Taxable Stock Investments 33.8% 2.5%

Debt 0.1% 195.4%

Total = 100%

Portfolio Allocation = Current asset distribution of our portfolio

Investment Performance = Change in account value due to asset appreciation/depreciation, deposits, and withdrawals

Tools To Get You Started

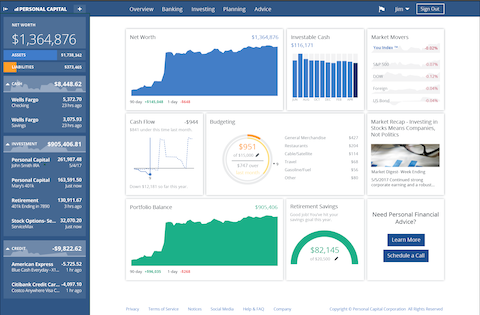

Get a head start on your journey toward achieving financial independence by analyzing and tracking your income, expenses, investment performance, and overall net worth with the free online wealth management tool Personal Capital.

We use Personal Capital regularly to analyze our investment fees, track our investments, and project our net worth. We also periodically review our progress toward retirement with their retirement planning calculator.

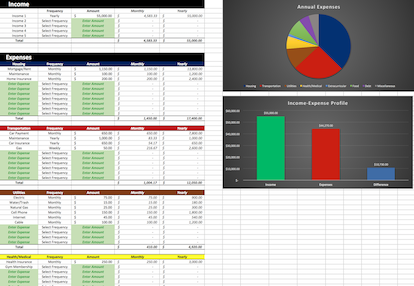

If you’d rather do things on your own, become a subscriber today and you’ll receive our Free Financial Planning Dashboard. This tool allows you to enter your income and expenses to create a detailed budget. You can use it to track your spending habits over time or just to get an idea of where your money is going each month. Take a look at the automatically generated charts and you may discover you have a little more cash to invest than you thought.

If you’re interested in detailed instructions on how to budget, save, pay off debt, and invest, check out The 6 Phases of Building Wealth. This book provides step-by-step instructions for working through each “Phase” in the process of achieving Financial Freedom. If you're just starting out, the information in this book will provide you with an invaluable resource. You can pick up the digital version for only $2.99 on Amazon.

Disclosure: Some of the links found on this website may be affiliate links. Affiliate links pay GGD a small commission when you click through and/or make a purchase. This is at zero additional cost to you.

Full Disclaimer/Disclosure

Related Posts

-

Monthly Financial Update - April 1, 2018

The Monthly Financial Update gives our readers an inside look at the allocation and performance of our personal portfolio. At the beginning of each month, we share a snapshot of our investments and highlight their…

-

Your Taxes May Be Lower Than You Think

Why Taxes? I recently had a discussion (debate) with a friend of mine comparing the benefits of pre-tax investments to those of Roth investments. I argued that, while there are many cases where Roth investing…

-

Retire Early And Pay Zero Income Taxes…Forever

Although your taxes may be lower than you think there's a good chance you still spend a significant portion of your income on taxes each year. Generally speaking, if you get a paycheck, a portion of it…