The Monthly Financial Update gives our readers an inside look at the allocation and performance of our personal portfolio. At the beginning of each month, we share a snapshot of our investments and highlight their performance over the previous month. In addition, we compute our progress towards achieving our retirement number.

Ride The Wave

After the stellar performance of our investment portfolio last month, we were hoping to see some big gains in June. We only achieved a relatively small amount of growth, however. Still, growth is growth! We are closer to early retirement today than we were yesterday so you won't hear any complaining from me! Since we know the stock market always goes up over the long-term, we will continue to ride the waves of short-term volatility all that way to the top.

Results:

0.56% month over month growth

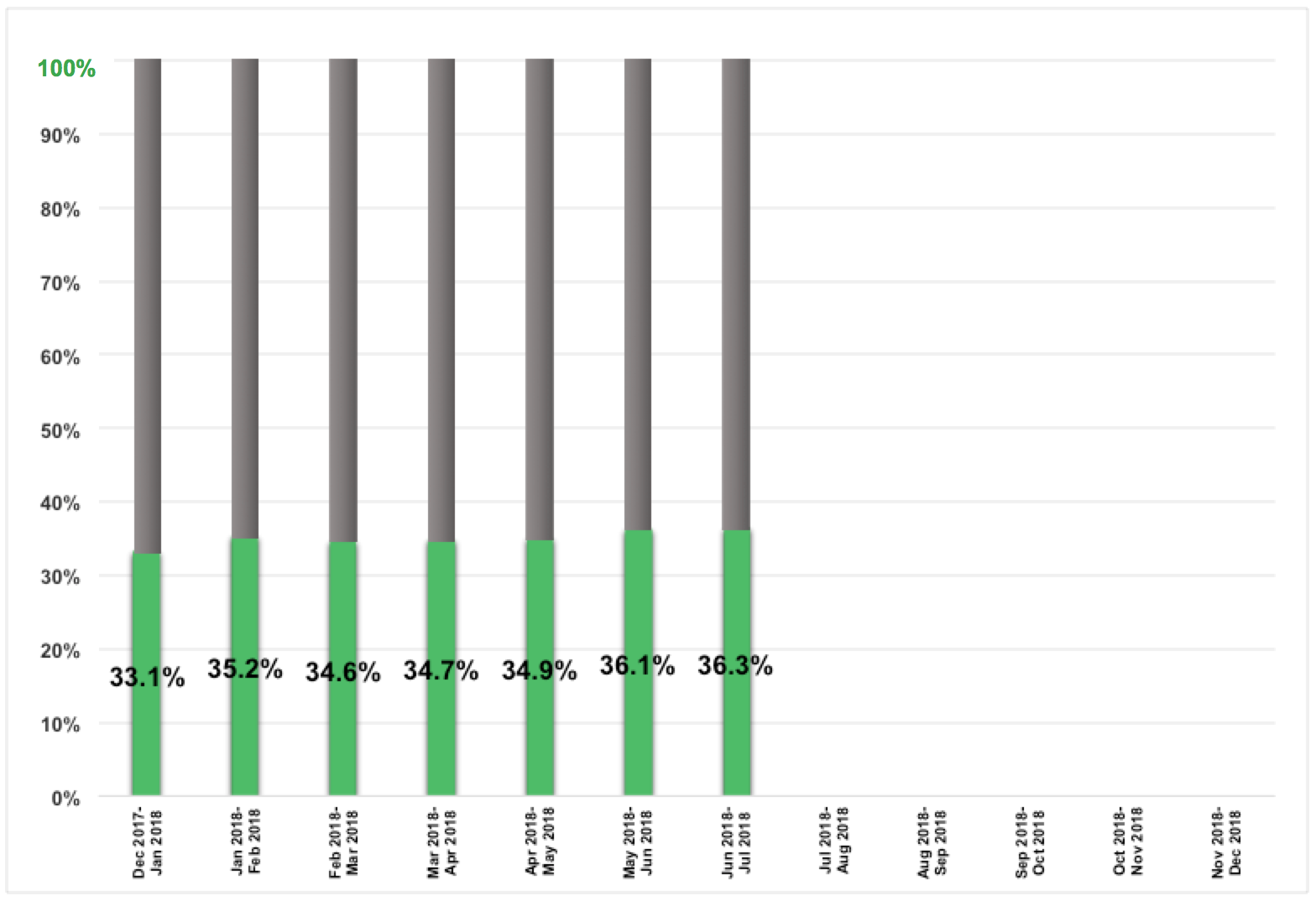

36.3% of retirement number saved

Check out our performance in the table below.

The Numbers

Accounts Portfolio Allocation Change In Value (June-July)

Liquid Funds 1.48% -13.67%

High-Yield Savings 7.39% 1.52%

REITs 1.08% 0.06%

401(k)s 51.43% 0.82%

IRAs 3.64% 0.61%

HSA 0.37% 28.66%

Cryptocurrencies 0.03% -23.83%

P2P Lending 0.28% -0.22%

Taxable Stock Investments 34.26% 0.33%

Debt 0.03% -67.60%

Total = 100%

Portfolio Allocation = Current asset distribution of our portfolio

Investment Performance = Change in account value due to asset appreciation/depreciation, deposits, and withdrawals

Tools To Get You Started

Get a head start on your journey toward achieving financial independence by analyzing and tracking your income, expenses, investment performance, and overall net worth with the free online wealth management tool Personal Capital.

We use Personal Capital regularly to analyze our investment fees, track our investments, and project our net worth. We also periodically review our progress toward retirement with their retirement planning calculator.

If you’d rather do things on your own, become a subscriber today and you’ll receive our Free Financial Planning Dashboard. This tool allows you to enter your income and expenses to create a detailed budget. You can use it to track your spending habits over time or just to get an idea of where your money is going each month. Take a look at the automatically generated charts and you may discover you have a little more cash to invest than you thought.

If you’re interested in detailed instructions on how to budget, save, pay off debt, and invest, check out The 6 Phases of Building Wealth. This book provides step-by-step instructions for working through each “Phase” in the process of achieving Financial Freedom. If you're just starting out, the information in this book will provide you with an invaluable resource. You can pick up the digital version for only $2.99 on Amazon.

Disclosure: Some of the links found on this website may be affiliate links. Affiliate links pay GGD a small commission when you click through and/or make a purchase. This is at zero additional cost to you.

Full Disclaimer/Disclosure

Related Posts

-

Monthly Financial Update - June 1, 2018

The Monthly Financial Update gives our readers an inside look at the allocation and performance of our personal portfolio. At the beginning of each month, we share a snapshot of our investments and highlight their…

-

Investment Hierarchy: Top 7 Investments For Retiring Young

When you make the decision to become an early retiree, one of the first things you'll realize is that there are many, many different choices when it comes to investment accounts. 401(k), IRA, HSA, 457,…

-

The Stock Market Always Goes Up

My first taste of investing came after graduating from college and starting my first “real” job. This initial experience consisted of picking which funds–from a list of 10 or 15–I would invest in, in my…

Well done this month, especially with what is happening to stocks and the crypto markets. I like your ration of liquid funds/investments to non-liquid investments. I am constantly striving to keep that ratio within is +/-3% band of 50/50.

Keep it up!

Thanks, Church! I could stand to reallocate a few things myself! Just another item on the long list of things to do…