The Monthly Financial Update gives our readers an inside look at the allocation and performance of our personal portfolio. At the beginning of each month, we share a snapshot of our investments and highlight their performance over the previous month. In addition, we compute our progress towards achieving our retirement number.

Best Month So Far

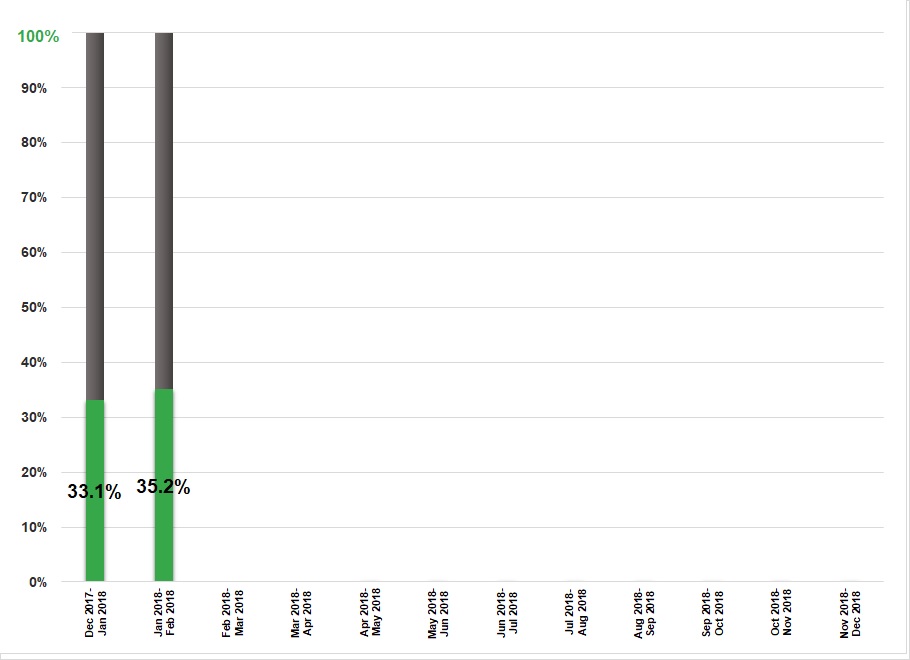

So far, 2018 has been a great year for our investment portfolio. The bull market has continued to thrive and we saw significant gains. In fact, our gains this month were the highest of any month since we started measuring. In all, our total net worth increased by 6.45% over the month of January! Using 25 times our expenses to calculate our retirement number and comparing it to our new total net worth, we can determine that we have now saved 35.2% of our retirement number. Early retirement here we come!

Check out our performance in the table below.

The Numbers

Accounts Portfolio Allocation Change In Value (Jan-Feb)

Liquid Funds 1.3% -21.7%

High-Yield Savings 7.8% -13.8%

REITs 1.5% 0.3%

401(k)s 52.0% 7.5%

IRAs 3.9% 54.7%

HSA 0.1% 0%

Cryptocurrencies 0.1% -28.7%

P2P Lending 0.3% 0.9%

Taxable Stock Investments 32.9% 9.0%

Debt 0.1% 329.8%

Total = 100%

Portfolio Allocation = Current asset distribution of our portfolio

Investment Performance = Change in account value due to asset appreciation/depreciation, deposits, and withdrawals

Tools To Get You Started

Get a head start on your journey toward achieving financial independence by analyzing and tracking your income, expenses, investment performance, and overall net worth with the free online wealth management tool Empower Personal Dashboard.

We use Empower Personal Dashboard regularly to analyze our investment fees, track our investments, and project our net worth. We also periodically review our progress toward retirement with their retirement planning calculator.

If you’d rather do things on your own, become a subscriber today and you’ll receive our Free Financial Planning Dashboard. This tool allows you to enter your income and expenses to create a detailed budget. You can use it to track your spending habits over time or just to get an idea of where your money is going each month. Take a look at the automatically generated charts and you may discover you have a little more cash to invest than you thought.

If you’re interested in detailed instructions on how to budget, save, pay off debt, and invest, check out The 6 Phases of Building Wealth. This book provides step-by-step instructions for working through each “Phase” in the process of achieving Financial Freedom. If you're just starting out, the information in this book will provide you with an invaluable resource. You can pick up the digital version for only $2.99 on Amazon.

Disclosure: Some of the links found on this website may be affiliate links. Affiliate links pay GGD a small commission when you click through and/or make a purchase. This is at zero additional cost to you.

Full Disclaimer/Disclosure

Related Posts

-

Investment Hierarchy: Top 7 Investments For Retiring Young

When you make the decision to become an early retiree, one of the first things you'll realize is that there are many, many different choices when it comes to investment accounts. 401(k), IRA, HSA, 457,…

-

Monthly Financial Update - January 1, 2018

The Monthly Financial Update gives our readers an inside look at the allocation and performance of our personal portfolio. At the beginning of each month, we share a snapshot of our investments and highlight their…

-

The Simple Formula I’m Using To Retire In My 30's

Wake up, go to work, spend a few hours with family, go to bed, rinse and repeat. Some form of this routine probably describes the typical day for most of us. Throughout our lives, we’re…