There are plenty of great investment options out there to choose from, but very few can compete with the advantages of a 401(k). When you add in employer matching to the equation, I believe 401(k)s become the best investment, period. Some other types of accounts may provide a bit more flexibility, but the overall benefits of a 401(k) vastly outweigh the advantages of those options. Generally speaking, an ideal investment would have all of the following qualities:

- Low Risk

- High Return

- Consistent Returns

- Favorable Tax Treatment

- Minimal Barriers To Entry

- Minimal Manual Management Required

With the right investment strategy, a 401(k) fulfills just about all of these requirements. Sounds like the perfect investment to me! Don’t believe it? Lets step through each item.

Low Risk

Just like any other investment account, the risk level of your 401(k) depends primarily on what you choose to invest in. Volatile investments increase the overall risk of your account, while stable investments do the opposite. Ironically, one attribute of 401(k) investing which is commonly listed as a drawback, the limited investment options, can help to minimize some risk. Typically, 401(k) offerings include a few index funds, a small sample of mutual fund options, some target date funds, and a company stock fund. These options eliminate many of the high-risk, exotic, and trendy investments that other accounts might allow (e.g. crypto-currencies, penny stocks, IPOs, individual stocks, etc.). So, the very limited nature of a 401(k) may, in fact, enhance it in other ways. Specifically, by reducing your ability to invest in the highest risk investments. Incidentally, if you follow an investment strategy similar to ours (long-term, broad market, index fund investing), the selections available in most 401(k)s are all you need to be successful.

High Return

The vast majority of employers with 401(k) plans offer some amount of dollar matching. Whether it’s dollar for dollar (i.e. 100% match), 50%, 25%, or 10%, for our purposes, doesn’t matter. What's important is that it’s free money. It’s an instant and guaranteed return. As soon as your contribution is deposited into your account you automatically receive the matching funds from your employer. The most common matching schedule would give you an immediate 50% return on your contributions, up to a certain percentage of income (a maximum of 6% of salary is common). As far as investments go, I feel very comfortable saying 50% is a high return. In fact, 10% would be high return! Remember this all happens before any investment gains. The actual growth of your investment is just extra icing on the cake.

Consistent Returns

Guaranteed, instant returns are about as consistent as you can get. As we’ve already noted, that’s exactly what employer matching gives you. If you contribute, you get paid. It’s that simple.

Favorable Tax Treatment

Traditionally, 401(k) contributions are made on a pretax basis and all earnings accrued are tax deferred. This means, you owe no taxes on anything in your 401(k) until you withdraw the funds. So, every dollar you contribute to a 401(k) lowers your taxable income for the year. This is perhaps, the greatest benefit of a 401(k) investment account. Lowering your taxable income decrease the taxes you owe, resulting in more money in your pocket, instead of the government’s.

Minimal Barriers to Entry

The main barrier to investing in a 401(k) is that your employer must choose to offer the plan before you can gain access. This may seem like a tough obstacle to navigate but, according to a recent estimate by the US Census Bureau, 79% of all U.S. employees have access to a 401(k) plan or some equivalent (though, regrettably, only 32% actually participate). So, whether you know it or not, it is very likely that your employer offers a 401(k) plan which you can enroll in. As long as it is offered, all you need to do is sign up. The enrollment process is usually straightforward and requires minimal effort on the part of the employee. If you fall into the 21% of employees who don’t have the option of a 401(k) at work, check out these other great investment accounts you can take advantage of to help grow your wealth.

Minimal Manual Management Required

All you need to do to set up your 401(k) account is choose a contribution rate and select your investment options. Once you’ve done this, in theory, you never have to look at the account again (I highly recommend you review it at least once per quarter). 401(k) contributions will then start being made automatically, via payroll deductions. The money never touches your normal bank account. All of the investing happens automatically, based on your investment elections. You can sit back and just let it grow. When it’s time to retire, your funds will be waiting for you in the account, fully grown into a retirement nest egg.

The psychological impact of this process should not be overlooked. Since everything happens automatically and behind the scenes, you’ll never be tempted to spend the money. It will be as if you don’t have it, and so you’ll learn to live on less while actually saving more. It’s automated saving and investing made easy!

Additional Benefits

Ability to take out a loan – You can take out a loan against your 401(k) (though I recommend you only do this in an emergency situation). When you pay back the loan, all payments and interest go to you.

Protection from creditors – 401(k)s are protected from creditors and tax liens.

Lifetime contributions – Unlike some retirement accounts, you can continue to contribute to a 401(k), at any age, as long as you are working.

Example

Let's run through an example to highlight the power of investing in a 401(k).

Carmen has a salary of $50,000 and would like to invest $18,500. She is a savvy investor and believes she can make a 20% gain if she invests the money in her taxable account. Due to the limited offerings of her newly opened 401(k) account she believes she’d only be able to generate a 10% return. What should she do?

Assumptions

Salary = $50,000

Invested Amount = $18,500

Tax Bracket = 25%

Taxable Account Return = 20%

401(k) Account Return = 10%

Employer 401(k) Match = $3,000 (50% of contribution, up to 6% of salary)

Taxable Account Investment (with short-term capital gain)

Investment Gains = $18,500 x 0.20 = $3,700

Total Taxable Income = $50,000 + $3,700 = $53,700

Yearly Taxes = $53,700 x 0.25 = $13,425

Carmen’s Total Net Income = $50,000 + $3,700 - $13,425 = $40,275

Taxable Account Investment (buy and hold)

Investment Gains = $18,500 x 0.20 = $3,700

Total Taxable Income = $50,000

Yearly Taxes = $50,000 x 0.25 = $12,500

Carmen’s Total Net Income = $50,000 + $3,700 - $12,500 = $41,200

401(k) Account Investment (without company match)

Investment Gains = $18,500 x 0.10 = $1,850

Total Taxable Income = $50,000 - $18,500 = $31,500

Yearly Taxes = $31,500 x 0.25 = $7,875

Carmen’s Total Net Income = $50,000 + $1,850 - $7,875 = $43,975

401(k) Account Investment (with company match)

Investment Gains = ($18,500 + $3,000) x 0.10 = $2,150

Total Taxable Income = $50,000 - $18,500 = $31,500

Yearly Taxes = $31,500 x 0.25 = $7,875

Carmen’s Total Net Income = $50,000 + $3,000 + $2,150 - $7,875 = $47,275

After running through multiple scenarios, Carmen comes to the conclusion that she should definitely invest the money in her 401(k).

Are these results surprising to you? Even if Carmen could double her return, by utilizing a taxable account instead of her 401(k), she’d still end up behind. Even without an employer match! Once the employer match is introduced, the net return of the taxable account is totally obliterated. This is the power of, what I believe to be, the worlds best investment, the 401(k).

Bonus

What if Carmen had reinvested the tax savings she claimed as a result of contributing to her 401(k)? Let's work it out.

401(k) Account Investment (with company match) + Reinvested Tax Savings

Investment Gains = ($18,500 + $3,000) x 0.10 = $2,150

Total Taxable Income = $50,000 - $18,500 = $31,500

Yearly Taxes = $31,500 x 0.25 = $7,875

Tax Savings vs Taxable Account = $13,425 - $7,875 = $5,550

Investment Gains On Invested Tax Savings = $5,550 x 0.20 = $1,110

Carmen’s Total Net Income = $50,000 + $3,000 + $2,150 +$1,110 - $7,875 = $48,385

Wowser! The benefits just keep piling on.

Final Thoughts

401(k) accounts are one of the greatest investment options available to us common folk. If you have the opportunity to invest in one make sure you take advantage.

Additional Note

When you retire it is possible to strategically use long-term capital gains to pay zero taxes, which, when compared to the normal income tax rate of 401(k) withdrawals, makes a taxable account a very attractive option. However, it is also possible to avoid taxes on your 401(k) withdrawals when you plan things correctly.

Do you think there is a better investment out there? If so leave a comment and we'll discuss!

Tools To Get You Started

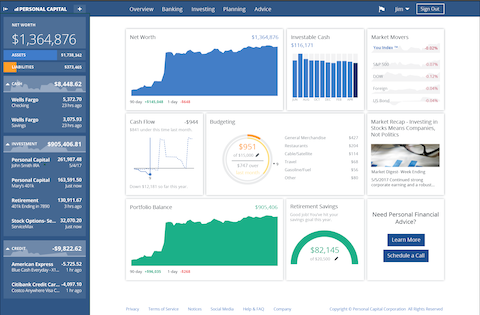

Get a head start on your journey toward achieving financial independence by analyzing and tracking your income, expenses, investment performance, and overall net worth with the free online wealth management tool Personal Capital.

We use Personal Capital regularly to analyze our investment fees, track our investments, and project our net worth. We also periodically review our progress toward retirement with their retirement planning calculator.

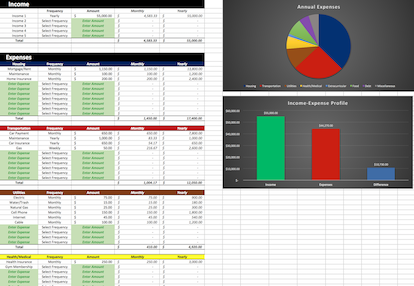

If you’d rather do things on your own, become a subscriber today and you’ll receive our Free Financial Planning Dashboard. This tool allows you to enter your income and expenses to create a detailed budget. You can use it to track your spending habits over time or just to get an idea of where your money is going each month. Take a look at the automatically generated charts and you may discover you have a little more cash to invest than you thought.

If you’re interested in detailed instructions on how to budget, save, pay off debt, and invest, check out The 6 Phases of Building Wealth. This book provides step-by-step instructions for working through each “Phase” in the process of achieving Financial Freedom. If you're just starting out, the information in this book will provide you with an invaluable resource. You can pick up the digital version for only $2.99 on Amazon.

Disclosure: Some of the links found on this website may be affiliate links. Affiliate links pay GGD a small commission when you click through and/or make a purchase. This is at zero additional cost to you.

Full Disclaimer/Disclosure

Related Posts

-

Investment Hierarchy: Top 7 Investments For Retiring Young

When you make the decision to become an early retiree, one of the first things you'll realize is that there are many, many different choices when it comes to investment accounts. 401(k), IRA, HSA, 457,…

-

The Simple Formula I’m Using To Retire In My 30's

Wake up, go to work, spend a few hours with family, go to bed, rinse and repeat. Some form of this routine probably describes the typical day for most of us. Throughout our lives, we’re…

-

Surprisingly Simple Investment Strategy For Retiring Early

The other day, while browsing through YouTube videos, I came across one that featured Tony Robbins discussing investing. I watched the video and found it had some good, if not groundbreaking, suggestions. There was one…