What if I told you there was a way to instantly increase your investment returns with just a few minutes of work per year? What if I also told you that, not only is this method still useful during periods of market decline, it actually becomes more effective when the market is dropping?

You'd probably think I was trying to sell you something. At least that's the thought I had when someone made similar claims to me. It all sounded a little too good to be true. Still, I listened to the details of this, purported instant investment return boosting method and followed up by doing some research on my own. I've got to say, I'm happy I didn't shrug it off as a sales pitch.

The fact is it's actually the real deal. There really is a way to instantly increase your investment returns, it really does only require a few minutes per year, and it truly does work best during market declines. This seemingly magical technique is known as Tax-Loss Harvesting.

Tax-Loss Harvesting

Tax-Loss harvesting is a way to "harvest" losses in your portfolio by selling an asset that has declined in value and then subsequently purchasing a similar/correlated, but not "substantially identical" (i.e. an assets so similar that the IRS views it as being the same thing), asset so that your asset allocation/market exposure remains the same. That's certainly a mouthful!

So what does it all mean?

Let's break it down into more easily digested pieces.

As you probably know, when you sell an investment that has increased in value (i.e. capital gain) you must pay taxes on the profits. Some of us may forget that the opposite is also true. When you sell an investment that has declined in value (i.e. capital loss) you are allowed to deduct the loss from your income, lowering your overall taxes. The first step in the 2-part tax-loss harvesting process is to take advantage of this fact.

Step 1 - Harvest Losses

Picture this, you’ve just finished reading Part 1 and Part 2 of the GoGreenDollar post, Why Saving Your Money In The Bank Will Leave You Broke, and you’re super-energized about moving money from your bank account to an investment account.

You open a Vanguard investment account and invest $10,000 in one of their Total Stock Market index funds.

The market immediately tanks.

Over the next few weeks, the value of your $10,000 investment drops 10% and is now only worth $9,000. Being a savvy GoGreenDollar reader, you don’t panic. You know this is the perfect opportunity for tax-loss harvesting. You take the first step by selling your investment to harvest the $1,000 loss.

By selling, you've created a $1,000 tax deduction, but you've also sold a losing investment, locking in the loss.

This can't be a good thing, right? I’m pretty sure buying high and selling low is not part of the formula for achieving financial independence.

Well, if we were to stop at this point that would be absolutely correct. But remember, there are two parts to the tax-loss harvesting process…

Step 2 - Reinvest

After selling your original investment to capture the $1,000 loss, you immediately execute the second step in the tax-loss harvesting process by using the $9,000 in your account to buy into one of Vanguard's Large-Cap index funds. Since this fund tracks a different market index (total stock market vs. Large-Cap) the IRS will not consider it to be significantly identical to your original purchase. It is, however, highly correlated to your original investment.

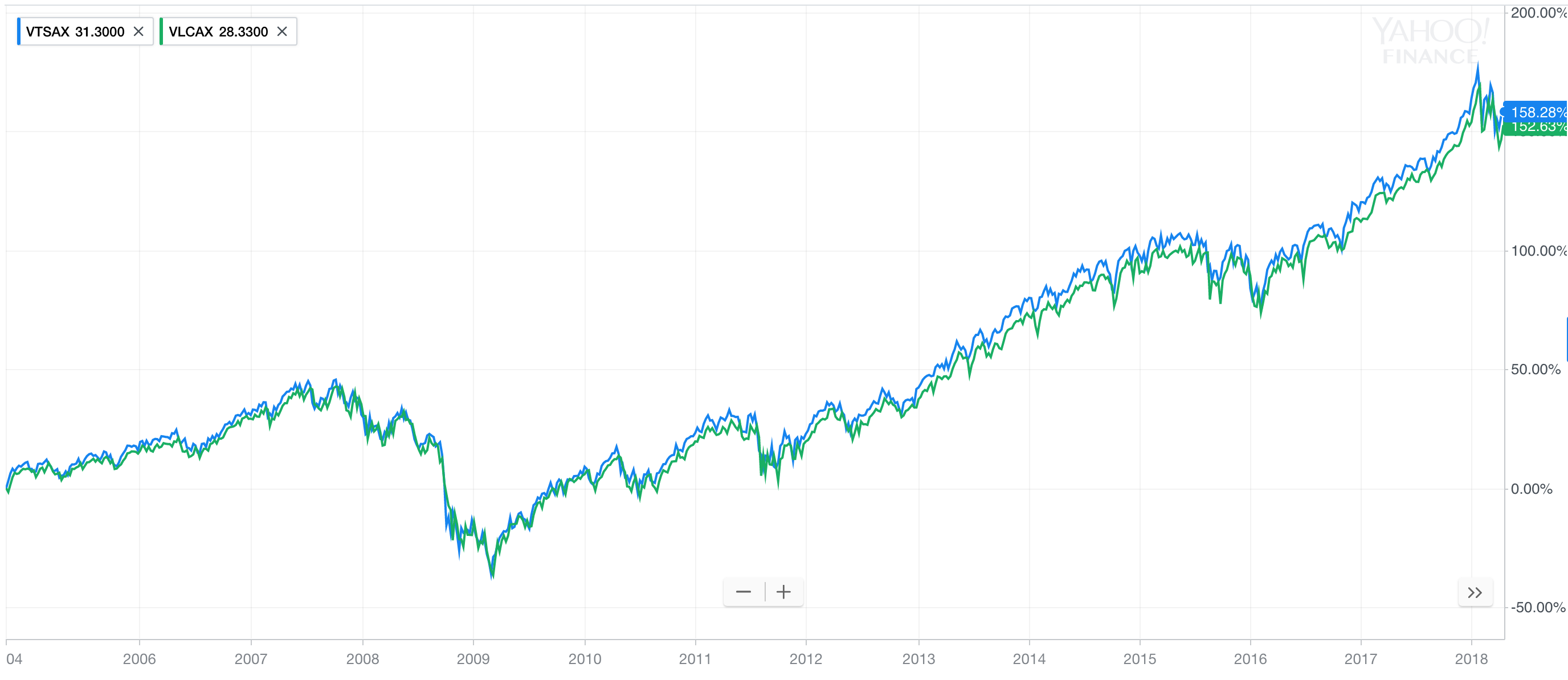

Being “highly correlated” means that these two market indices tend to move together. When one goes up so does the other, when one goes down the other does as well. As a result, investing in one will produce very similar results to investing in the other. Look at the chart below to see how closely these two investments align.

Total Stock Fund (VTSAX) vs Large Cap Fund (VLCAX)

Other Highly Correlated Funds: U.S. - VTSAX / VFIAX / VLCAX, International - VTABX / VFWAX / VTMGX, Growth - VSMAX / VIMAX / VEXAX

After a few months the market recovers (as it always does).

The value of your investment is $10,000 once again. However, since you performed tax-loss harvesting you were able to capture a $1,000 tax deduction without changing your market exposure! Not a bad deal right?

Let's walk through another example and examine the numbers.

Example

Brian recently invested $25,000 into a total stock market index fund. In the time since he made this investment, the market has dropped 15%, bringing the value of his investment down to $21,250. Instead of holding the investment and waiting for it to recover, Brian decides to perform tax-loss harvesting.

Assumptions

Tax Rate = 25%

Step #1

Brian sell’s his total stock market index fund for $21,250, harvesting a $3,750 loss.

Step #2

Brian immediately reinvests the $21,250 into an S&P 500 index fund, maintaining his market exposure.

The market moves up and Brian finds his investment is now worth $30,000. What was his total return?

If Brian had simply held his investment he would have made a 20% return (i.e. $30,000 - $25,000 = $5,000). Not bad!

But what happens when we factor in the tax savings from tax-loss harvesting?

With a tax rate of 25%, the $3,750 loss Brian captured will allow him to reduce his taxes by $937.50 (i.e. $3,750 x 25%). Thus, the total overall return looks as follows:

Investment Growth = $30,000 - $25,000 = $5,000

Tax Savings = $3,750 x 25% = $937.50

Total Return = $5,000 + $937.50 = $5,937.50

That’s a 23.75% return (i.e. $5,937.50 / $25,000)!

By performing tax-loss harvesting Brian was able to increase his overall return by 3.75%! I don’t know about you, but I think that’s well worth a few minutes of work.

Watch Out For The Wash-Sale Rule

A wash sale is any sale that occurs within 30 days before or after a substantially identical asset was purchased. Any loss that occurs as a result of a wash sale is non-deductible.

Without the wash-sale rule, an investor would be able to sell an asset at a loss and then immediately repurchase the exact same asset for the same price. They would lock in the “loss” and still be able to keep the asset. The wash-sale rule was created to prevent investors from claiming these types of artificial losses. Tax-loss harvesting allows an investor to obtain similar results without violating the wash-sale rule.

The wash-sale rule is the reason why tax-loss harvesting uses assets that are highly correlated but not substantially identical.

Note: If you do accidentally create a wash sale, it won’t completely nullify your entire loss, it only cancels out the proportional of the loss equal to the number of shares that were purchased during the 60-day window (30 days before and 30 days after).

Note 2: The wash-sale rule applies across all of your investment accounts (including retirement accounts). So even if the transactions happen in totally different accounts, you can still create a wash sale.

Note 3: Even when a loss is disallowed because of a wash sale, you don’t totally lose the deduction. Instead, the amount of the deduction is added to the cost basis of the asset you repurchased. Whenever you sell the asset in the future the amount of the loss will be factored in (assuming you don’t create another wash sale).

Things To Remember

When considering tax-loss harvesting, there are a few things you should keep in mind.

1. Tax-loss harvesting can only be performed in your taxable investment accounts. Buying and selling in a retirement account is not a taxable event, and so, Tax-Loss Harvesting provides no benefit.

2. The maximum tax deduction for a harvested capital loss is $3,000 per year. However, if you capture a loss greater than this it can be continually carried over as a deduction for future years (up to $3,000 per year) until the amount of the loss is exhausted.

3. Automatically reinvesting dividends can trigger a wash sale if dividends are paid and reinvested within 30 days before or after you have executed a tax-loss harvesting transaction. To avoid this, you may want to check the dividend payment schedule before performing tax-loss harvesting and/or manually invest dividends so that you avoid any conflicts.

Final Thoughts

Tax-Loss Harvesting can be a powerful tool in your financial independence tool belt. It is a quick and easy way to instantly increase your overall investment returns, so when the opportunity presents itself, be sure to take advantage!

For a step-by-step example of performing tax-loss harvesting in a Vanguard account, check out this post over on Physician On Fire.

Tools To Get You Started

Get a head start on your journey toward achieving financial independence by analyzing and tracking your income, expenses, investment performance, and overall net worth with the free online wealth management tool Personal Capital.

We use Personal Capital regularly to analyze our investment fees, track our investments, and project our net worth. We also periodically review our progress toward retirement with their retirement planning calculator.

If you’d rather do things on your own, become a subscriber today and you’ll receive our Free Financial Planning Dashboard. This tool allows you to enter your income and expenses to create a detailed budget. You can use it to track your spending habits over time or just to get an idea of where your money is going each month. Take a look at the automatically generated charts and you may discover you have a little more cash to invest than you thought.

If you’re interested in detailed instructions on how to budget, save, pay off debt, and invest, check out The 6 Phases of Building Wealth. This book provides step-by-step instructions for working through each “Phase” in the process of achieving Financial Freedom. If you're just starting out, the information in this book will provide you with an invaluable resource. You can pick up the digital version for only $2.99 on Amazon.

Disclosure: Some of the links found on this website may be affiliate links. Affiliate links pay GGD a small commission when you click through and/or make a purchase. This is at zero additional cost to you.

Full Disclaimer/Disclosure

Related Posts

-

Your Taxes May Be Lower Than You Think

Why Taxes? I recently had a discussion (debate) with a friend of mine comparing the benefits of pre-tax investments to those of Roth investments. I argued that, while there are many cases where Roth investing…

-

Surprisingly Simple Investment Strategy For Retiring Early

The other day, while browsing through YouTube videos, I came across one that featured Tony Robbins discussing investing. I watched the video and found it had some good, if not groundbreaking, suggestions. There was one…

-

Why Saving Money In The Bank Will Leave You Broke (Part 1)

In 1923, Germany began printing and circulating two-trillion mark banknotes. That’s a “2”, followed by 12 zeros (i.e. 2,000,000,000,000) on each individual banknote! What would cause a country to print such a large denomination of…